In this week’s Steady Investor, we cover special events and news that we believe are currently impacting the market and will continue to for the rest of 2021, such as:

- The fall of U.S. unemployment rates

- Higher oil prices

- Risk of China contagion

The U.S. Unemployment Rate Fell, but for the Wrong Reasons – In September, the U.S. economy added a disappointing 194,000 new jobs, which was the smallest gain since December 2020. The job gains fell far short of expectations, as did the economic recovery in Q3. The Delta variant surge put a soft patch in economic activity that showed up clearly in the data. And yet, the unemployment rate in the U.S. fell from 5.2% in August to 4.8% in September. Good news, right? Not exactly. The quirk with U.S. unemployment data is that it measures people actively looking for work – if a person is on the sidelines and not looking for a job, then they are not counted in the official unemployment rate. Thus, the unemployment rate can fall when people leave the labor market, which is what we saw in September. The number of workers who cited the pandemic rose in September for the first time since January and reached 1.6 million. There are other reasons folks leave the labor force – retirement, lack of child care, or in the present moment, refusal to get vaccinated. Whatever the reason, a record number of Americans are quitting their jobs – in August, nearly 3% of the workforce (4.3 million people) left a job, which is the most since data started being collected in 2000. In some cases, workers are leaving for the aforementioned reasons. In others, workers are leaving jobs because they are confident, they can find work, and perhaps better pay, elsewhere.1

_________________________________________________________________________

Handling Volatility – What You Should Do!

Sudden market declines often result in emotional decision-making – like when investors believe that selling out of stocks is the best route to avoid further losses. The real challenge is not finding a way to eliminate volatility—it is developing a mental approach to dealing with it. Our guide, “Helping You Manage Market Volatility,” will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”2

_________________________________________________________________________

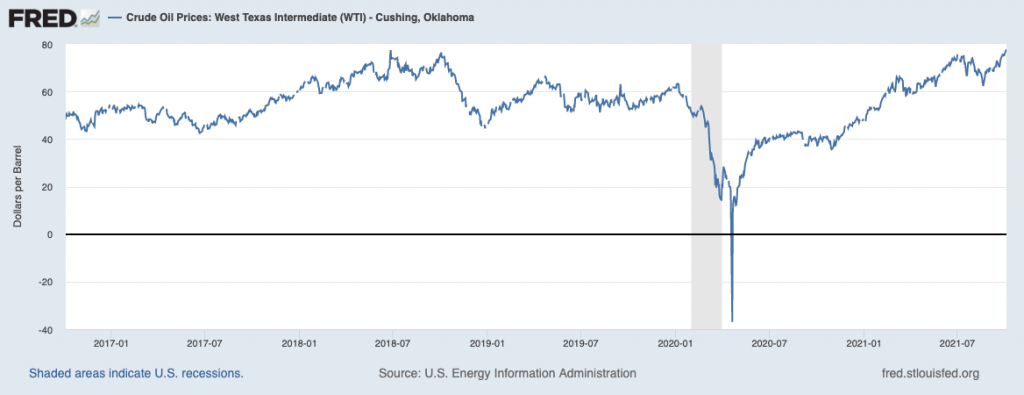

Oil Prices Continue to Push Higher – Oil prices have crept up to around $80 a barrel, marking a seven-year high and a 60+% increase in 2021 alone. Natural gas and heating oil prices have also soared, and most readers have likely noticed higher prices at the pump. As ever, prices are set by supply and demand, and the current pressures on price are a result of very strong demand being met by tight supplies. As the global economy comes back online and U.S. consumers lead the charge in economic activity, manufacturers and suppliers are racing to ramp up production to meet demand, which requires energy. While we might reasonably expect energy producers to ramp up production to capitalize on higher prices, doing so takes time and may not provide immediate relief.3

Keeping an Eye on the Risk of China Contagion – China’s $5 trillion real estate market continues to roil – home sales are stalling and crackdowns on easy lending have choked off liquidity to some of the largest property developers. The year-over-year declines in home sales are approaching 20% to 30%, figures that may arise in the short-term as the market recalibrates. Many Chinese families have wealth tied up in homes and apartments, which can put a dent in finances and spill over into lower consumption and growth. Meanwhile, China’s economy is facing another crisis as President Xi Jinping continues to press forward with market reforms that target China’s private-sector businesses. Chinese stocks have been battered as the state has moved from private technology companies to the education sector, and now to state-owned banks to examine whether they have forged too strong of ties with private firms. The effort is part of Xi Jinping’s move to shift China even further away from Western-style capitalism, which has been very damaging to Chinese shares.5

Navigating Through Market Volatility – One challenge that many equity investors are facing and will most likely continue to face throughout the remainder of the year is how to react to current volatility. It is important to remember that volatility is a normal part of the market flow. We believe the key is not to look for ways to eliminate it, but to develop a mental approach to dealing with it.

Our Volatility guide, “Helping You Manage Market Volatility,”6 will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

3 Wall Street Journal. October 11, 2021. https://www.wsj.com/articles/oil-price-jumps-above-80-and-natural-gas-races-higher-turbocharged-by-supply-shortages-11633943832?mod=djemRTE_h

4 Fred Economic Data. October 5, 2021. https://fred.stlouisfed.org/series/DCOILWTICO

5 Wall Street Journal. October 12, 2021. https://www.wsj.com/articles/chinese-developers-report-sharp-drops-in-monthly-home-sales-11634037472?mod=djemRTE_h

6 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.