Judy T. from Dallas, TX asks: Mitch, there’s pretty much constant talk about interest rates falling this year, with the Federal Reserve cutting borrowing rates. But I’ve noticed that Treasury bonds keep going up, which seems like the opposite of what should be happening. Can you explain?

Mitch’s Response:

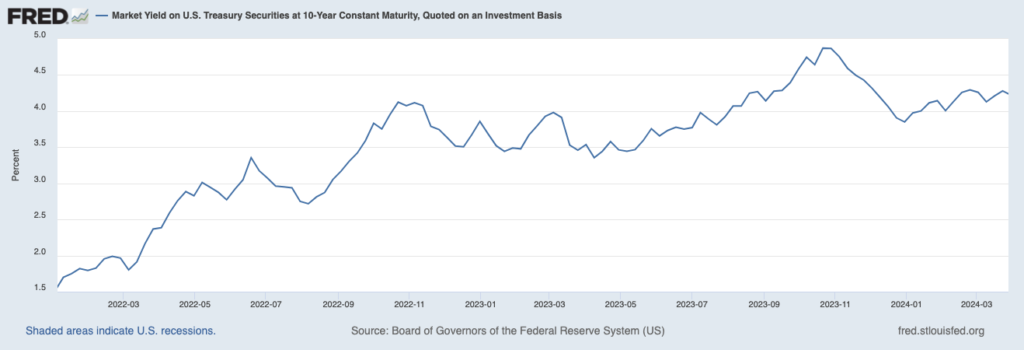

Thank you, Judy, that’s a sharp observation. To provide readers with context, we can take a look at a chart of the 10-year U.S. Treasury bond over the past couple of years. As seen below, the trendline is positive—yields have soared from around 1.5% two years ago to over 4.0% today. And since the beginning of 2024, when the notion of rate cuts became more definitive than hypothetical, 10-year Treasury bond yields crept up about 30 basis points.

Tax Planning? Download Our Free Guide for Guidance!

There are only a few more weeks left to organize your tax planning. Don’t wait until the last minute; start now to maximize your savings and minimize stress.

To help, I recommend downloading our free guide, Tax Planning in 2024: A User-Friendly Guide2, which aims to simplify the complexities of tax laws, empowering individuals and business owners to make strategic decisions that minimize tax liability.

It also covers a range of key tax issues, such as:

• Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

• Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

• Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions and other essential topics.

• Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Download Tax Planning in 2024: A User-Friendly Guide2

So, to your point, when investors and consumers were expecting borrowing costs like mortgage rates, credit card rates, and corporate bond rates to fall, they’ve risen instead. What gives?

There are a few factors at work. The first one to consider is that Treasury bond yields largely reflect investor expectations about the fed funds rate over the life of a bond. At present, the Fed funds rate is between 5.25% and 5.5%, and investors have been in the process of recalibrating expectations. First, it was six rate cuts, now it’s three. Treasury yields have followed suit essentially, rising as investor expectations for the Fed funds rate have risen too.

Another factor keeping a bit of upward pressure on the 10-year is the end of quantitative easing (QE) and the Fed’s shrinking balance sheet. During the era of QE, the Fed was a major buyer of mortgage securities and Treasury debt, which kept upward pressure on bond prices (and downward pressure on yields). Now that the reverse is happening, there’s less demand, meaning less upward pressure on price.

In terms of what factors could keep upward pressure on 10-year U.S. Treasury bond yields from here, it’s really about inflation and economic growth. If inflation and/or economic growth accelerates in 2024, it would pressure the Fed to keep short-term rates elevated, which would cause investors to again scale back bets on rate cuts. That could keep the 10-year U.S. Treasury bond in the 4% to 5% range.

Last week brought some good news on that front—the Fed’s preferred inflation gauge, the PCE price index, came in at 2.5% year-over-year. That was in line with expectations.

With economic factors stabilizing, now is the perfect time to tackle your tax planning and ensure it doesn’t become a headache within the next few weeks!

Our user-friendly guide, Tax Planning in 20243, provides an overview of the many issues involved in tax planning, including ways you can reduce your tax burden. This guide is by no means exhaustive, but offers a solid resource you can use to have more effective discussions with your family and tax advisors. It covers:

• Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

• Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

• Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions and other essential topics.

• Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “Tax Planning in 2024: A User-Friendly Guide” for any reason and at ZIM’s discretion.

3 ZIM may amend or rescind the free guide “Tax Planning in 2024: A User-Friendly Guide” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.