Earnings Strength Confirms Resilience, But Leadership Remains Narrow

The Q2 2025 earnings season is wrapping up, with just a handful of companies left to report. The results provide a clear message: American corporations found ways to power ahead, despite a challenging backdrop of tariffs, policy uncertainty, and shifting global demand.

As I write, total Q2 2025 earnings are on track to rise by +12.1% from a year earlier on +6.1% higher revenues. Long time readers of my column know how much weight I place on strong earnings results. But the real market-moving feature of this earnings season was not just the strong results. It was about how much they exceeded expectations.1

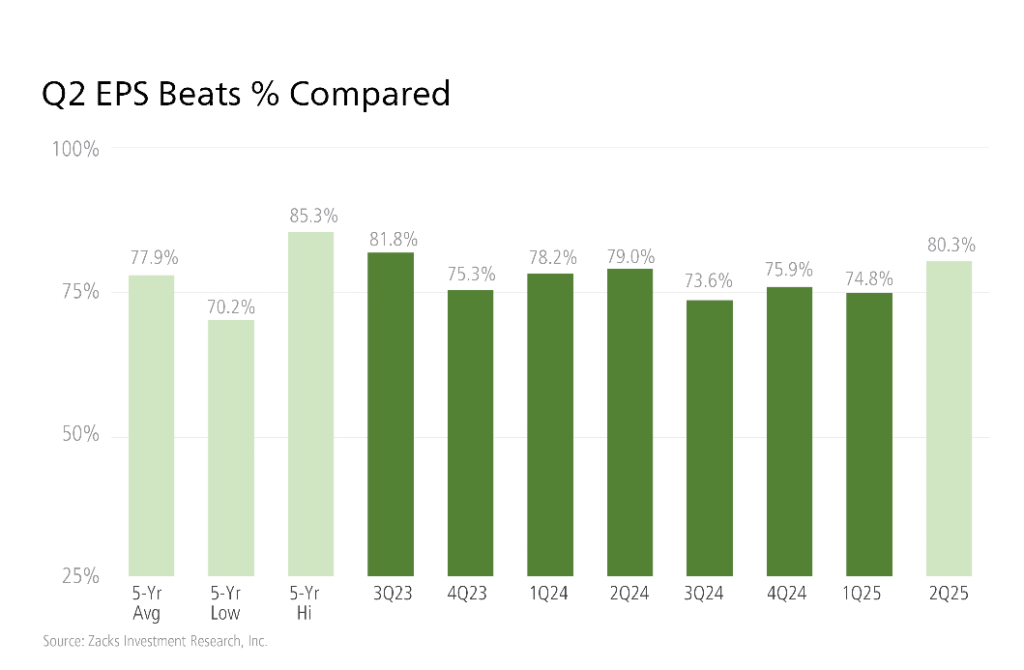

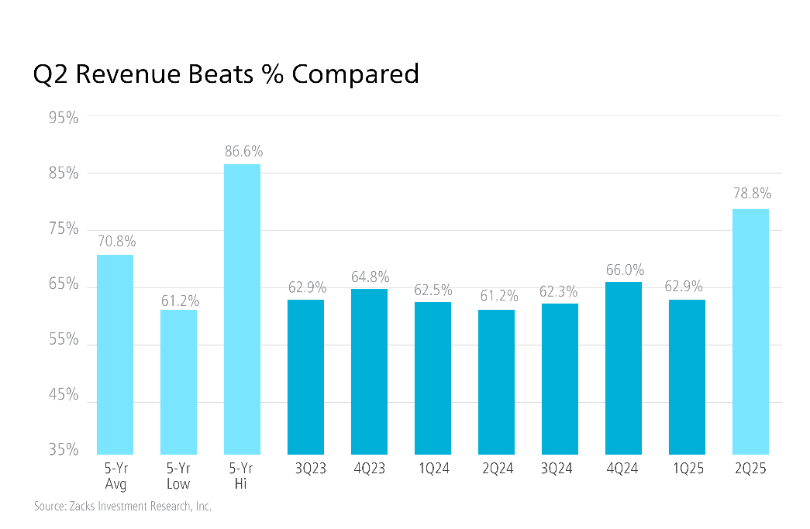

Take a look at the chart below. You can see that 80.3% of S&P 500 companies exceeded earnings per share (EPS) estimates, which is nicely above the five-year average of 77.9%. The percentage of companies that beat revenue estimates also stands out as well above the five-year average and previous years’ results.2

How to Position Your Portfolio Beyond Earnings Season

Q2 results proved that U.S. companies can thrive despite tariffs and policy shifts. But long-term investors know the real test is what comes next.

