David B. from El Paso, TX asks: Hi Mitch, I’ve seen stories about a huge stockpile of cash sitting on the sidelines, which could make its way into the stock market if interest rates fall. Do you see this as a real possibility, or is there something else to the story here?

Mitch’s Response:

Thanks for writing, David. You ask an interesting question, and I think the response has a few angles worth exploring.

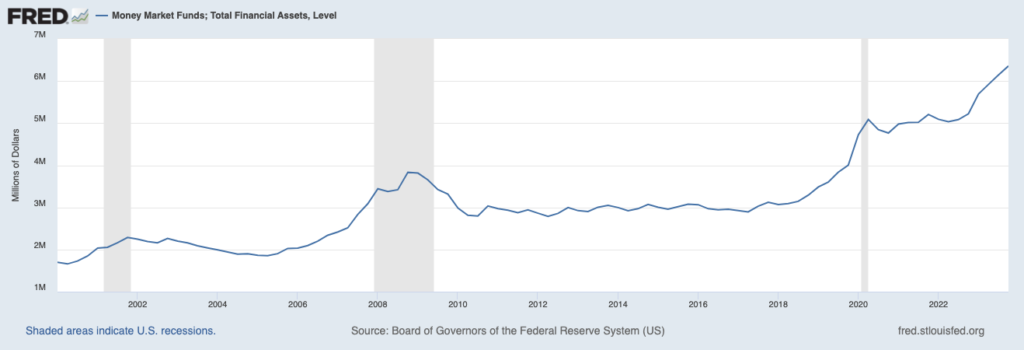

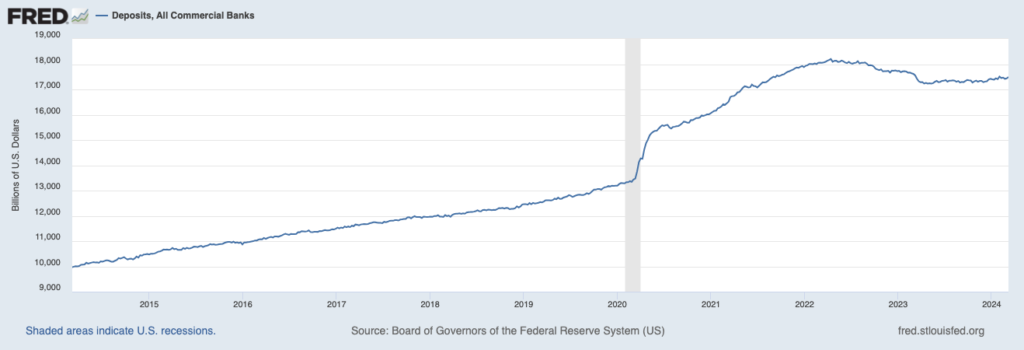

First, I’ll set the stage for other readers by clarifying what you mean by the ‘stockpile of cash sitting on the sidelines.’ For context, we can look at the two charts below. The first chart is of assets in money market funds, and the second chart is total deposits at all commercial banks in the U.S. As the charts make clear, there has been a post-pandemic surge in cash, with money market funds sitting at over $6 trillion as of the end of last year, and deposits at $17 trillion as of the end of February.1

How to Spend Money in Retirement & Make Sure it Lasts

Retirement means living the life you want, in the place you want, with activities you enjoy. Of course, making all that happen means spending some of the money you’ve worked so hard to accumulate.

If you want to ensure your money will last, it’s essential to understand some strategies and best practices. Our free guide, 4 Strategies for Spending Money in Retirement2 offers some common-sense guidelines to help ensure your retirement nest egg lasts as long as possible. You’ll also get insight on:

- Spending 101: Understanding Tax Buckets

- The 4% Rule

- Dynamic Spending with the 5% Rule

- And more…

If you have $500,000 or more to invest, download our guide 4 Strategies for Spending Money in Retirement.2 Simply click on the link below to get your copy today!

Download Zacks Guide, 4 Strategies for Spending Money in Retirement2

Money Market Funds at Roughly $6 Trillion

Source: Federal Reserve Bank of St. Louis3

Deposits at All Commercial Banks at Roughly $17 Trillion

Source: Federal Reserve Bank of St. Louis

In short, these are historic levels of cash parked on ‘the sidelines,’ which investors have accumulated as a result of pandemic stimulus, a strong labor market, and higher yields ushered in by the Federal Reserve’s rate hike and QT campaigns.

As you point out in your question, a popular narrative that has emerged recently is the thinking that as interest rates fall (perhaps later in 2024), investors will ditch low yields in money market funds or savings accounts and instead, will invest the cash in the equity markets and/or other risk assets, in search of higher yield. Bulls see this as a “wall of cash” that could drive equity markets higher.

In theory, lower interest rates may encourage investors to seek out higher returns via higher risk, and we could see cash rotate from risk-free securities into equities and other risk assets. But I don’t think investors should think of this relationship as either-or. In other words, not all cash is earmarked for investing when the time is right. As households grow wealth and the economy grows over time, we should expect to see cash balances across the economy generally rise as well.

For instance, while the S&P 500 is up nearly 10% year-to-date, money market funds have also seen a sharp increase, with some $150 billion in new funds through the first two months of 2024. Another recent study looked at the past four instances when the Federal Reserve was pausing or cutting rates, and found that money market funds continued to experience significant growth.

To be fair to the bulls who see a “wall of cash” destined for risk assets like stocks, I do think a combination of falling interest rates and more optimism about economic growth could shift cash from money market funds and savings accounts into stocks, which could bolster returns. But I don’t envision it being a seismic flow of assets as some pundits have suggested.

Now to shift a little bit, I’m calling for all investors who are currently focusing on their retirement plan. You have diligently built your retirement nest egg through hard work and careful planning and may be wondering where to spend your money.

There are many different strategies related to spending in retirement, and some of them are more complex than others. In our exclusive guide, 4 Strategies for Spending Money in Retirement4, we explore some effective strategies and best practices that investors should consider when developing a retirement spending plan. You’ll get insight on:

- Spending 101: Understanding Tax Buckets

- The 4% Rule

- Dynamic Spending with the 5% Rule

- And more…

If you have $500,000 or more to invest and are ready to learn more, click on the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

3 Fred Economic Data. March 7, 2024. https://fred.stlouisfed.org/series/MMMFFAQ027S#

4 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.