In today’s Steady Investor, we look at key factors that we believe are currently impacting the market, and what could be next for the markets such as:

- What could the US economic recovery look like?

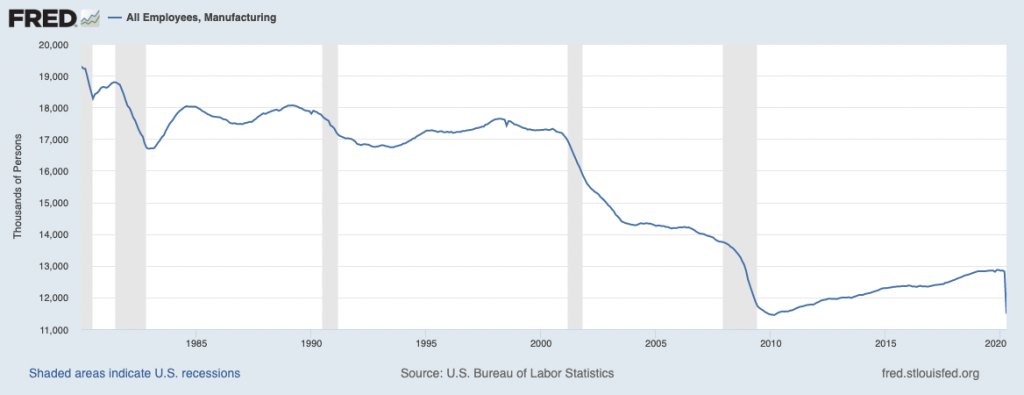

- Inside the harsh reality for US manufacturers

- Could lower consumer and business expectations be a good thing?

The Nike-Swoosh-Shaped Economic Recovery? Market-watchers and economists have been eyeing China’s economic recovery. Since China was the first country to run through the cycle of the pandemic (shutdowns, restriction on movement, gradual reopening), economic data from China can be useful for projecting how a gradual recovery may look in the U.S. and elsewhere. The takeaways are mixed, but not dire: Chinese factory profits fell by -36.7% in Q1 and the economy suffered its worst quarterly decline in decades, but the sharp drop-off was followed by a sharp bounce-back to pre-virus factory activity.1 The main issue was that China’s economy returned to a world where demand had collapsed, such that even a resurgence in economic activity did not result in a snapback of sales, deliveries, and trade. Because the entire world is riding the same wave and demand is only likely to creep higher over the next several months, we might reasonably expect that the economic recovery looks more like a Nike “Swoosh” than a “V.” The good news, in our view, is that we have likely already reached the lowest point of economic activity for the crisis, so the gradual climb upwards is arguably underway. The question is, what will the rate of recovery be?

_____________________________________________________________________

How to Use Market Volatility to Your Advantage

Current market volatility is challenging for just about every investor, especially with all the unknowns that come with the current pandemic. But for all the worry and discomfort volatility often causes, did you know there are also several positive aspects of volatility?

If you have $500,000 or more to invest, get our free guide, “Using Market Volatility to Your Advantage” and learn our insights, based on decades of experience, about how a volatile market may be able to actually help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”2

_______________________________________________________________________

A Harsh Reality for U.S. Manufacturers – Stories are starting to emerge around the country of factories shifting from furloughs to outright closures. It’s difficult news to digest, particularly for those whose jobs are being eliminated and may not return. The factory closures are adding up from a dishware maker in North Carolina to a cutting board maker in Michigan, a Polaris jet ski manufacturer in Indiana, and a factory that produces furniture foam in Oregon. The harsh reality for many of these manufacturers, however, is that the Covid-19 pandemic may simply be accelerating an event that would have occurred anyway in a matter of time. Since the late 1960s, the United States has been losing manufacturing jobs in a steady decline. The globalization of supply chains has been a major factor, but the US economy has also been evolving from an industrial economy into a services, consumption, and technology/information-based economy over the same period. 3 Many companies are using the tragic moment to speed up strategic shifts that may have been inevitable.

U.S. Manufacturing Employment Has Been in Steady Decline

Source: Federal Reserve Bank of St. Louis4

Expectations are Falling, and That May Be a Good Thing – US consumers and small businesses are lowering their expectations for a strong economic rebound. In April, Americans’ views on the job market and personal finances declined dramatically. More Americans than ever were worried about losing their job, while a record number also had low expectations for future earnings, income, and spending. Similarly, the small business optimism index recorded its biggest two-month decline in the index’s history, with a majority of small businesses around the country not expecting a rebound for at least six months.5 All this pessimism may be a good thing. When it comes to equity markets, one of the major drivers of future returns is whether the actual economic outcome exceeds expectations. As expectations fall, the bar is lower for the economy to surprise to the upside, which can help push stocks higher. In this sense, investors should root for dire sentiment, as it builds the “wall of worry” stocks historically love to climb.

It may be hard to find the silver linings in the current crisis, but that doesn’t mean they aren’t there. To help give you additional insight into how you can make the most of turbulent times, I recommend reading our guide “Using Market Volatility to Your Advantage.”6 This guide can help you learn about our insights, based on decades of experience, about how a volatile market may be able to actually help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion

3 The Wall Street Journal, May 10, 2020. https://www.wsj.com/articles/factories-close-for-good-as-coronavirus-cuts-demand-11589122800

4 U.S. Bureau of Labor Statistics, All Employees, Manufacturing [MANEMP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MANEMP, May 14, 2020.

5 The Wall Street Journal, May 11, 2020. https://www.wsj.com/articles/new-york-fed-finds-big-deterioration-in-consumer-views-in-april-11589209825

6 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.