Oil prices have been marching higher for months, a fact that many readers likely know based on recent trips to the pump. The cost of a barrel of West Texas Intermediate oil has soared from the low teens in April 2020 to over $90 a barrel today, as surging demand continues to be met with constrained supply. Many economic forecasters and energy analysts are calling for $100 per barrel and soon.1

If oil prices continue to move higher, costs for businesses and consumers will continue to go up as well, which could sap margins and spending, respectively. This begs the question: will high oil and gas prices crush this bull market?

I think the answer is no. The first reason I’ll give is based purely on history, and the second reason is based on a supply and demand imbalance I think should correct later this year.

If the Bull Market Dies, Are Your Investments Prepared?

With concerns that rising oil prices could kill the economic expansion and bull market, many investors are wondering if their investments are prepared for what’s to come. This can lead investors to make drastic moves and fall prey to mistakes like trying to time the market.

To help you protect your investments and make decisions based on fundamentals and data, I am offering all readers a first look into our just-released March 2022 Stock Market Outlook report2. This report will provide you with our forecasts along with additional factors to consider:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces optimism in 2022?

- Zacks forecasts for 2022

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released March 2022 Stock Market Outlook

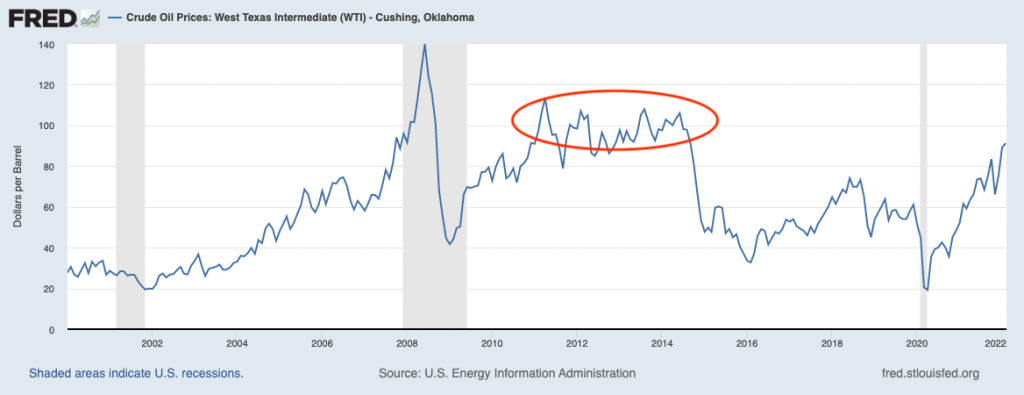

Let’s start with the history. Many readers may not remember, but there was a period from mid-2011 to 2014 when oil prices hovered around $100 a barrel pretty consistently (circled in red on the chart below). Gas prices were quite high then, too, even higher than they are in parts of the country today.

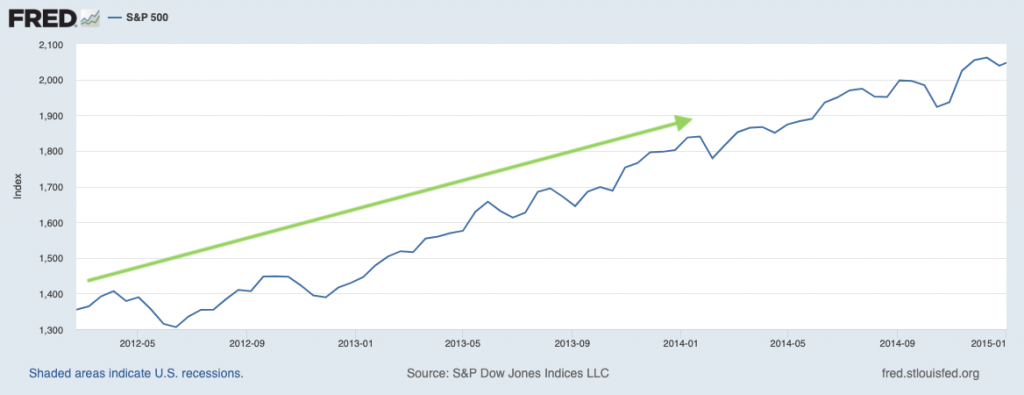

The stock market did not seem to mind – during the period from 2011 to 2014 when a barrel of oil cost more than $100, the S&P 500 went up +65.1%.3 The U.S. economy grew throughout that period as well, albeit at modest rates. Modest GDP growth was more due to the economic ‘hangover’ from the Global Financial Crisis than high oil prices, in my view.

