As the holiday season approaches, investors often shift their attention to ‘retail sales’ as a health barometer for the overall economy. The U.S. consumer accounts for around two-thirds of total output, so it makes sense that our fixation on discretionary sales numbers creates a fresh buzz every year. Don’t expect this year to be any different.

On one hand, if retail sales numbers disappoint, it could spawn some serious doubts about how much breath is left in this expansion. Short-term volatility could follow. If the Fed gets involved as a result (pray they don’t) and decides to hold off on a rate hike, that could make matters even worse. Fed

anxiety about the economy’s underlying strength harbors investor anxiety over the short-term outlook for equities. It’s a recipe for another market correction.

The opposite can also be true of course. A strong holiday shopping season could provide a nice tailwind for stocks to finish the year higher, and it would likely keep the Fed on track for the long awaited quarter point rate hike. That’s a recipe for a rally, and everyone loves a good Santa Clause rally.

It would seem that investors are left with a bet on their hands. Do you sell in front of what you see as a weak season for consumers, or do you buy into a positive surprise? I say do neither.

Retail Sales Aren’t a Great Leading Indicator

By definition, retail sales figures cover total sales from the previous month. As such, they don’t tell us what’s going to happen – they tell us what’s already happened. In that sense, retail sales are more of a coincident indicator than a leading one. It gives us insight about the current state of the economy but not where it’s headed.

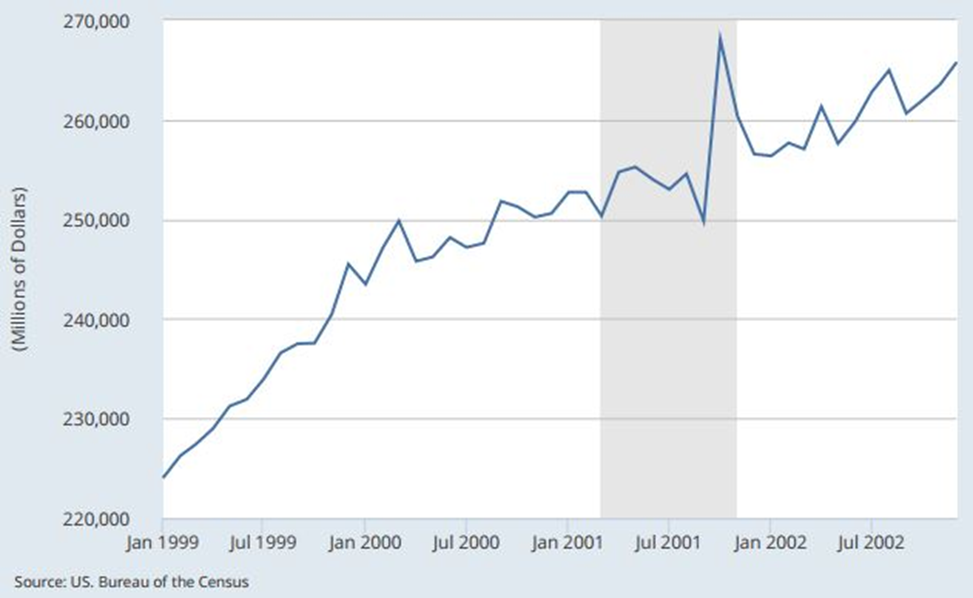

Looking back at how changes in retail sales have coincided with stock market performance underscores the point. If you take a look at retail sales from 1999 – 2003, you can see that retail sales actually moved sideways as the bear market took hold, and even went up before the recession ended. There was no ‘canary in the coal mine.’

Retail Sales Didn’t Experience Much Weakness During the Tech Bubble in 2000 (See Chart Below)

Fast-forward to the more recent bear market and the picture looks markedly different. The economic recession essentially began in October of 2007 (the housing recession arguably started in 2005), with retail sales managing to move normally through summer of 2008. It was then however that retail sales plunged dramatically, but by that time the market was already well into bear market territory. Retail sales wouldn’t have been a good leading indicator here either.

Retail Sales Cratered, but the Bear Market was Already Half Over (See Chart Below)

Bottom Line for Investors

I could see the retail sales story this holiday season being somewhat of a yawn – maybe they disappoint just slightly or maybe they surprise to the upside, but just by a bit. Either way, investors shouldn’t get too optimistic or pessimistic if sales jump or decline materially. Retail sales figures alone don’t give us a complete story about where the economy, or stocks, are headed.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.