With the end of the year fast approaching, many investors may be wondering what factors could affect the market before year-end and what can they expect in 2020. In this week’s Steady Investor, we look at four factors we believe you should keep an eye on before year-end, such as:

- What is next for the trade deal?

- Upcoming British elections will determine what party will gain power and form a government.

- Consumer spending is a key driver of growth in the U.S. economy. How will Holiday Sales play in?

- The Conference Board’s Leading Economic Indicator Index (LEI) has been a reliable predictor of recessions over the last few decades. What does the LEI suggest the U.S. economy?

Factor #1: A Positive or Negative Surprise on Trade

A few weeks ago, markets cheered the announcement of a potential “Phase 1” of a trade deal between the U.S. and China. It appeared as though China was going to agree to new commitments on intellectual-property protections, issues related to technology transfer, further liberalization of its markets, and a substantial increase in agricultural purchases. Fast forward to today, and most of that optimism has faded.

The false-positive and topsy-turvy nature of these trade negotiations should surprise no one at this point, and markets do not seem pressured by recent reports that the talks are fizzling. China has invited American trade negotiators back to Beijing for another round of face-to-face talks, but top American officials are reluctant to make the trip without firm commitments that China will follow through on Phase 1 terms. Meanwhile, President Trump has threatened to raise tariffs even further if China fails to meet U.S. demands.1

In short, the trade deal is set up now in such a way that, in our view, the market has priced-in gridlock. If the back-and-forth continues with no deal, we do not think the market will be overly affected. But the factor to watch between now and the end of the year is whether we’ll be delivered a huge breakthrough with an inked deal (positive surprise) or a total collapse of the talks where the two sides enter ‘cold war’ mode (negative surprise). In either outcome, the market could respond accordingly.

_____________________________________________________________________________

Get These 7 Secrets to Building the Ultimate Retirement Portfolio

Navigating market cycles while creating a retirement portfolio that meets your financial goals is no small feat. To build a portfolio that can potentially reach your goals, you must put some time and effort into defining your investing objectives, determining your asset allocation, and managing your investments over time.

If you have $500,000 or more to invest, I recommend downloading our guide 7 Secrets to Building the Ultimate DIY Retirement Portfolio. It provides a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own and pursue long-term investing success.

Download Your Copy of 7 Secrets to Building the Ultimate DIY Retirement Portfolio.2

_____________________________________________________________________________

Factor #2: British Elections

Mark your calendar for Thursday, December 12. That’s when 46 million voters in the United Kingdom will have the option of heading to the polls to vote for their areas’ member of Parliament (MP), which could ultimately determine what party will gain power and form a government. The Conservative party, currently led by Prime Minister Boris Johnson, is hoping they can increase the number of MPs to pass laws more easily. They currently hold 298 seats, and need 326 total to have a majority.3

This vote is crucial because it could very well seal Brexit’s fate. If Conservatives gain a majority in the House of Commons and form a government on their own, the likelihood of a “hard Brexit” increases significantly. Leaving the European Union without a deal in place become a distinct possibility. On the other hand, if the Labour party picks up more seats it may serve as indication that the electorate has concerns about Brexit, which would give way to “soft Brexit” – or the insistence on leaving the EU with a deal and roadmap in place.

Factor #3: Holiday Retail Sales Activity

Consumer spending is a key driver of growth in the US economy. It follows that 2019 is shaping up to be the most critical holiday shopping season of this 10+ year economic expansion. Will the U.S. consumer continue spending at a healthy clip, or will we see a front-and-center indication that the consumer is running out of steam? The numbers in December will matter.

Early indications of consumer health are positive. Consumer confidence is rebounding ahead of holiday shopping season, and retail sales are coming off a +0.3% month-over-month uptick. Data also indicates that shoppers are expected to increase spending by 5% over last year’s figures, with over 50% of all holiday shopping expected to take place online.4 The job market is a key driver of consumer spending, and continues to hold its own with steady job growth. Companies of all sizes, however, are starting to reveal concern over lack of qualified workers.

