With the recent news and headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

• Credit card debt soars in the U.S.

• October jobs report shows strong performance

• The challenge with converting office spaces to housing

Credit Card Debt Soars, and May Go Higher for Holiday Shopping – The U.S. consumer has been powering economic growth in 2023, driven in large part by a strong labor market and rising wages. But they’ve also been buying more on credit. According to the Federal Reserve Bank of New York’s latest household credit and debt report, Americans’ total credit card balance eclipsed $1.08 trillion in Q3, which was up $154 billion from last year. That marked the biggest year-over-year increase on record, which should not come as a surprise – Americans are earning more, and goods and services are more expensive.1

Consumer credit card balances at large banks have risen sharply since 2021

Are You Unsure How to Make Your Retirement Last?

Retirement means living the life you want, in the place you want, with activities you enjoy. Of course, making all that happen means spending some of the money you’ve worked so hard to accumulate.

If you want to ensure your money will last, it’s essential to understand some strategies and best practices. Our free guide, 4 Strategies for Spending Money in Retirement3 offers some guidelines to help ensure your retirement nest egg lasts as long as possible. You’ll also get insight on:

• Spending 101: Understanding Tax Buckets

• The 4% Rule

• Dynamic Spending with the 5% Rule

• And more…

If you have $500,000 or more to invest, download our guide 4 Strategies for Spending Money in Retirement.2 Simply click on the link below to get your copy today!

Download Zacks Guide, 4 Strategies for Spending Money in Retirement3

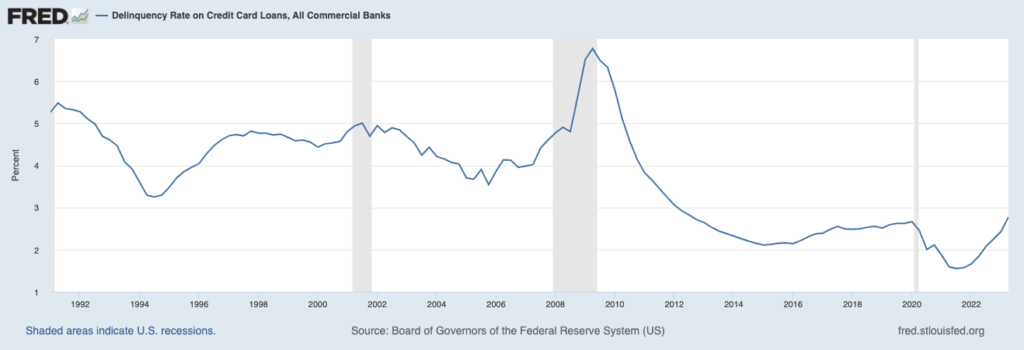

Many media outlets and headlines frame Americans’ credit card spending as out of control and risky to the economy, and cite the $1+ trillion figure as alarming. It has also been reported that the delinquency rate on credit cards reached its highest level since 2011, with the biggest increase coming from borrowers aged 30 to 39. But zooming out a bit more, we can see that delinquency rates (chart below) are still well below historical averages. In our view, there’s no need to sound the alarm bell yet.

Delinquency Rate on Credit Cards

October Jobs Report Shows Strong, But Cooling, Labor Market – The U.S. Department of Labor released the October jobs report late last week, and the results showed a stable, but slightly cooling labor market. As we’ll explain below, that’s a good thing. In October, employers added 150,000 new jobs, nearly all of the job gains came from just three sectors—healthcare, government, leisure & hospitality—with the rest of the economy effectively seeing no job growth for the month. We’d also note that monthly payroll gains have slowed to 204,000 over the past three months, and the unemployment rate has been slowly but consistently moving higher. It was 3.4% in April, rose to 3.8% in September, and registered in October at 3.9%. Wages have also continued to tick higher, with average hourly earnings rising 0.2% from September and 4.1% year-over-year. With year-over-year inflation coming in at 3.4% year-over-year in September, it means that U.S. consumers are seeing positive real wage growth – a good sign. We mentioned earlier that the slightly cooling labor market can be viewed as a good thing. The reason is the Federal Reserve. With higher long-duration interest rates and a cooling labor market, the Fed is increasingly likely to decide monetary policy and financial conditions are sufficiently tight to keep inflation at bay, which implies no further rate hikes in 2023.5

Can Empty Office Buildings Be Converted to New Housing? Many readers have seen the headlines about empty office buildings in downtowns around the U.S. With the surge in hybrid and remote work in the aftermath of the pandemic, many companies have decided not to renew leases or simply do not have enough local employees to make having an office worth the cost. That has led to increased calls to convert office buildings into new apartment/housing units, in an effort to solve another one of America’s issues: not enough housing stock. The problem is that converting offices to apartments is extremely difficult. Last year, developers were able to create 3,575 apartment units from office space, which is less than 1% of all apartments built in 2022. The challenges in converting offices to apartments are many: current financing is expensive with high-interest rates, apartment rents are falling which makes new investors shy away, and many conversions require major interior demolition and extensive plumbing to make floor plans work.6

Strategies for Spending Money in Retirement – You’ve worked hard and planned carefully to build your retirement nest egg – where do you begin when it comes to spending it?

There are many different strategies related to spending in retirement, and some of them are more complex than others. In our exclusive guide, 4 Strategies for Spending Money in Retirement6, we explore some effective strategies and best practices that investors should consider when developing a retirement spending plan. You’ll get insight on:

• Spending 101: Understanding Tax Buckets

• The 4% Rule

• Dynamic Spending with the 5% Rule

• And more…

If you have $500,000 or more to invest and are ready to learn more, click on the link below to get your copy today!

Disclosure

2 Fred Economic Data. October 5, 2023. https://fred.stlouisfed.org/series/RCCCBBALTOT#

3 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

4 Fred Economic Data. August 21, 2023. https://fred.stlouisfed.org/series/DRCCLACBS

5 Bureau of Labor Statistics. November 3, 2023. https://www.bls.gov/news.release/pdf/empsit.pdf

6 Wall Street Journal. November 6, 2023. https://www.wsj.com/real-estate/commercial/turning-empty-offices-into-apartments-is-getting-even-harder-b6659020?mod=djemRTE_h

7 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.