In today’s Steady Investor, we look at key investing themes that we believe are currently impacting the market, such as:

- The U.S. economy shows exceptional growth

- China escalates trade tensions

- October labor report reveals mixed signals

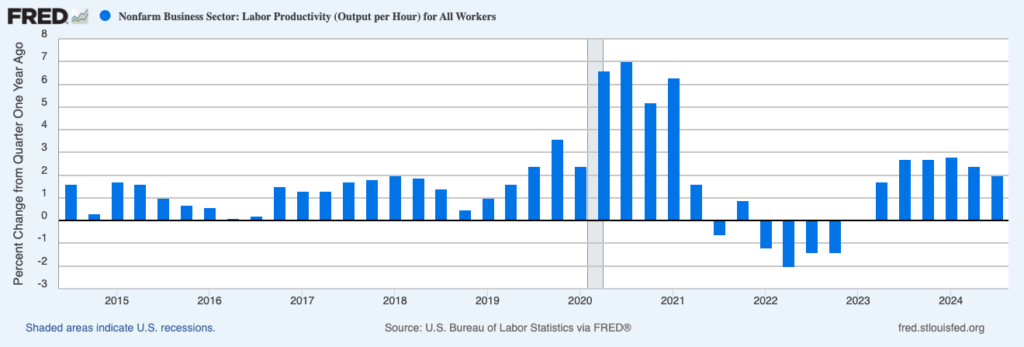

Productivity Growth in the U.S. Sees Steady Increase – Job growth has slowed in the U.S. over the past several months, while economic growth has picked up. A key feature explaining how this divergence is possible is rising productivity. In 2024, quarterly productivity has grown by at least 2% year-over-year, with productivity gains notched over the past five quarters. As seen in the chart below, the steady gains in productivity are consistently higher than what’s been experienced in the previous decade, excluding the immediate post-pandemic rebound—when low productivity jobs like food service were slow to come back online.

Protect Your Retirement from Market Uncertainties

You’ve worked tirelessly to build your retirement savings, but what happens if market volatility puts it all at risk? Don’t let unexpected downturns threaten your future.

Our free guide, How Solid Is Your Retirement Strategy?2, gives you the tools to create a resilient plan that protects your wealth through market ups and downs. It covers:

- The importance of flexible portfolio allocation

- Why keeping some liquid assets can potentially help you preserve more wealth

- Understanding your risk tolerance in case of a market downturn

- Plus, more strategies to help you protect your retirement assets

Get the peace of mind you deserve— if you have $500,000 or more to invest, download your copy now and secure your financial future!

Get our FREE guide: How Solid Is Your Retirement Strategy?2

The productivity gains in the U.S. are notable for their contrast to other developed economies like Europe and Canada, where productivity has grown by less than 1% on average over the last decade. Productivity gains are crucial for driving healthy long-run economic growth, because the productive capacity of the economy can expand without too much overheating in the labor market. By some accounts, rising productivity in the U.S. has happened out of necessity, as companies face a tight talent pool and have turned to other measures—like investment in technology—to get more productive output out of each worker.

China Bans the Export of Rare Earth Metals to the U.S. – Many investors and market watchers were alarmed this week when China announced it was outright banning the export of rare earth metals gallium, germanium, antimony, and superhard materials to the U.S. These metals are essential components of semiconductors, satellites, night-vision goggles, and other high-tech, often military applications. China is the world’s top supplier of these metals, which had some investors concerned about short- and long-term implications. But a closer look at the issue reveals some key insights. For one, the U.S. has not imported any gallium and germanium in 2024, and the business community has indicated that ample supplies exist in inventory, with alternative sources available to explore as well. China’s move appears to be more posturing than anything else, in response to the Biden Administration’s decision to place more export controls on high-bandwidth memory chips.3

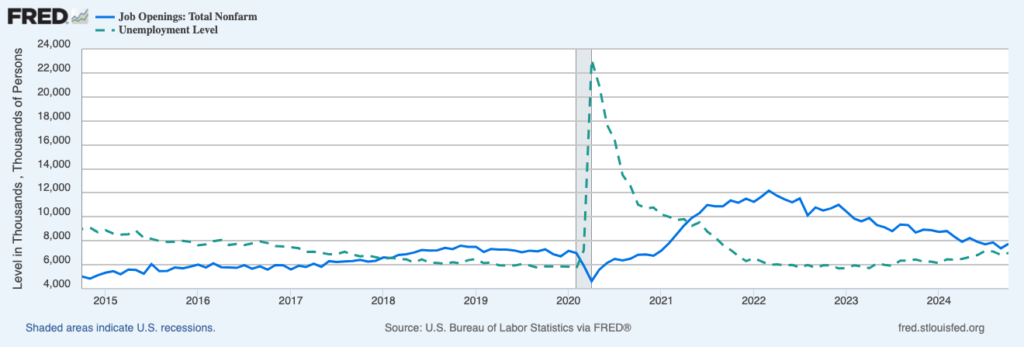

What the Latest U.S. Jobs Report Tells Us About Potential Fed Policy – The Labor Department delivered the latest JOLTS (Job Openings and Labor Turnover Survey) report last week, which showed further loosening in the labor market. Job openings increased by 372,000 from September, bringing the total for October to 7.74 million. A higher level of job openings tends to ease pressure on wage growth, which can factor as a positive for inflation data. The ratio of job openings as a percent of the total labor force increased from 4.4% to 4.6%. All told, there is about one open job for every unemployed American, which as seen on the chart below is a balance last achieved in 2018.4

Job Openings (blue line) and Unemployment Level, Persons (green dotted line)

In our view, this data points to a normalization in the labor market, which reinforces the idea that the Fed can focus almost universally on inflation data in determining the path of rates.

Strategies to Safeguard Your Retirement in Today’s Market – Imagine spending years growing your retirement savings, only to have market volatility threaten everything you’ve worked for. Don’t let unpredictable market swings jeopardize your future. Build a strategy that safeguards your wealth through both the highs and lows.

Our free guide, How Solid Is Your Retirement Strategy?6, equips you with the tools to create a resilient plan that protects your retirement no matter what the market does. Inside, you’ll discover:

- The importance of flexible portfolio allocation

- Why keeping some liquid assets can potentially help you preserve more wealth

- Understanding your risk tolerance in case of a market downturn

- Plus, more strategies to help you protect your retirement assets

If you have $500,000 or more to invest, get our free guide today!

Disclosure

2 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

3 Yahoo Finance. December 3, 2024. https://www.yahoo.com/news/china-targets-critical-metals-tit-102821740.html

4 CNBC. November 3, 2024. https://www.cnbc.com/2024/12/03/job-openings-jumped-and-hiring-slumped-in-october-key-labor-report-for-the-fed-shows.html

5 Fred Economic Data. December 3, 2024.

6 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.