Factor #4: Will Leading Economic Indicators Continue Turning Over?

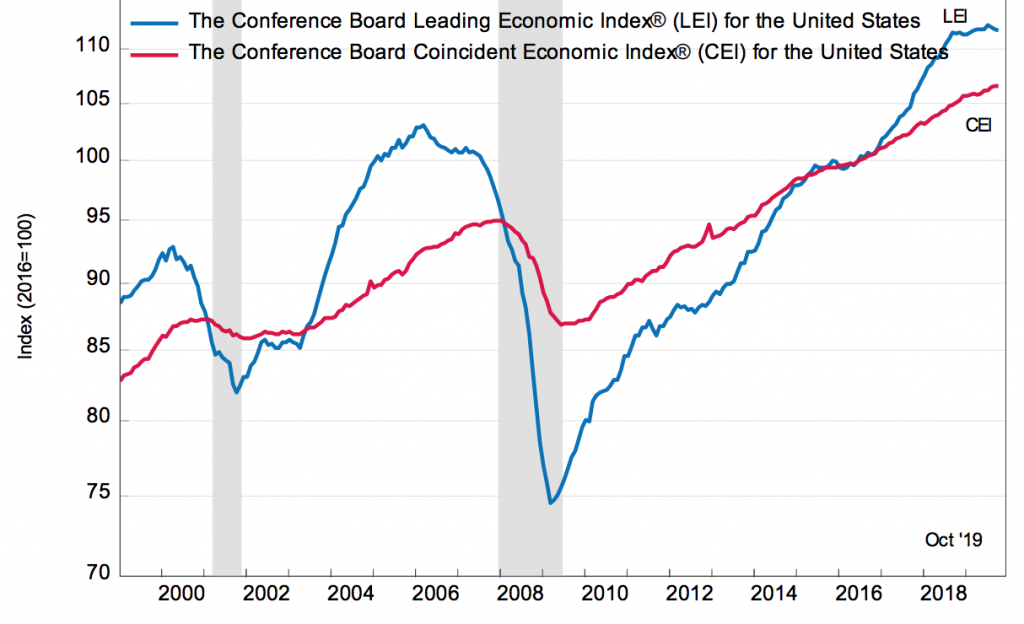

The Conference Board’s Leading Economic Indicator Index (LEI) has been a reliable predictor of recessions over the last few decades, as you can see from the image below. Historically, as the LEI (blue line on chart) peaks and starts to turn over, a recession has followed shortly thereafter:

The LEI Index has Turned Over Before Each of the Previous Two Recessions

Source: Conference Board LEI5

The Conference Board’s LEI for the United States declined for a third consecutive month in November, with its six-month growth rate turning negative for the first time in over three years. According to the Conference Board, weakness was driven by weak new orders in manufacturing, falling average weekly hours for workers, and rising unemployment insurance claims. In short, a softening in the labor market that may be tied to the lack of qualified workers detailed in Factor #3. In all, the LEI suggests the U.S. economy may end on a weak note, making it a key factor to look for in December, in our view.

As we wait to see how these stories pan out by

year-end, I recommend focusing on your long-term financial goals. To help you

do this we are offering our just-released free guide, 7 Secrets to

Building the Ultimate DIY Retirement Portfolio.6 It

provides a step-by-step blueprint of our customized investing process to

potentially help you build a sound retirement portfolio of your own and pursue

long-term investing success.

If you have $500,000 or more to invest, get this

guide to learn our ideas on the step-by-step process to building and

maintaining a retirement portfolio that will help you reach your goals and

enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

3 BBC News, November 1, 2019. https://www.bbc.com/news/uk-politics-49826655

4 CNBC, September 23, 2019. https://www.cnbc.com/2019/09/23/holiday-spending-expected-to-rise-5percent-this-year-driven-by-online-sales.html

5 The Conference Board, November 21, 2019. https://www.conference-board.org/pdf_free/press/US%20LEI%20PRESS%20RELEASE%20-%20NOVEMBER%202019.pdf

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Recipients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this document.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.