Our guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio3, shows how to build a portfolio designed to grow through every market cycle.

Inside, you’ll find details on:

- How to accurately establish your retirement income needs

- The two phases of determining your asset allocation

- Investing rules to help you avoid self-sabotage

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000+ to invest, get our free 7 Secrets to Building the Ultimate DIY Retirement Portfolio3 guide today.

The one sentence takeaway: businesses are still spending, consumers are still buying, and markets have responded accordingly.

This is not a cause for being ‘pound the table bullish,’ however. As I’ve written in recent columns, the feedback loop on tariffs and other policy changes is not immediate. Companies front-ran many tariffs and have worked through inventory, without having to pass on too many costs to consumers or see a big impact on margins. But this can’t continue indefinitely.

If tariffs persist at current levels, or rise further, more companies will likely need to raise prices, which could eventually weigh on demand. Business investment data also point to the same caution. While equipment spending looked solid in Q2, investment in structures fell -10.3%, and R&D registered its third consecutive decline. Both trends hint at executives becoming more selective about long-term projects until they see a clearer policy direction.

Leadership in the market also remains narrow. Technology firms continue to drive much of the growth story. In Q2, Tech sector earnings grew at a double-digit pace, propelled by demand for data centers, chips, and software tied to AI. The “Magnificent 7” stocks in particular have been standout performers, with earnings up +26.4% year-over-year on +15.5% higher revenues. While this leadership has lifted indexes, it has also concentrated risk. Excluding the Tech sector, Q3 earnings for the rest of the S&P 500 are expected to rise just +2.1%, compared with +5% overall. That discrepancy highlights how much weight a small group of companies continues to carry.

There are reasons to be cautious, but on balance, the economy continues to look ‘steady state’ to me. For Q3, S&P 500 earnings are projected to grow +5% from last year on +6% revenue growth. Notably, estimates have ticked higher since the start of July, which is a reversal from recent years when estimates tended to drift lower as the quarter progressed. The growth engine continues to run hottest in a few specific places like Tech, so we’ll need to see if that strength continues to broaden. It’s a reminder that investors should be mindful of concentration and avoid extrapolating recent gains as if they were uniform across the market. It’s important to be selective.

Bottom Line for Investors

Second-quarter earnings confirmed what markets have been signaling for months: resilience is still the operative word for the U.S. economy and corporate profits. Upward revisions to Q3 estimates and continued consumer spending are encouraging signs that growth hasn’t run out of steam. But it would be a mistake to assume the rally will be a straight line higher from here. The earnings picture remains top-heavy, and companies may not be able to shield consumers from higher tariff costs indefinitely.

Overall, I think the backdrop remains bullish, supported by healthy profits, fiscal tailwinds, and a still-strong labor market. Staying invested is the right approach, but balancing exposure beyond the biggest winners can help ensure portfolios remain positioned for whatever the next phase of this expansion delivers.

For retirement investors, the challenge is turning today’s resilience into tomorrow’s results. That means building a portfolio that’s designed for long-term growth while staying flexible enough to handle policy shifts and market surprises.

To help with this, I’m offering our guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio4, which shares practical strategies for aligning your portfolio with long-term goals, even when markets are uncertain. You’ll learn:

- How to accurately establish your retirement income needs

- The two phases of determining your asset allocation

- Investing rules to help you avoid self-sabotage

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000+ to invest, get our free 7 Secrets to Building the Ultimate DIY Retirement Portfolio4 guide today.

Disclosure

2 Zacks.com. August 27, 2025. https://www.zacks.com/commentary/2743870/breaking-down-q2-retail-earnings-good-or-bad

3 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

4 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.