Bryan T. from Erie, PA asks: Hello Mitch, after going through this debt ceiling drama and seeing volatility in the stock market, I’m wondering if we’re going to see a replay come December when the government runs out of money again. Your thoughts?

Mitch’s Response:

Thanks for sending in your question, Bryan. I’m sure many other readers share your concerns, and you are correct to point out that we’re likely to have a “here we go again” moment in December, when this issue must be revisited by Congress.

Before I offer a few thoughts on the debt ceiling issue specifically, I think it’s important not to draw a straight line between September volatility and the debt ceiling. I would argue that the two issues are not necessarily closely related. September volatility, in my view, was more closely tied to the China Evergrande issue, the stock market pricing-in Fed ‘tapering’ later in the year, and perhaps some short-term growth concerns tied to the Delta variant. The debt ceiling issue was in the mix, in my view, but not front-and-center by any means.

Protect Your Retirement Against Life’s Unknowns

Get our free guide to learn how to build a retirement strategy that takes the “what-ifs” into account.

You may not know what the future holds, but it is important to not get caught up in the fears of the unknowns and miss the opportunities ahead. In our guide, you’ll get valuable and practical ideas to help build a “weatherproof” strategy that can potentially protect your retirement from any storm that can threaten your financial security.

If you have $500,000+ to invest, get our free How Solid Is Your Retirement Strategy?* guide today.

One reason I do not put too much weight on the debt ceiling issue is that the markets have seen this song-and-dance before, and the actual risk of the U.S. defaulting on debt is far lower than advertised in the media. The news made it seem as though the U.S. was teetering on the edge of default for the first time in history, but that was not the case at all. Not even close.

In order to truly understand the debt ceiling issue and its risks, one must differentiate between ‘government obligations’ and debt payments due. Government obligations – like Social Security payments, child tax credits, other entitlements – are not debts. Not paying entitlements on time could seriously impact American families that rely on them, but it does not equate to a “default.” If you send your daughter in college $500/month for living expenses, and you are late one month or miss the payment entirely, you are not “defaulting.” If you miss a mortgage payment, however, there are real consequences to your financial and credit standing.

The debt ceiling issue has similar dynamics. Raising the debt ceiling means meeting government obligations, like Social Security payments. But the U.S. Treasury does not need Congress’s authorization to make interest payments on debt, nor does it need Congressional approval to issue new debt to refinance a maturing bond. Not making these debt payments would put the U.S. in default, which would be very damaging to the markets, in my view. But that’s not the issue in the debt ceiling debate, which is really focused on entitlement payments.

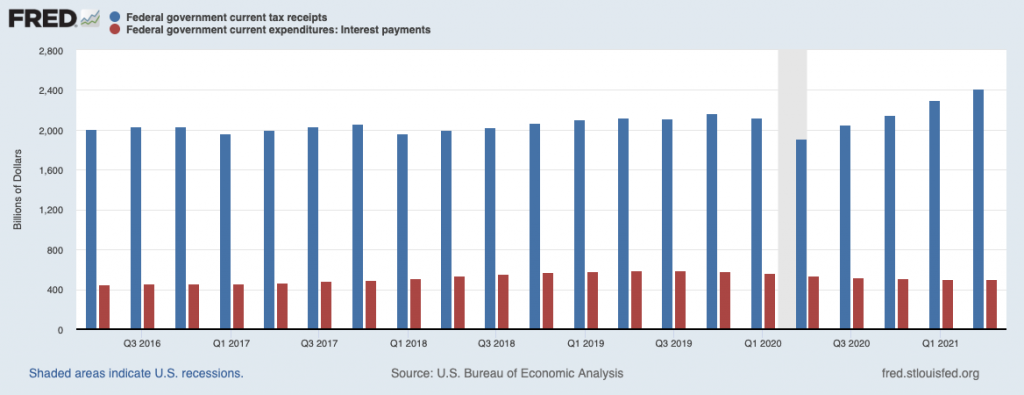

Come December when the debt ceiling issue may return to headlines, I’d encourage you to remember this distinction between ‘obligations’ and ‘default.’ To be fair, missing obligations/entitlement payments could impact sentiment and result in volatility, but it is not the same thing as default, which would be a credit event. At the end of the day, in order for the U.S. Treasury to stay current on debt interest payments, it can use tax revenues, of which there are plenty to cover expenditures:

I would also encourage you to focus on the fundamentals when volatility is strong, especially if you are working towards a successful retirement. Our guide, How Solid is Your Retirement Strategy3, will provide valuable and practical ideas to help build a “weatherproof” retirement strategy that can potentially protect your retirement nest egg from any storm that can threaten your financial security.

If you have $500,000 or more to invest, download our free guide, How Solid is Your Retirement Strategy3.

Disclosure

2 Fred Economic Data. September 30, 2021. https://fred.stlouisfed.org/series/W006RC1Q027SBEA#0

3 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.