The first chart below shows the period when oil was above $100 a barrel, and the second chart shows the S&P 500 from 2012 onward. As you can see, higher oil prices may not have necessarily helped the economy and markets, but they certainly did not hurt.

The second reason I do not think higher oil prices will kill the economic expansion and/or bull market is because of supply forces.

The period of high oil prices from 2011 to 2014 gave way to a shale boom in the U.S., which, coupled with OPEC also increasing supply, caused oil prices to plummet (readers can see the drop-off in prices around 2015). The well-remembered U.S. shale boom was heavily financed with debt, which ultimately led to a wave of bankruptcies and failed companies when oil prices crashed. Some analysts believe the lessons learned in that period will result in broad reluctance for shale producers to take advantage of high oil prices this time around, meaning supply will remain constrained in 2022. But the data so far suggests otherwise.

In the U.S. Permian basin, shale exploration and development rig activity are back to about 70% of pre-pandemic levels, and oil production is close to crossing all-time highs above 5 million barrels per day. In the gas-rich Haynesville close to the U.S. Gulf Coast, activity is just about at its highest level in a decade. U.S. oil production in February is expected to rise to 8.54 million barrels per day, which is only 730,000 barrels less than the record set in November 2019. Back then, oil prices were $20 lower than they are today.

At the end of the day, U.S. shale producers are very wary of taking on big debt and overproducing as they have in the past. But they are not wary of ramping up production to take advantage of higher prices. As of late last year, the break-even cost for shale producers was $37 per barrel. With oil trading above $90 per barrel, the incentive to come back online is high.

The other side of the supply equation is, of course, OPEC. The organization has indicated on a few occasions its intention to increase production and most recently announced a 400,000 barrel-per-day increase in March. But figures from OPEC are not always reliable, and to date, OPEC production remains about 5 million barrels per day below peak levels. Market-watchers are understandably worried about the impact of a Russian invasion of Ukraine, given Russia’s status as a significant oil and commodities producer, particularly for Europe. This possibility remains a wildcard, and could give way to more choppiness and even higher prices in the near term – an outcome I think would simply shift supply elsewhere, and bring even more producers online.

Bottom Line for Investors

Higher oil prices are not ideal for energy-intensive businesses or consumers, but they are also not a death knell for earnings or an economic expansion. The U.S. economy was notably weaker in the 2011 to 2014 period than it is today, in my view, and the economy and markets managed to do just fine during that period of $100+ oil.

It may not happen immediately but eventually sustained higher prices will encourage more production, particularly from U.S. shale companies. We are starting to see signs of that now. As production ramps up and more supply comes online, price pressures will eventually ease, in my view. I do not necessarily see this as a multi-year process as we saw in the previous cycle – U.S. shale companies can bring production online relatively quickly and efficiently, and with oil close to $100 per barrel, I believe they will.

If you are uncertain about what to do with your investments during a time like this, I recommend that investors focus on factors that can protect their investments for the long term. To help, I am offering all readers our Just-Released March 2022 Stock Market Outlook Report6.

You’ll discover Zacks’ view on:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces optimism in 2022?

- Zacks forecasts for 2022

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Fishers Investments. February 2, 2022. https://www.fisherinvestments.com/en-us/marketminder/our-perspective-on-those-100-oil-forecasts

4 Fred Economic Data. February 9, 2022. https://fred.stlouisfed.org/series/DCOILWTICO

5 Fred Economic Data. February 15, 2022. https://fred.stlouisfed.org/series/SP500#0

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.