Brianna J. from Las Cruces, NM asks: Good Afternoon Mr. Zacks, I’m writing with a question about interest rates and inflation. I’ve always heard that when inflation goes up interest rates usually go up as well. But the opposite is happening now. Can you explain the disconnect?

Mitch’s Response:

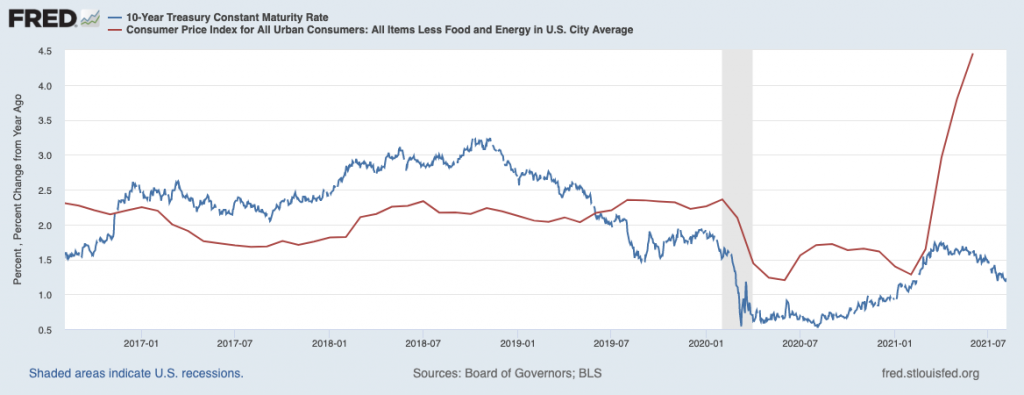

Thanks for sending in your question, Brianna. Let me first offer a visual to readers who may not be following the inflation and interest rate dynamic as closely as you. The blue line in the chart below represents the 10-year U.S. Treasury bond yield while the red line is charting the consumer price index excluding food and energy. It’s clear to see the two lines have diverged greatly over the last few months:

Interest Rates are Falling While Inflation Goes Up

_____________________________________________________________________________

Tips on Managing Market Volatility

Volatility has a way of causing even the most experienced investor to make mistakes—that’s why it is important to not avoid it but to develop a mental approach to dealing with it.

Our guide, “Helping You Manage Market Volatility,” will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”2

_____________________________________________________________________________

As you mention in your question, we would generally expect interest rates to rise as inflation goes up, as investors would demand a higher yield to compensate for the reduced purchasing power that comes with inflationary pressure. But we’re seeing just the opposite today.

I think there are two factors to consider when explaining the divergence between inflation and interest rates. The first is the distinct possibility that inflation may be transitory in nature, which remains the assessment of the Federal Reserve currently. The thinking here is that the surge of demand has created temporary disruptions in supply chains and in the labor markets, which is putting upward pressure on prices over the short term. The Fed believes supply will eventually catch up with demand, and these pressures should abate with time. Falling interest rates today may be signaling this eventual outcome.

Another possible explanation is that too many investors piled into the view that longer duration Treasury bond yields would surely head higher, on the heels of rising inflation and a too-hot economy. Betting that Treasury yields would move higher is also a bet that Treasury prices would fall, and data suggests many institutional investors made bets against Treasuries this year-to-date. This set the table for short covering as investors kept buying bonds, which ultimately kept downward pressure on yields.3

At the end of the day, the move in Treasuries is likely a combination of many factors, which likely include – in my view – a more modest outlook for inflation and the expectation that the U.S. economy will settle into a post-pandemic steady growth rate sooner than later.

While the economy is headed for steady growth, that does not mean there will not be volatility along the way. You can’t eliminate volatility, but you can learn how to navigate through it.

To help give insight into some ways you can do this, check out our guide, “Helping You Manage Market Volatility.”4 It will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

3 Wall Street Journal. August 9, 2021. https://www.wsj.com/articles/treasurys-big-rally-gets-help-from-skeptics-of-low-rates-11628501581?mod=hp_lead_pos4

4 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets countries and 27 Emerging Markets (EM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. An investor cannot invest directly in an Index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.