Twilio, a cloud communication platform backed by Silicon Valley investors, delivered good news for hundreds of technology start-ups following its IPO that raised over $150M. Twilio clients include Uber, OpenTable and Nordstrom for which the company provides software to support client communication via voice, video and messaging.

The shares of the company were priced at $15 per share, above the range of $12 to $14 per share proposed in its updated IPO prospectus, but it ended its first trading day with a 92% jump to $28.79 per share after opening 60% higher at $23.99.

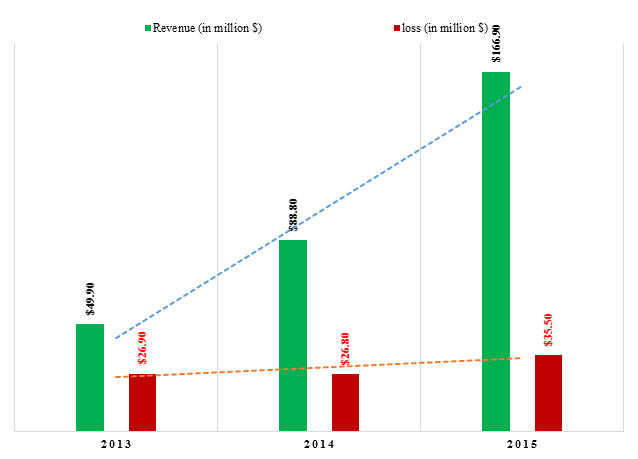

Although the company has yet to turn a profit, it has experienced steady revenue growth over the last couple of years. Investors were attracted to its fast-growing and innovative business model, which does not require marketing spend to boost revenue. It also speaks positively to investor’s risk appetite for growth stories, which is a good sign.

Twilio Has Strong Revenue Growth, But Still Operates at a Loss

(Source: CNBC)

As Twilio’s first day of trading coincided with the BREXIT results, many considered this as a brave move from the company. Additionally, the market has not been very receptive to new tech I.P.O.’s—only three have debuted so far in 2016, and to date have only raised a total of $322 million (down by 90%) compared to $3.35 billion over the same period last year. This makes Twilio’s IPO all the more eye-catching.

5 Reasons Investors Are Enthusiastic for Twilio

- The company is uniquely situated in a relatively unexplored corner of the technology world catering to software developers.

- Its high-growth business model and little competition in the cloud communications platform category provides the company ample future growth opportunity.

- With a growing appetite for adding features like text and voice messaging amongst app developers, Twilio is expected to see sustained demand.

- Being a leader in its category, the company works with some of the big names of the tech industry like WhatsApp (contributes 15% to the company’s revenue), Coca Cola and Uber, among others. This impressive client list not only ensures a steady revenue flow, but has created a positive brand image for the company which will help attract new customers.

- A strong financial record with a massive top line growth rate of 88% (y-o-y basis) coupled with declining losses and continuously improving EBITDA ( earnings before interest, taxes, depreciation and amortization) margin.

What does this IPO mean for the U.S. IPO market?

With only 34 IPO’s to date compared to 72 at the same time last year, Twilio’s successful IPO is expected to bring some enthusiasm back to the IPO market along with a big sigh of relief from the Silicon Valley venture capital community. If Twilio thrives, it could inspire other growing tech companies to consider a public offering as well. Names like AirBnB, Dropbox, Evernote and Pinterest could start to trickle over.

Bottom Line for Investors

Twilio’s debut performance shows that the market has been waiting anxiously for a significant tech unicorn to go public, but Twilio’s size prevents it from being any kind of bellwether for the IPO market. One success story does not make this a trend, but it will be interesting to watch as some of the other big players in the industry weigh the timing of their IPOs, if they come at all.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.