As we kick off the new year, this week’s Steady Investor assesses the factors influencing the current market and anticipates what lies ahead, such as:

• Finding equilibrium in today’s job market

• Strong auto sales in 2023 and what it means now

• U.S. manufacturing in a current slump

Finding Equilibrium in the Job Market – The U.S. Labor Department released its job openings and labor turnover summary (JOLTS) report on Wednesday, and data in the report reinforced the idea that the U.S. labor market has stabilized in a strong place. According to the JOLTS summary, there were 8.8 million job openings at the end of November, which is still well above the number of unemployed people actively seeking a job and suggests there is still steady demand for workers.1

More Job Openings (blue line) than Unemployed Persons (red line)

Are You Protecting Your Retirement Investments?

Picture putting years of hard work into securing your retirement savings, only to risk losing half due to unpredictable market swings. That’s why it’s crucial to have a smart plan in place to handle the market’s ups and downs.

To help your retirement planning, we’re offering our free guide, How Solid Is Your Retirement Strategy?3, which gives investors valuable and practical ideas to help build a “weatherproof” retirement strategy. It covers:

• The importance of flexible portfolio allocation

• Why keeping some liquid assets can potentially help you preserve more wealth

• Understanding your risk tolerance in case of a market downturn

• Plus, more strategies to help you protect your retirement assets

If you have $500,000 or more to invest, get our free guide by clicking on the link below.

Get our FREE guide: How Solid Is Your Retirement Strategy?3

Although the job market remains strong, there has been a welcomed trend of cooling over the past two years, with Federal Reserve Chairman Jerome Powell commenting that, “the era of this frantic labor shortage [is] behind us.” According to data from the job-listing site, Indeed, total job postings were down 15% in 2023, and federal data showed that the ‘quits rate’ (2.2%) is at its lowest level since 2020, suggesting that workers are less certain about their prospects in the labor market. Fewer open jobs and fewer quits both point to an increasing likelihood that wage pressures will ease, which is an outcome that the Fed wants to see.

Strong Auto Sales in 2023 Double as a Positive for Inflation – The auto industry had a bad year in 2022. Snarled supply chains, issues at manufacturing facilities worldwide, and dealerships with anemic inventories led to the worst sales year in over a decade. 2023 was much, much better. Supply chain problems faded and production ramped back up globally, essentially unwinding many of the issues that hurt sales in 2022. Rising inventories, easing prices, and more promotional deals resulted in industry-side sales of 15.5 million vehicles last year, a 12.4% jump from last year. Many automakers also reported double-digit sales gains year-over-year in 2023, with General Motors maintaining its position as the U.S.’s top seller. GM reported this week that it sold 2.6 million vehicles in 2023, a 14% increase from 2022 sales. More inventory and a few manufacturing issues led to prices falling from 2022 levels, but consumers still paid an average of $46,055 for a car last year – far higher than 2019 levels.4

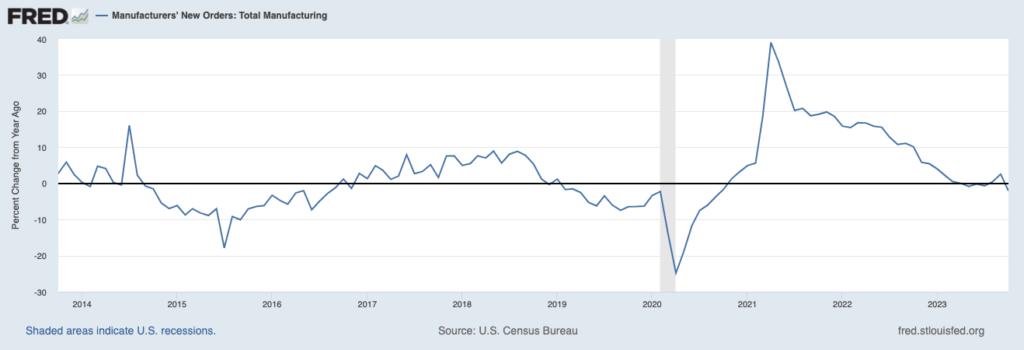

A Mixed Bag for U.S. Manufacturing – The U.S. manufacturing sector spent much of 2023 in a slump, but factory construction in the U.S. is experiencing a boom. How can both be true at the same time? Let’s start by examining the slump, which is evident in the Institute for Supply Management’s (ISM) manufacturing index data for December.5 The index came in at 47.4 in December, which while an improvement from November’s 46.7 still marks the 14th consecutive month of contraction. New orders, which offer the clearest signal of demand, continue to decline as seen in the chart below.6

Manufacturing New Orders, % Change from a Year Ago

Meanwhile, the U.S. manufacturing sector is also said to be entering a ‘golden age,’ with billions of dollars of new government subsidies flowing from the Inflation Reduction Act and the Chips and Science Act, which included $39 billion in subsidies for semiconductor producers. Therein may lie some of the disconnects – the subsidies only target a subset of manufacturers in high-tech and renewable energy sectors, which comprise a very small sliver of overall industrial production. Even still, spending on new factories rose 40% in 2022 and was up 72% through the end of October 2023, which implies that more production and gains in manufacturing employment are in the offing.

How to Protect Your Retirement from Unknowns in the Market – While market volatility cannot be entirely prevented, there are methods to shield your retirement assets from the fluctuations that occur.

In our free guide, How Solid Is Your Retirement Strategy8, we cover ways to help prepare you for what’s to come as you plan your ultimate retirement. You’ll get insight on:

• The importance of flexible portfolio allocation

• Why keeping some liquid assets can potentially help you preserve more wealth

• Understanding your risk tolerance in case of a market downturn

• Plus, more strategies to help you protect your retirement assets

If you have $500,000 or more to invest, get our free guide today!

Disclosure

2 Fred Economic Data. January 3, 2024. https://fred.stlouisfed.org/series/JTSJOL#

3 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

4 Wall Street Journal. January 3, 2024. https://www.wsj.com/business/autos/u-s-auto-sales-bounced-back-in-2023-ecd389dd?mod=djemRTE_h

5 ISM. 2023. https://www.ismworld.org/globalassets/pub/research-and-surveys/rob/pmi/rob202312pmi.pdf?mod=djemRTE_h

6 Wall Street Journal. December 31, 2023. https://www.wsj.com/articles/why-manufacturing-is-in-a-slump-despite-signs-of-a-renaissance-50661126?mod=djemRTE_h

7 Fred Economic Data. January 3, 2023. https://fred.stlouisfed.org/series/AMTMNO#

8 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.