The unpredictable nature of the pandemic and vaccine rollout have complicated economic forecasting models in 2021. Consumer behavior is very difficult to predict, and corporations are reluctant to overcommit to earnings forecasts in 2021. Indeed, over the past six months, CEOs have been all over the map in statements about when the economy could normalize – some see strong rebound activity as soon as the spring, while others are pushing optimism out to 2022.

The bottom line for most executives is an obvious one: the full thrust of the economic rebound depends on how quickly we can reach mass immunization; which health experts say requires more than 70% of the population to develop immunity from Covid-19.1

__________________________________________________________________________

Why You Should Stick to the Fundamentals Throughout 2021!

There is no way to know exactly how or when the economy will recover. With so many unpredictable factors impacting such as the vaccine rollout and the next stimulus plan, many investors may fall prey to emotional decision making and trying to time or predict the market. Instead of falling prey to this mistake, I recommend staying focused on the fundamentals and key data points that can positively impact your investments in the long-term.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- S&P 500 earnings growth

- Outlook for underlying U.S. economy?

- U.S. returns expectations for 2021

- What produces 2021 optimism?

- Is it time to buy U.S. stocks?

- Update on U.S. fiscal stimulus

- And much more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released March 2021 Stock Market Outlook2

__________________________________________________________________________

There’s a reasonably long road ahead – as I write, under 10% of the U.S. population has received at least one dose of the vaccine, and a U.S. Census Bureau survey of 68,000 Americans found that some 50% were unsure about taking the vaccine at all. Even still, the pace of daily vaccine shots being administered continues improving by the day, and I expect it will continue to improve in the coming weeks and months.

So, what will the economic recovery look like in 2021? I’m looking at corporate earnings, consumer sentiment, and energy markets for clues.

Let’s start with earnings. Here at Zacks Investment Management, we keep a very close eye on corporate earnings, estimates, and statements. I mentioned earlier that CEOs have been all over the map in their outlooks, but in the most recent earnings-call transcripts, I’ve noticed a marked rebound in sentiment. Bank of America also uses transcripts to measure corporate sentiment among S&P 500 companies, and recent analysis found that sentiment in Q4 had risen to an all-time high. Corporations are ready to get back to normal, just like we are.

Corporate profits have also rebounded more quickly than expected over the past year. While full-year corporate earnings are likely to be greater than -10% in 2020, we’re expecting an over +20% jump in 2021. The relatively slow – but accelerating – vaccine rollout does not alter our outlook.

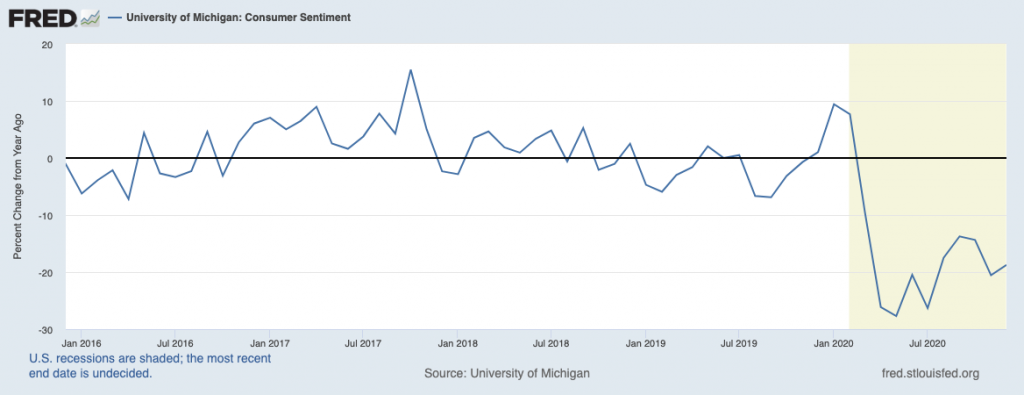

On the consumer sentiment front, we can see below that the University of Michigan’s index of consumer sentiment has rebounded off the lows, and appears poised to continue charting its recovery (the pandemic-driven recession shaded in yellow):

Source: Federal Reserve Bank of St. Louis3

A recent consumer expectations survey from the New York Federal Reserve also highlights growing strength. According to the NY Fed’s January Survey of Consumer Expectations, American households expect spending to be 4.2% higher a year from now, which underscores the belief there’s light at the end of this tunnel. Respondents also expected their incomes to be 2.4% higher, citing expectations for a strengthening jobs market.

Finally, the energy markets have shown signs of pricing an economic recovery sooner rather than later. The price of oil is determined by supply and demand, which I would argue are both supporting higher prices. Production cuts and inventory reductions have kept a check on supply, but demand is also rising as countries position to push growth forward in the second half of 2021. Brent crude futures are trading some 50% higher than where they were in October 2020, with the price for a barrel of oil pushing to $60 for the first time in over a year.

Bottom Line for Investors

Long-time readers of my column know I rarely bet against the United States’ ability to overcome adversity. The pandemic and now the vaccine rollout represent adversity #1 for the U.S. (and the world) in 2021, and I’m anticipating a better-than-expected outcome for a return to economic normalcy. I’m looking for corporate earnings growth greater than 20% year-over-year in 2021, and full year GDP growth of 5+%. In my view, owning quality stocks is the optimal way to capture this growth.

We may not know how 2021 is going to roll out, but the key is to not give into fear and sudden emotional investing. It’s better to use a more long-term strategy to help your financial gain, not only this year, but also down your financial timeline. To help better position yourself for what’s to come, I recommend focusing on what matters – key data points and economic indicators that could impact your investments. To help you do this, I am offering all readers our Just-Released March 2021 Stock Market Outlook Report.

This report looks at several factors that are producing optimism right now and contains some of our key forecasts to consider such as:

- S&P 500 earnings growth

- Outlook for underlying U.S. economy?

- U.S. returns expectations for 2021

- What produces 2021 optimism?

- Is it time to buy U.S. stocks?

- Update on U.S. fiscal stimulus

- And much more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Fred Economic Data. January 29, 2021. https://fred.stlouisfed.org/series/UMCSENT

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”