Today’s market offers plenty of noise and plenty of opportunity. In this issue of Steady Investor, we look at what’s shaping investor sentiment now and how you can keep your strategy focused on long-term growth.

- Understanding the “U.S. Dollar Debasement Trade”

- Markets rise despite Government shutdown

- Refinancing surges as rates dip

Understanding the “U.S. Dollar Debasement Trade” – The rise of the so-called “debasement trade” has become one of 2025’s standout market stories, largely tied to gold’s performance.As the media frames it, investors are increasingly concerned that fiscal policy, political instability, and ballooning debt could erode the value of traditional currencies, especially the U.S. dollar. Rather than park cash in Treasurys or bank accounts, many investors are reaching for perceived alternatives like gold and silver. The appeal isn’t necessarily about inflation protection or a looming crisis. In fact, what makes this rally unique is that it’s happening during a period of relative market calm, not amid a crisis. Instead, many see it as a hedge against future policy missteps, with ever-widening deficits and growing pressure on central banks to lower rates. The question investors need to step back and ask, however, is whether the dollar is truly at risk of losing its standing.In short, we think the answer is no. The U.S. dollar remains deeply embedded in global finance. According to the Bank for International Settlements, it was on one side of nearly 90% of all foreign exchange trades so far in 2025, up slightly from previous years. That dominance has proven remarkably stable despite political shocks, tariff waves, and budget brinkmanship. Investors have not sold dollars en masse, and there is little evidence of a rapid shift away from Treasurys in global reserve portfolios. Some argue the Chinese yuan is gaining in marginal share in FX transactions, but it still accounts for less than 9% of global trade activity and less than 3% of cross-border payments, per SWIFT. In our view, the “debasement trade” likely reflects investor enthusiasm for momentum-driven assets and diversified hedges, not legitimate concern that the dollar is on the brink of collapse.1

The Market Keeps Moving. Smart Investors Stay Grounded.

Between rate-cut talk, record market levels, and political headlines, it can feel like everything’s changing at once. One day optimism is high, the next, investors are bracing for a pullback. The truth is that uncertainty is just part of the investing landscape.

That’s why we created Navigating Market Volatility2, a free guide that shares four principles every investor can use to stay grounded when markets shift. It’s built around one goal— helping you stay confident in your plan, even when the headlines feel chaotic. It also covers topics such as:

- Sharp market declines and corrections are a normal part of investing

- The best market days come unexpectedly (often within days or weeks of the worst days)

- Trying to pick market tops and bottoms is nearly impossible

- Trust your strategy and discipline, not the headlines

- Plus, more insights and assistance to help you keep your investment strategy on course

If you have $500,000 or more to invest, get your free volatility guide today!

Download Your Free Copy Today: Navigating Market Volatility: 4 Principles for Staying the Course2

The Shutdown Continues, But the Stock Market Does Not Seem to Mind – As the U.S. government shutdown stretches into its second week, markets are doing what they often do in the face of Washington gridlock: going up.Since the shutdown began on October 1, the S&P 500 has notched multiple all-time highs, which may seem counterintuitive to many readers given higher levels of uncertainty. But the market’s behavior is consistent with the history of government shutdowns. After the five-week government shutdown that ended in January 2019, the S&P 500 surged 36% over the following year. Following the 1982 shutdown, it jumped nearly 20% in 100 days. Of course, not every shutdown sees gains: In 2018, the S&P fell in the months following the standoff. But even then, losses were relatively modest.Why the resilience?Remember, markets are forward-looking. They tend to discount short-term noise, like shutdown headlines, and focus instead on long-term fundamentals. Past data show that any GDP lost during a funding lapse is typically made up once government operations resume. Meanwhile, essential functions, including interest payments on U.S. debt, continue uninterrupted.3

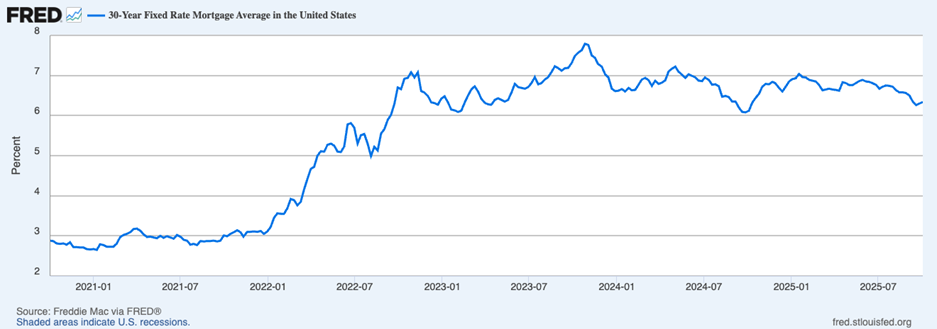

A Sign that Homeowners are Eager for Lower Mortgage Rates – A recent dip in mortgage rates sparked a brief but intense surge in refinancing, offering a glimpse at just how eager homeowners are to reduce their monthly payments.The average 30-year mortgage rate fell to 6.26% in mid-September, the lowest level in 11 months. In response, refinancing activity jumped 80% over three weeks, according to the Mortgage Bankers Association. That momentum quickly stalled when rates ticked back up, but the burst in activity underscored a growing sensitivity to even modest rate changes.4

30-Year Fixed Mortgage Rate

Homeowners who bought during the last few years (when borrowing costs were elevated) are especially eager to refinance. In Q2, 90% of all rate-and-term refinancings were for loans originated in 2023 and 2024. Many of these borrowers carry large mortgages and haven’t built much equity yet. Lower rates offer them meaningful monthly relief. According to ICE Mortgage Technology, the average debt-to-income ratio among Q2 refinancers dropped to 34%, easing pressure on household budgets. If rates fall to 6%, more than 5.9 million mortgage holders could refinance to save at least 0.75 percentage point, potentially cutting their monthly payments by nearly $400. The refinancing rebound could also revive activity for lenders, who have seen volumes drop sharply since the pandemic-era boom. And for the broader economy, cheaper refinancing could unlock spending power, especially if more homeowners tap equity through cash-out refis or home equity lines.

Headlines Change Fast. Don’t Let Them Shake Your Plan – Market headlines will keep shifting from rate cuts, to earnings surprises, and to policy changes. But lasting success comes from tuning out the noise and staying focused on what drives long-term growth.

Our free guide, Navigating Market Volatility6, shares practical ways to stay disciplined when uncertainty rises. Inside, you’ll learn how to keep your portfolio steady, avoid emotional decisions, and stay confident in your strategy, no matter what the next market move brings. If you have $500,000 or more to invest, get your free volatility guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Navigating Market Volatility: 4 Principles for Staying the Course offer at any time and for any reason at its discretion.

3 Wall Street Journal. October 7, 2025. https://www.cnbc.com/2025/10/07/government-shutdowns-stock-market-performance.html

4 Wall Street Journal. October 8, 2025. https://www.wsj.com/economy/housing/homeowners-are-pouncing-on-the-tiniest-drop-in-mortgage-rates-2f66f72d?mod=economy_lead_pos4

5 Fred Economic Data. October 9, 2025. https://fred.stlouisfed.org/series/MORTGAGE30US#

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Navigating Market Volatility: 4 Principles for Staying the Course offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.