There is no denying that the manufacturing sector is an integral part of the U.S. economy – the sector contributes around 2.17 trillion to GDP and accounts for about 12% of our nation’s total output. However, the years of strong output and jobs is largely a thing of the past. A little known, and underappreciated fact, is that U.S. manufacturing output is currently nearing all-time highs. However, this growth “feels different” jobs haven’t grown with it.

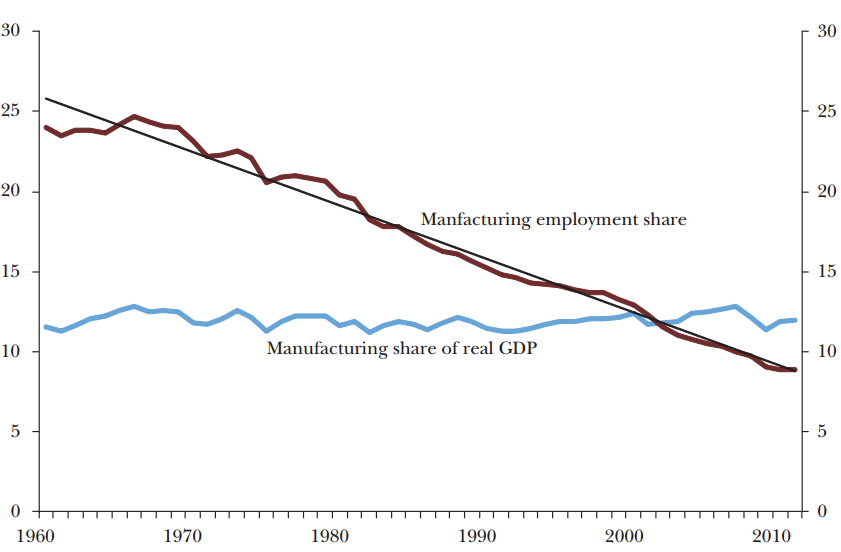

Manufacturing Value-Added and Employment as a Share of the Total U.S. Economy, 1960–2011 (in 2005 prices)

(Source: Industry Accounts of the Bureau of Economic Analysis)

Manufacturing output, as a share of GDP, has remained stable in the last decade or so. Why? Because automation has enabled productivity to skyrocket driving high skilled manufacturing which has seen incredible growth (think computers, electronics, semiconductors and so forth). Politicians on the campaign trail love targeting the manufacturing sector and make promises to create new jobs or “bring manufacturing back.” What they really should be focused on is training more Americans in high-skilled manufacturing so we can continue to dominate that space. Few, if any, politicians will do this, however, as it means potentially foregoing too many votes in purple states.

The reality is that 90% of the manufacturing industry that lies outside of the computer and electronics sectors have seen their share of real GDP fall, while productivity growth has been fairly slow. Many would say it’s because we’re shipping these jobs to China, which is true, but China’s manufacturing sector has also been on the decline in the last decade or so. Some of these jobs simply aren’t needed anymore, and they almost certainly are not coming back.

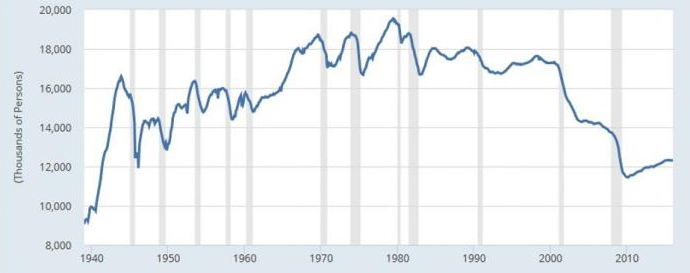

Total Manufacturing Employment from 1940 – 2016

(Source: U.S. Bureau of Labor Statistics)

Blame productivity…or don’t – declines in employment started in earnest around 1979. Notable, and enduring, productivity gains among U.S. manufacturers over the past few years continue to provide the U.S. manufacturing sector with a sustained competitive advantage over most other countries (evident in that productivity of the U.S. manufacturers has gone up by 40% since 2003). That’s a good thing!

Here’s the key: In 2016, American productivity is not only at its all-time high but is also nine times more productive per employee than the manufacturers in China and has surpassed Japan (the second best economy) by nearly 25%. Compared with emerging economies in Mexico, India, Brazil and China, U.S. production efficiency is around 80-90% higher.

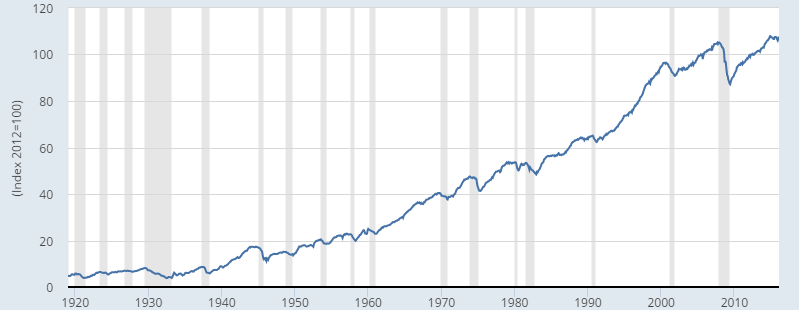

Industrial Production Index for the United States

(Source: Industrial Production Index)

By curtailing the in-house production of less valuable items like garments, toys or certain electronics, American manufacturers focused on the production of value – adding items where comparative advantage is greatest enabling the U.S. to achieve high levels of efficiency. From an economic perspective, nothing could be better news – U.S. manufacturing creates 100% more value with 37% fewer workers.

Creating more value with fewer workers means Americans are more efficient and productive than ever. Global free trade, outsourcing the production of less valuable items and technological innovation in areas of software, robotics and communications has enabled the American manufacturer to win on a global scale.

Bottom Line for Investors

It is a fact that, post 2009 financial crisis, the U.S. manufacturing industry has been in a decline, perhaps more so than if economic conditions weren’t so middling. The recent oil price glut, strong dollar and gloomy export scenario have made the fall all the more inexorable and caused jobs to disappear from the industry.

Despite these obstacles, production efficiency achieved by the U.S. manufacturing industry deserves praise, not criticism, and is a testament to the technological strength amassed by Americans in the last few decades.

It’s difficult to experience job losses anywhere and it’s never easy to shift careers. But, it’s important to remember that a number of job losses from the manufacturing sector have shown up elsewhere as job gains in other parts of the economy, many in high-skilled manufacturing. These economic changes are, no doubt, painful in the short run (think about the transition from an agricultural economy to an industrial economy and how many farmers were displaced). However, in long run, it brings gains in output and employment not only to the U.S., but for the rest of the world as well.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.