Zacks Investment Management provides insight into the biggest news stories, and key factors that we believe are currently impacting the market such as:

- Is the Fed poised to accelerate the ‘Taper’?

- The U.S. housing market is still hot

- Status of the U.S. labor market

Is the Fed Poised to Accelerate the ‘Taper’? According to the Labor Department, the consumer price index (CPI) rose 5.4% year-over-year in September, which continues the trend of above-expectation inflation in the U.S. economy. Fed officials have stuck to the narrative that inflationary pressures will likely be ‘transitory’ as supply chain issues abate, but more recently Fed Chairman Jerome Powell and other Fed governors have been shifting their tone. On Friday of last week, Chairman Powell said explicitly that supply-chain disruptions would likely last longer than expected, and that the Fed “will need to make sure that our policy is positioned for a range of possible outcomes.” If that sounds like the Fed starting to hedge their ‘transitory’ position, it’s because they are – officials have now confirmed they will start reducing the $120 billion monthly QE purchases at their November 2-3 meeting, and some officials have suggested unwinding purchases faster while also moving up the potential timeline for higher rates. In our view, the equity markets have already priced in the reduction in monthly bond and mortgage security purchases, but a quicker timeline to raise the Fed funds rate may generate volatility in the short term. Minutes from November 2-3 will be telling.1

___________________________________________________________________________

Avoid 8 of the Biggest Financial Mistakes

How can investors prepare for what’s to come while in a volatile market? There is no definite answer! However, you still have the opportunity to protect your investments and better prepare for any given financial situation.

While there are many unknowns at present, we believe there are eight common mistakes that many investors make when planning for retirement. In our guide, 8 Retirement Mistakes to Avoid, we outline these mistakes and how you can potentially avoid them.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Learn About the 8 Retirement Mistakes to Avoid!2

___________________________________________________________________________

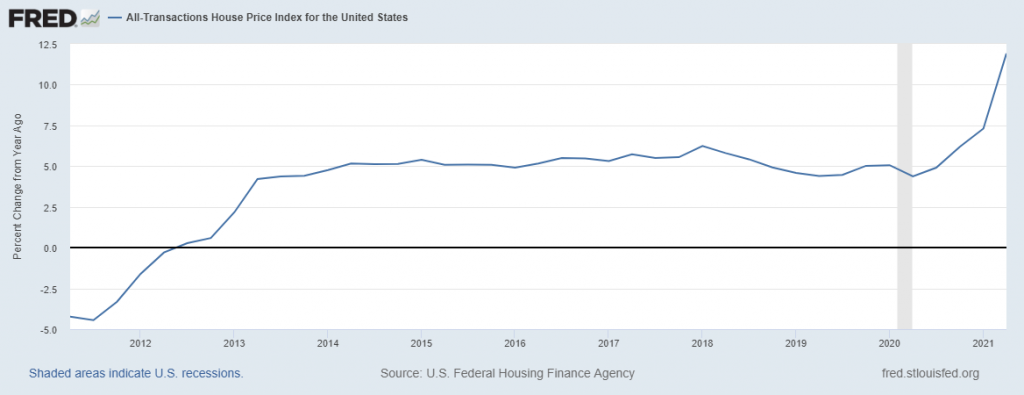

Another Month, Same Headline: The U.S. Housing Market Stays Hot – Headlines often focus on issues with sticky inflation and snarled supply chains, but one area of the economy that has stayed hot virtually throughout the pandemic has been U.S. housing. Whether or not the strength of the housing market is a good thing depends largely on whether someone is a buyer or a seller. Many first-time homebuyers are having a particularly challenging time – the S&P CoreLogic Case-Shiller National Home Price Index soared almost 20% in August from a year earlier, with the median existing-home sales price up 13% year-over-year in September. Higher prices have in many cases led to higher-than-expected sales prices for sellers, but it has also reduced the share of first-time buyers in the market down to 28% – the lowest level since July 2015. As you can see from the chart of the national home price index below, prices have surged since the pandemic started, and have not let up since.3

What Data from the U.S. Labor Market is Telling Us – Jobless claims in the U.S. dropped to 290,000 last week, which marks a new low within this pandemic-influenced economy. Jobless claims are perhaps a better metric than the unemployment rate to consider when determining the health of the labor market, as claims serve as a proxy for layoffs. In 2019, a year when the U.S. economy was considered quite strong and before the pandemic struck, the weekly average for jobless claims was 218,000, meaning the U.S. economy is approaching a level of health in line with the previous expansion. Continuing claims, which measure how many people are still unemployed and receiving benefits, also fell to a pandemic low. As unemployment benefits eventually expire for those who are in the continuing claims category, a labor market with ample jobs awaits. In our view, we should continue to see improvement in the jobs market as a result.5

Retirement Mistakes to Avoid During Times of Uncertainty – While we can’t predict or control the future of the market, it is possible to stay focused on actions that can help guide your future investments. There are common mistakes and habits that we believe can help some investors succeed while others fail. Don’t fall prey to common investing mistakes!

To help you understand some of these mistakes and how to avoid them, we have created the guide, 8 Retirement Mistakes to Avoid.7

In this guide, we provide our thoughts on what we believe are 8 of the biggest retirement mistakes investors should avoid. If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion.

3 Wall Street Journal. October 26, 2021. https://www.wsj.com/articles/home-price-growth-holds-at-record-in-august-11635253603?mod=djemRTE_h

4 Fred Economic Data. August 25, 2021. https://fred.stlouisfed.org/series/USSTHPI#0

5 CNBC. October 24, 2021. https://www.cnbc.com/2021/10/21/us-jobless-claims-total-290000-vs-300000-estimate.html

6 Fred Economic Data. October 28, 2021. https://fred.stlouisfed.org/series/ICSA#0

7 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.