In this week’s Steady Investor, we look at some of the current events that are shifting the market, such as:

- The main driver in the U.S. economy remains strong

- Status on Fed Rate hikes

- Strength in the housing market

A Main Driver of U.S. Economic Growth Remains Strong – On a macro level, developed country economic activity is often framed in terms of services and manufacturing. In export-driven countries like China and Japan, manufacturing is generally considered the more important measure of the two. But in services- and consumption-based economy like the U.S., services activity matters far more than manufacturing. There’s good news to report: the latest data from S&P Global shows service activity in the U.S. at a 13-month high. Overseas, Japan also showed strong services and manufacturing activity as did Europe, though the latter is still coping with high energy and food prices. According to the latest U.S. data, services activity was strong across travel, dining out, and other leisure activity. Manufacturing activity went in the opposite direction, as bloated inventories and weak new orders have dented growth. The composite purchasing managers index, which measures manufacturing and services together, rose to 54.5 in May from 53.4 in April, with any reading above 50 signaling expansion. This relatively robust measure of economic activity may complicate the Federal Reserve’s plans for monetary tightening, as elevated services and spending activity will arguably keep some level of upward pressure on prices. Below, we discuss whether that means the Federal Reserve’s planned interest rate “pause” in June is still on the table.1

Worried These Events Could Affect Your Investments?

Current events, such as the latest debt ceiling standoff, is raising concerns about whether the U.S. may default on debt payments for the first time in history.

To better navigate through market changes, it’s important to prepare your investments. In our May 2023 Zacks Market Strategy Report, we look at the debt ceiling issue and what it means for investors. Get your free copy to learn more about:

- Debt Ceiling Drama is Back

- A Historical View of Debt Ceiling Standoffs and How the Impacted Markets

- Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more, download your guide today!

Download Our Exclusive “Market Strategy Guide”2

Is the Federal Reserve Actually Poised to Pause Rate Hikes in June? The Federal Reserve has engaged in an aggressive rate hike campaign, pushing the benchmark fed funds rate from the zero bound to between 5% and 5.25%, a 16-year high. Chairman Jerome Powell has been sending signals that the Fed could pause rate hikes at the June meeting, as he recently said that “having come this far, we can afford to look at the data and the evolving outlook and make careful assessments.” Powell also added that “the risks of doing too much versus doing too little are becoming more balanced,” which was a break from earlier language suggesting that the real risk was in not raising rates enough. The market had all but priced in a pause in the tightening cycle – until this week. Now, a handful of Fed officials have indicated their decision to raise or hold rates at the next meeting could be a close call. Some have indicated that inflation does not seem to be slowing quickly enough and that the U.S. economy is still too strong – as evidenced by the services PMI referenced above and by the still-tight labor market. In Fed governor Neal Kashkari’s words, “I would object to any kind of declaration that we’re done [raising rates].3

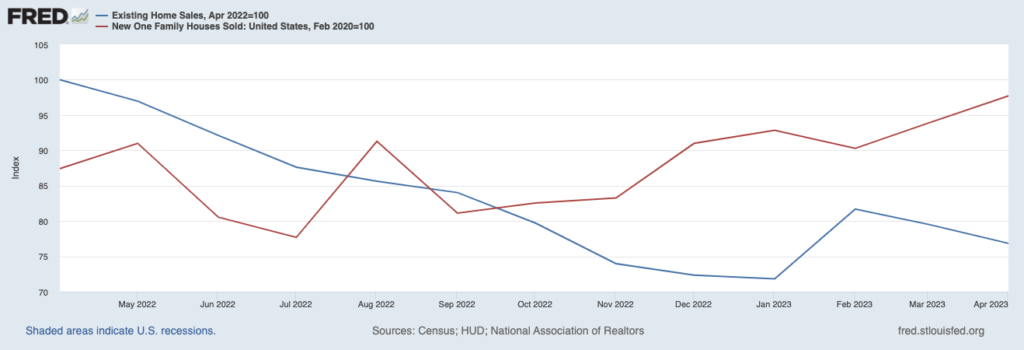

New Home Sales Post Strong Showing – The U.S. housing market is often characterized as being in a downturn, but a more nuanced view of the data suggests that pockets of weakness are also accompanied by pockets of strength. We have written in this space before about the geographic split in U.S. housing, where home sale activity in the South and East has been holding up well relative to the West. But there is another ‘split’ in the data worth highlighting: the sale of new homes versus existing homes. Existing home sales have been under pressure, as homeowners with low mortgage rates are (understandably) reluctant to move – which could also mean swapping a low rate for a higher one. As such, the inventory of existing homes is low, which is driving weak sales activity. For new homes, however, the picture looks better. New home sales rose in April to a level not seen in over a year, up 4.1% from March and 11.8% year-over-year.4 The divergence between the two is clear in the chart below:

Source: Federal Reserve Bank of St. Louis5

Homebuilders understand that with interest rates likely to remain elevated, the supply of existing homes is likely to remain tight in the foreseeable future – which also means demand for new homes may remain firm as well. That has pulled forward new construction and is also adding to overall economic activity (since new home starts are the principal way real estate adds to GDP).

A Closer Look at the Debt Ceiling Drama – The latest debt ceiling standoff is raising concerns about whether the U.S. may default on debt payments for the first time in history.

Even though we know from recent history how this story goes—and how it will likely go again—the issue has to be taken seriously each time. In our May 2023 Zacks Market Strategy Report, we look at the debt ceiling issue and what it means for investors. Get your free copy to learn more about:

- Debt Ceiling Drama is Back

- A Historical View of Debt Ceiling Standoffs and How the Impacted Markets

- Bottom Line for Investors

If you have $500,000 or more, fill out the form to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

3 Wall Street Journal. May 21, 2023. https://www.wsj.com/articles/fed-official-is-open-to-foregoing-june-rate-hike-ebb9c7c7?mod=economy_more_pos6

4 CNN. May 23, 2023. https://www.cnn.com/2023/05/23/homes/new-home-sales-april/index.html

5 Fred Economic Data. May 18, 2023. https://fred.stlouisfed.org/series/EXHOSLUSM495S#

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.