In today’s Steady Investor, we break down the forces shaping markets at the start of the year, and the risks investors should be paying attention to now, including:

- Geopolitical shock, economic impact unclear

- Labor market cooling, still resilient

- Housing policy shift, limited impact

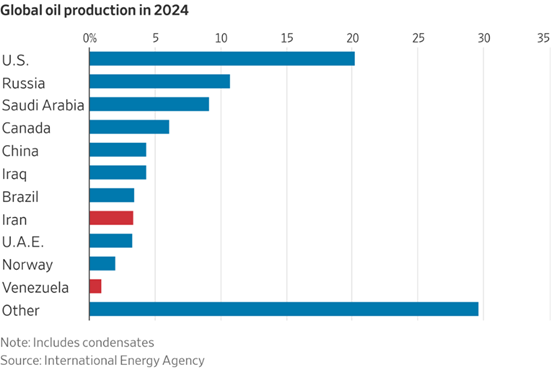

How the Venezuela Issue May—or May Not—Impact Oil Markets and the Economy – Over the last weekend, U.S. forces captured and arrested Venezuelan President Nicolás Maduro in a major geopolitical development. There is plenty of political and strategic commentary about the move and what could happen next. But our concern here will be on the potential impact on oil markets and the U.S. economy. Beginning with the oil trade, Venezuela now produces roughly 900,000 barrels per day, or less than 1% of global oil supply1:

Retirement Planning in Today’s Market

With geopolitical tensions and policy uncertainty driving markets, investors are facing forces they can’t control.

In this environment, retirement planning isn’t about reacting—it’s about having a strategy that can hold up as conditions change. Many are now reassessing whether their approach is built for today’s risks and long-term retirement needs.

I recommend downloading our free guide, 8 Steps Toward a Stress-Free Retirement2. It outlines a practical roadmap for building a retirement plan focused on long-term stability and income planning, including:

- The “magic number” every retirement investor needs to know

- How to plan for emergencies that can derail your retirement investments

- Why missing just 25 trading days can decimate your returns

- Three ways to generate income during retirement

- Plus, other key steps to help you realize your retirement goals

If you have $500,000 or more to invest and would like to learn more about retirement planning considerations, download 8 Steps Toward a Stress-Free Retirement2.

Though Venezuela does not currently produce a substantial amount of oil (relatively speaking), the country holds enormous reserves, and any eventual easing of sanctions or reopening to foreign investment could increase supply over time. But it’s also true that years of underinvestment have left Venezuela’s oil infrastructure severely degraded, and reviving production would require substantial capital, legal clarity, and sustained political stability. None of these required outcomes are guaranteed, of course. Even under optimistic assumptions, meaningful output gains would likely take years, with early effects showing up more as costs than earnings. It will be a highly interesting story to monitor over time, but we don’t expect a flood of new crude on the markets that will drastically lower prices. From an economic perspective, the implications are even more limited. Venezuela’s economy represents only a tiny fraction of global GDP, meaning recent events do little to alter the outlook for worldwide growth, inflation, or corporate earnings. As history shows, markets tend to look through regional disruptions quickly once investors do the math and conclude that global commerce continues largely unchanged.

What Private Data and the Latest JOLTS Report Says About the U.S. Labor Market – Fresh labor-market data continue to point to an economy that is slowing incrementally but not sliding into distress. According to the latest estimates from ADP, private sector hiring turned modestly positive in December, with businesses adding a net 41,000 jobs during the month after cutting roles in November. Over the past several months, job gains have slowed from earlier in 2025, when monthly hiring regularly topped 100,000. More recently, net job creation has averaged closer to 20,000 per month, consistent with a labor market that is losing steam but still expanding. The latest JOLTS (Jobs and Labor Turnover Survey) report paints a similar picture. The November 2025 report showed job openings falling to a one-year low and hiring declining further, reinforcing the view that employers are growing more selective. What hasn’t happened is a surge in layoffs. After years of difficulty finding workers, many employers appear reluctant to let go of employees unless conditions deteriorate meaningfully.3

Could a New Rule Impact Housing Supply and Prices in the U.S.? The Trump administration created some headlines in the housing market this week, with the announcement that the administration would seek to bar large institutional investors from buying additional single-family homes. Home prices are up more than 50% since 2019, largely reflecting years of underbuilding, higher construction costs, and mortgage-rate lock-in that have discouraged existing homeowners from selling. Bringing on more supply of houses is a key goal in lowering prices, but the rule change may not create a meaningful shift. Institutional investors own only an estimated 2%–3% of the overall U.S. housing stock, suggesting that even a sweeping ban would not materially change national supply conditions in the near term. Many institutional landlords have also been shifting their strategy of late, moving away from acquiring existing homes and toward build-to-rent developments. That trend underscores a key point for markets: policies that restrict ownership without expanding construction do little to resolve the structural imbalance between housing supply and demand.4

Markets and economic conditions will continue to change, but retirement outcomes are driven by a small set of decisions made consistently over time. Having a clear framework matters, especially as investors weigh income needs, risk, and long-term sustainability.

Our complimentary report, 8 Steps Toward a Stress-Free Retirement5 lays out that framework and highlights several key retirement planning considerations, including:

- The “magic number” every retirement investor needs to know

- How to plan for emergencies that can derail your retirement investments

- Why missing just 25 trading days can decimate your returns

- Three ways to generate income during retirement

- Plus, other key steps to help you realize your retirement goals

If you have $500,000 or more to invest, click on the link below to get your free copy today!

Disclosure

2 ZIM may amend or rescind the “8 Steps Towards a Stress-Free Retirement” guide for any reason and at ZIM’s discretion.

3 BLS. 2025. https://www.bls.gov/news.release/jolts.nr0.htm

4 Wall Street Journal. January 7, 2025. https://www.wsj.com/economy/housing/trump-housing-large-investor-single-family-home-ban-13e06f61?mod=hp_lead_pos1

5 ZIM may amend or rescind the “8 Steps Towards a Stress-Free Retirement” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm's research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor's. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.