Jeffrey P. from Springfield, MO asks: Hello Mitch, I’m sure you’re getting a lot of questions on Russia, but here’s one more. Do you think the economic sanctions could have unintended consequences on the U.S. or global economy? Maybe in the form of much higher energy and commodity prices? How might that affect stocks?

Mitch’s Response:

Thanks for writing. That’s a great question. The economic sanctions story is still developing as I write, and there will no doubt be more sanction pronouncements after I send this off to you.

The latest sanction is pretty hard-hitting – the United States announced it is sanctioning Russia’s central bank, to prevent it from using its $630 billion in foreign reserves to cushion the economy and the Russian ruble against all of the other economic penalties and fallout. Last week, the Russian central bank was able to use those reserves to halt a crash in the ruble, but that option is now off the table. Russian stock markets have also stopped trading.1

Point is, sanctions so far will certainly have a meaningful economic impact on Russia. The U.S. has very little trade exposure to Russia – total imports and exports from Russia to the U.S. is a fraction of 1% of total trade. Europe has greater exposure with 40% of all natural gas coming from Russia, but so far deliveries have not been interrupted and spring is coming, which should temper demand in the months ahead.

How You Can Benefit from a Volatile Market?

The market is currently experiencing periods of turbulence, and the negative news that headlines continue to bring may cause you to feel nervous about what’s to come. This feeling is completely normal for investors. Sudden ups and downs of the market can be very challenging to manage, but even in the most uncertain times, there are positive aspects that stem from a rollercoaster market.

If you have $500,000 or more to invest, get our free guide, “Using Market Volatility to Your Advantage,” and learn our insights, based on decades of experience, about how a volatile market may be able to help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on how market volatility can ‘shake up’ complacent investors, why volatility may help prevent overheating and market ‘bubbles’, and more!

Download Our Guide, “Using Market Volatility to Your Advantage”2

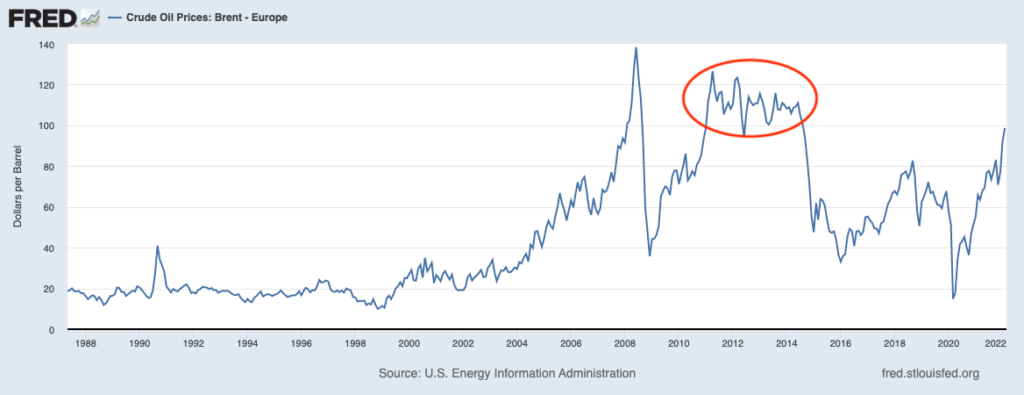

I think you are right to point out that near-term, energy, and commodities markets could feel some upward pressure. I would not be surprised if oil prices climb to above $100 per barrel. But as I have written before, the effect of higher oil prices on the global economy and markets may not be as drastic as many people fear. A $10 per-barrel increase in the price of oil may increase U.S. headline inflation by less than 1% and could hit GDP growth by about 10 basis points – not super meaningful. It is also worth remembering that oil prices (chart below) remained firmly above $100 a barrel from the beginning of 2011 through the summer of 2014, during which time the U.S. economy grew and the stock market went up by over +50%. In short – higher oil prices do not necessarily mean economic recession or weak markets.

Source: Federal Reserve Bank of St. Louis

It is also important to consider that oil markets are global. If Russian supply falls in the next few months – which is not a foregone conclusion – then we might see supply increase elsewhere, such as from U.S. shale producers or Saudi Arabia, for instance. Time will tell.

I do think there is a risk to a full-scale trade war emerging between Russia and trading partners, which would no doubt create problems in the commodity supply chains and drive up prices. At this stage, Russia is very unpredictable – but launching a full-on trade war would hurt them the most, given government revenue relies on the export of natural resources. With Russia already greatly hobbled by broad, international sanctions, cutting off the West economically could send its economy into a rapid downturn (which may already be in the offing). But again, time will tell.

My final thought here is that the stock market has likely already priced in all manner of scenarios that might emerge from here. Even if commodity prices continue rising – which is a distinct possibility – it needn’t derail the global economic recovery that’s underway. The global economy can withstand higher commodity prices in the near term.

Did you know that are ways to use a volatile market to your advantage? I am offering our guide, “Using Market Volatility to Your Advantage”3 to learn about our insights, based on decades of experience, about how a volatile market may be able to help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on how market volatility can ‘shake-up’ complacent investors, why volatility may help prevent overheating and market ‘bubbles’, and more! If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

3 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.