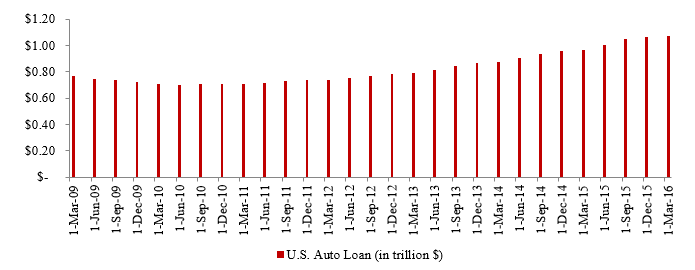

Following the subprime loan crisis that induced the Great Recession, the media has noted at least two other debt crises more recently including those revolving around student debt and, now, car loans. According to Federal Reserve Bank of New York data, U.S. auto loans, in aggregate, have surpassed $1 trillion, up more than 40% from its pre-crisis peak.

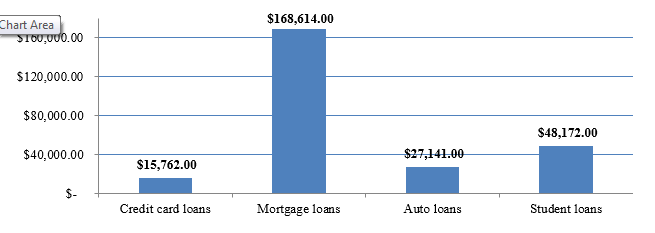

Average Household Debt by Category (U.S.)

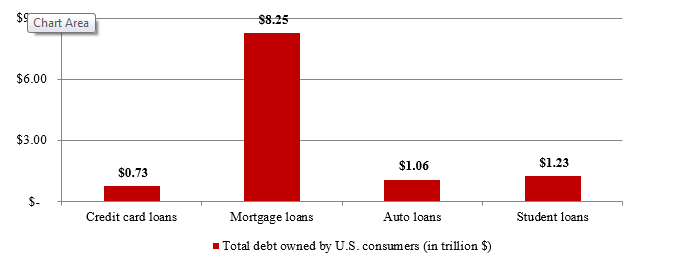

Total Debt by Category (U.S.)

Source: NerdWallet

Rising U.S. Auto Loan Debt since March 2009

Source: Federal Reserve Bank of New York

So What Triggered a Rise in U.S. Auto Loans?

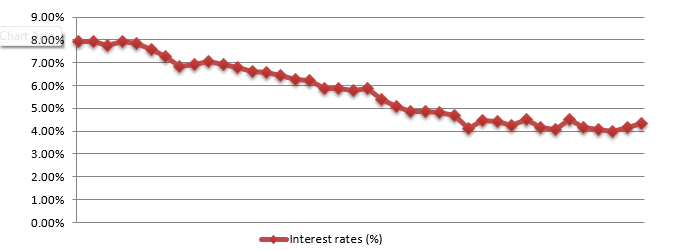

The rise in U.S. auto loans cannot be attributed to one single occurrence, but rather a combination of factors. First, record sales of 17.5 vehicles in 2015 from U.S. automakers, driven by pent up demand for vehicles, spurred auto loan growth. The trend has continued in 2016 as sales of 8.65 million vehicles have been recorded through June 2016, up 1.5% from last year’s record of 8.5 million. Second, lower gasoline prices have added fuel to the sales fire. Third, low interest rates have sparked an increase in auto loans as borrowers with top credit scores can obtain loans with less than 3% interest.

Decreasing Commercial Bank Interest Rates on 48-Month New Car Loan

Source: Federal Reserve Bank of St. Louis

Fourth, cutthroat competition among the banks has led to relaxed underwriting standards for borrowers. Case in point: About 86% of new cars were financed in 2015, up from 80% in 2008 (according to Frontier Group).

Fifth, helpful, but expensive, safety features (like collision-avoidance systems) further stretched the auto loan book given higher prices of new vehicles. In 2015, the average price of a new car, or light truck, reached a record high of $31,831.

Areas of concern

- Loans to borrowers with the poorest creditability (i.e. credit scores below 620) has risen by more than 150% from the market bottom attained six years ago, compared to a 98% rise in overall auto lending during the same time.

- With the outstanding auto loans hitting more than a trillion dollars, with an average balance of $12,000 per person (or nearly 8 percent of disposable income), it is just behind the dreaded student loan epidemic which stands at $1.3 trillion.

- Lax borrowing standards, which fueled the recent boom in auto sales, resulted into a steady rise in the delinquency rate on the subprime auto loans. These security backed subprime car loans reached its highest level since 2009. More than 5% of the subprime auto loans were delinquent by 60 days or more, the highest level since September 2009 (4.97%). Regions like North Dakota (42%), Oklahoma (15.3%), Louisiana (14%) and Texas (14.9%), which are heavily oil dependent economy, experienced an unprecedented rise in the quantum of seriously delinquent (60 days or more) auto loans in the last quarter of 2015. Crash in the oil prices and a flurry of pink slips in the oil industry resulted in this outcome.

Bottom Line for Investors

The recent surge in subprime auto loans has brought back fears reminiscent of the mortgage backed securities crisis of 2008. Still, these subprime auto loans are different in some key ways:

- The total auto loans are much smaller relative to the subprime mortgage loans; and recent success of the American Banks in the Fed’s stress tests indicates banks are strong enough to manage potential losses.

- As vehicles depreciate, auto loans can’t easily be packaged and sold as an investment product, ideas unlike mortgages during the housing boom.

- As average monthly auto loan payments are much smaller, compared to monthly mortgage payments, they are more manageable.

Most economists are of the opinion that, even if the auto-loan market isn’t facing a repeat of the 2008 crisis, the development shouldn’t be ignored as deteriorating auto credit dynamics could have a ripple effect and drag on the U.S. economy.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.