Across the board, energy prices are on the rise. Crude oil prices have risen over 60% in 2021 alone, and are hovering around a seven-year high. Natural gas prices have nearly doubled in the last six months, and are currently at levels not seen since the blizzards in 2014 pummeled the Northeast. The national average for gas prices is over $3 a gallon – which I’m sure many readers have noticed – and coal prices are also at record highs.1

The cause of rising prices is, as ever, a supply and demand issue. As the pandemic risk has faded and consumers have ramped up spending, it has resulted in increased production and shipping globally – which requires energy. As demand has soared, oil-exporting countries (namely, OPEC+) have only increased production incrementally, keeping supply relatively tight.

On the natural gas front, inventories in the U.S. are low following the rare winter freeze in Texas (which saw pipelines freeze and demand soar), and also due to Hurricane Ida forcing almost all of the Gulf of Mexico’s gas output offline.2 June and July’s heatwaves also put a dent in gas inventories, particularly as a drought-stricken West could not produce sufficient hydropower to power air conditioners. Europe is also staring down a winter beset by higher natural gas prices, as lackluster wind-power generation and a hot summer dwindled inventory as Russia plays hardball with exports.

____________________________________________________________________________

When Uncertainty Rises, Focus on the Facts and Data!

Concerns about rising energy prices and other factors surrounding the market may leave you feeling uncertain when contemplating your next investing decision. But, don’t let market concerns force you to make sudden decisions based on fear and emotions!

Investors must stick to the facts and hard data. That is why we recommend keeping your focus on the long-term by looking into key economic indicators that can make a positive impact on your financial success. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks Rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Zacks Rank industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released November 2021 Stock Market Outlook1

____________________________________________________________________________

All told, of the roughly half of Americans who warm their homes with natural gas, the Energy Information Administration (EIA) estimates that costs could be 30% higher than last year. Those costs could be even higher if winter is colder than usual, or perhaps a bit lower if winter is warmer than average. The bottom line, however, is that consumers should expect higher gas bills this winter.

Many argue there is a straight line that connects higher energy prices with lower consumer spending for everything else, which could become especially true heading into the winter season. In a sense, higher energy prices can serve as a de facto tax on consumers, since consumers cannot quickly and easily change energy consumption like we can change spending on retail, travel, or restaurants, for instance. If we’re spending more money on energy bills and gas at the pump, it could mean less spending on other goods and services, which could impact economic growth.

Or so the argument goes. I think the reality is a bit more nuanced. For one, about 7% of consumer spending goes towards energy, according to the Labor Department. In my view, this implies that we would need to see sustained higher energy prices across the board to see a material impact on spending, since higher energy prices would need to outlast the some $2 trillion in excess savings Americans currently hold. I’m not convinced that the supply-demand imbalance in the energy markets will last that long.

The stock market has also weathered higher energy prices than what we’re seeing today. Starting with crude oil, readers may remember a decade ago when oil prices averaged around $100 a barrel from early 2011 to mid-2014 (green circle in the chart below):

Crude Oil Prices (West Texas Intermediate) from 2009 – Present

While oil prices spent years near the $100 a barrel mark, stocks continued their climb within the economic expansion that followed the 2008 Global Financial Crisis. As you can see in the chart of the S&P 500 below, there were certainly plenty of patches of volatility – but the positive trend-line was largely unfazed by higher oil prices.

The S&P 500 from 2012 – End of 2014, Which Corresponded with High Crude Oil Prices

In fact, higher oil prices in the early and mid-2010s were a catalyst to economic growth, as they led to increasing investment in rigs and shale production, which increased demand for steel, equipment, construction workers, and transportation workers.

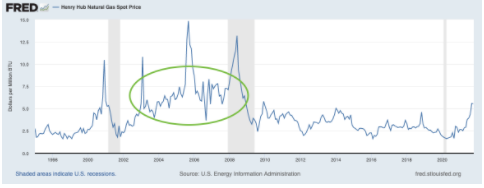

A somewhat similar story can be traced in the natural gas markets. As seen in the chart below, natural gas spot prices were higher in the mid-2000s than they are today, but the stock market was again unfazed – every year from 2003 to 2007 was positive for the S&P 500.

Bottom Line for Investors

Higher energy costs can affect many different parts of the economy – higher producer input costs, shipping costs, heating bills in the winter, and prices at the pump. Taken together, higher energy costs are inflationary, and higher energy prices for consumers could mean less to spend on other goods and services. Some would argue higher energy prices act as a tax on consumers, and I do not disagree.

The question is whether higher energy costs persist for several months or even years, and whether higher costs ultimately overwhelm the greater than $2 trillion in excess savings American households currently have. I think the answer is no. It is also important to note that on a relative basis, energy prices are not at record highs – the economy and market have done well with prices even higher than what we’re seeing today. Higher energy bills this winter may be an inconvenient reality – but I don’t think it also means economic and market calamity.

This is why we also encourage investors to focus more on key data points and economic indicators that positively impact their long-term investments. Through any market change, the key is to protect your assets! And to help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks Rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Zacks Rank industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Wall Street Journal. September 19, 2021. https://www.wsj.com/articles/natural-gas-prices-surge-and-winter-is-still-months-away-11631986861

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

4 Fred Economic Data. October 14, 2021. https://fred.stlouisfed.org/series/DCOILWTICO

5 Fred Economic Data. October 18, 2021. https://fred.stlouisfed.org/series/SP500

6 Fred Economic Data. October 14, 2021. https://fred.stlouisfed.org/series/DHHNGSP

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.