In today’s Steady Investor, we look at key factors that we believe are currently impacting the market, such as:

- Stock market rallies on hopeful vaccine candidates

- Higher priced homes are in strong demand during this pandemic

- A different kind of struggle in the airline industry

- Will saving during COVID-19 cause a new wave of big spending in the future?

Stock Market Rallies on Hopeful Vaccine Candidates – The market rallied sharply early in the week, as Pfizer and German partner BioNTech announced hopeful early vaccine results. Though the results have not been peer reviewed and are not fully complete, they show to be 90% effective in protecting people from contracting Covid-19 – a very promising outcome indeed. Meanwhile, Moderna is said to be about a week away from releasing data from a large trial of its experimental Covid-19 vaccine, which could add another strong option into the mix. The stock market surged on the Pfizer news, only to give up some of the gains as the week wore on. Investors are looking for any sign of a timeline to the end of the pandemic, when vaccines can be widely available to the American public and economic activity can resume completely unrestricted. As for the promising early result from Pfizer and BioNTech, those shots could be available as early as this year, though the first batches will be reserved for front-line workers and the old and vulnerable. Some estimates peg the vaccine becoming widely available by the spring, perhaps April. In our view, getting the pandemic under control – and effectively and efficiently distributing the vaccine – remain the biggest risks to the nascent economic recovery.1

______________________________________________________________________________________________

Download Our Dean’s List of Investment Strategies!

The recent COVID-19 news of a vaccine coming soon is affecting the market drastically. As we wait for the outcome, there is still uncertainty causing concern for many investors. Finding the right investment strategy can make a huge difference when managing the highs and lows of the market, and can help prepare your long-term investments for success.

To help you learn more about strategies that cater to different investment objectives, we have created our Dean’s List of Investment Strategies. Our Dean’s List describes five of our investment strategies that are ranked in the top of their respective classes by Morningstar (as of 9/30/20).2

If you have $500,000 or more to invest and want to learn about five of our top strategies, click on the link below.

Learn More About Our Top-Ranked Strategies!3

______________________________________________________________________________________________

The U.S. Housing Story Continues Strengthening – Can it Last? We have written many times in this space about the robust housing recovery, fueled in no small part by remote work and the need for more space. For the first time ever, millennials made up the highest percentage of new mortgage applications, a sign that a migration out of cities has taken hold in the wake of the pandemic. In particular, the last few months have seen strong demand for higher priced homes. According to the National Association of Realtors, nearly 25% of home buyers over the summer paid at least $500,000, which is up from 14% in the previous nine months.4 Even as the pandemic has wreaked havoc on some parts of the U.S. economy, many of the high-skilled and white-collar workers who can work digitally and from home have emerged unscathed. The demand for more space is pushing up home prices, but once the migration runs its course and the pandemic risk fades, the question becomes: can it last?

A Different Kind of Struggle in the Airline Industry – Airlines have taken a big hit in the pandemic, for obvious reasons. But the industry is also feeling pressure in other ways that are not so obvious – tariff wars. A little over a year ago, the United States imposed tariffs on $7.5 billion of Airbus jets (made in France), which received approval from the World Trade Organization on the basis that Airbus jets receive significant state subsidies. Just this week, the European Union retaliated, imposing $3.99 billion in tariffs on Boeing jets (made in the U.S.). The tit-for-tat tariffs will no doubt raise the prices of planes for airlines and other buyers, which may deliver a sting at just the wrong time.5

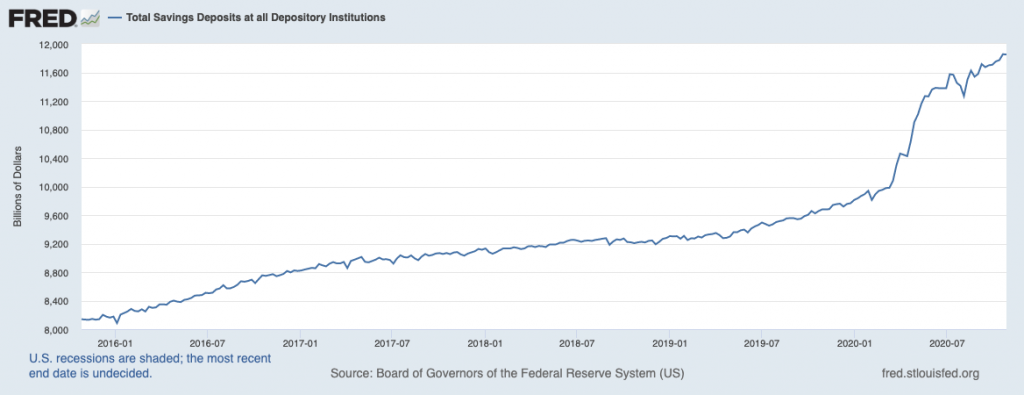

Americans Have Been Socking Away Cash – Is a Big Wave of Spending Coming? Americans have accumulated some $2 trillion in new savings deposits over the last 10 months, even though banks have lowered deposit rates to basically 0%. The pandemic has played a big role in Americans’ desire to sock away cash. For one, stimulus checks and boosted unemployment benefits gave many the ability to save the extra cash. But second, the crisis and associated lockdowns/restrictions also pushed many to stay home, cook meals, spend less on entertainment and travel, and cut back other discretionary spending over the spring and summer. The end result: Americans saved money (see chart). Total deposits at U.S. banks swelled to about $15.9 trillion, up from around $13.2 trillion at the start of 2020. In our view, it seems likely that this ‘stashed cash’ is a wall of liquidity waiting to be released back into the economy, especially once the risk of the pandemic fades completely. A spending boom feels possible – if not likely – in the second half of 2021.6

Total Savings Deposits Have Spiked in 2020

There is no way to know exactly how this pandemic will continue to impact the market and economy, but finding the right investment strategy can make a huge difference when managing the highs and lows of the market. To help you learn more about strategies that cater to different investment objectives, we have created our Dean’s List of Investment Strategies.8

Our Dean’s List describes five of our investment strategies that are ranked in the top of their respective classes, according to Morningstar (as of 9/30/20).7 If you have $500,000 or more to invest and want to learn more about these strategies, click on the link below to see how they could potentially benefit you.

Disclosure

2 ZIM may amend or rescind the “Dean’s List of Investment Strategies” guide for any reason and at ZIM’s discretion.

3 These rankings may not be representative of any one client’s experience. In addition, they are not indicative of future performance

4Wall Street Journal. November 11, 2020. https://www.wsj.com/articles/pandemic-boosts-upper-end-of-housing-market-coast-to-coast-11605106801

5 Wall Street Journal. November 9, 2020. https://www.wsj.com/articles/boeing-jets-other-u-s-goods-worth-4-billion-face-eu-tariffs-11604927987

6 Wall Street Journal. March 15, 2020. https://www.wsj.com/articles/fed-faces-crucial-decisions-to-alleviate-virus-shock-11584303662?mod=djemMoneyBeat_us

7 Federal Reserve Bank of St. Louis. November 5, 2020. https://fred.stlouisfed.org/series/SAVINGS#0

8 ZIM may amend or rescind the “Dean’s List of Investment Strategies” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.