Few things about 2020 have felt normal, and the November election is not likely to offer much relief. But as we have learned time and again throughout history – and in particular this year – stocks love to climb a wall of worry. Even though U.S. stocks posted their weakest September in almost 10 years, the S&P 500 index still managed to finish the third quarter up +8.5%. Together with Q2, the S&P 500 has risen by almost +30% in six months, delivering its best two-quarter performance since 2009. Defying just about everyone’s expectations, U.S. stocks are positive in 2020.1

One of the biggest economic stories of the quarter came from the housing sector. In the month of July, housing sales soared 23% from June, hitting an annual pace of close to 1.5 million. Sales of new single-family homes jumped 14% month-over-month in July, hitting an annual pace of 901,000. For the first time ever, the median price of an American home is greater than $300,000.2 The strength we’re seeing in the housing market today is roughly equal to what we saw 2005, when the housing market peaked.

Downstream effects of the housing boom have been evident in consumer spending on furniture, appliances, and home improvement, which has outperformed spending across most other sectors. Construction employment has recovered briskly. One familiar name in the space, Home Depot, offers anecdotal evidence of the sector’s strength: the company posted its best quarterly (Q2) sales growth in nearly 20 years.

______________________________________________________________________________

Make the Most of Your Long-term Returns

Uncertainty politically, economically and socially seems to be the only constant, and with it comes many fears and unknowns. To help you navigate this turbulent time, we are offering an exclusive look into our just-released October Stock Market Outlook Report.

This report will help you make decisions based on data and fundamentals instead of fears and media hysteria. This report contains some of our key forecasts to consider such as:

- Should you be worried about the 2020 Presidential Election?

- What stocks could go up when vaccine distribution rolls out?

- Signs of recovery in certain sectors

- What of U.S. GDP Growth?

- An update on U.S. fiscal stimulus

- U.S. returns expectations for 2020

- What produces 2020 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released October 2020 Stock Market Outlook3

_____________________________________________________________________________

While housing enjoys a strong year, the jobs market is rebounding but also struggling to claw its way back to pre-pandemic levels. In September, U.S. employers added 661,000 jobs, which was far below the 859,000 expected and marks a sharp slowdown from gains made over the summer. The U.S. has replaced 11.4 million of the 22 million jobs lost to the pandemic, but momentum is likely to slow until the virus comes under better control and/or a vaccine is widely distributed. Neither outcome seems likely for 2020, which underscores the need for more fiscal stimulus before the end of the year, in my view.

In late August, Federal Reserve Chairman Jerome Powell laid out a new policy vision for the Fed, indicating they would be implementing a “flexible form of average inflation targeting.” This was Fed-speak for saying the Fed will allow inflation to drift above 2%, meaning they appear increasingly willing to let inflation overshoot its targets in an effort to push unemployment back to its maximum level. 17 Fed officials said they believed rates would stay near zero until at least the end of 2021, with 13 officials pushing the date further out to 2023.4 For investors, the Federal Reserve essentially codified ‘lower for longer’ interest rates in the third quarter.

Finally, I think there have also been underappreciated, pandemic-related positives supporting markets. In particular, the lower incidence of Covid-19 deaths in Q3 may help explain the relatively muted market response to rising infections. Over time, we have also gained a better understanding of the virus, which likely allowed risk assets to anticipate the quicker-than-expected restart. The U.S. health system is also much more prepared for hospitalizations today than it was three or six months ago.

What to Expect Ahead

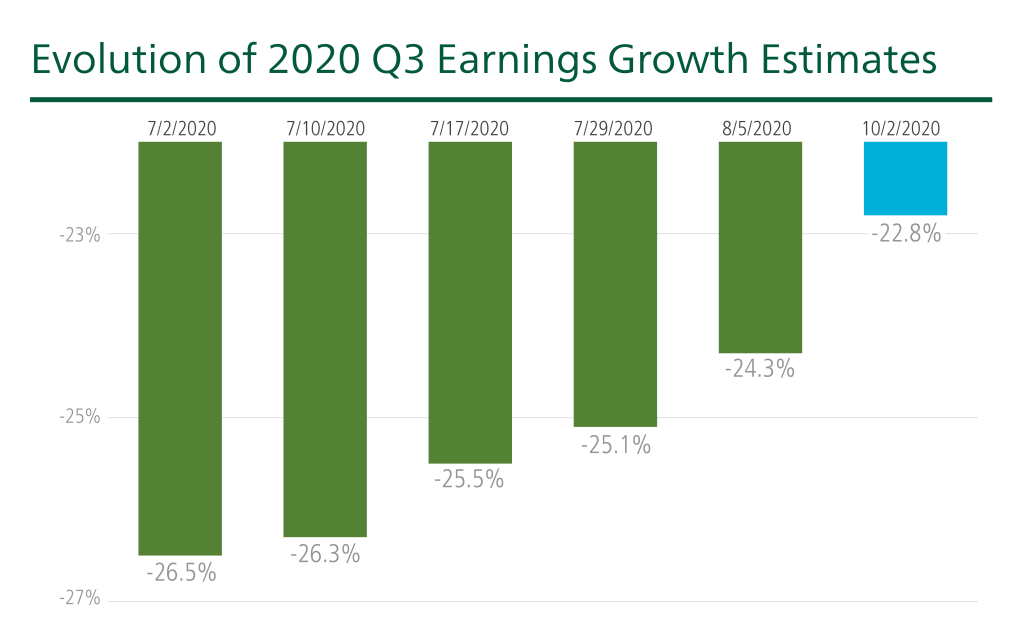

I’ll start with earnings. We expect total S&P 500 earnings to decline -22.8% from the same period (Q3) last year, on -2.9% lower revenues. This earnings decline seems steep, especially following the -32.3% decline in Q2 when economic and business activities came to a halt as a result of the pandemic-driven lockdowns.5 But investors should focus less on the earnings decline and more on how earnings expectations have changed over time.

In that light, the earnings outlook has been steadily improving since the start of Q3 (see the chart below). While the latest labor market and factory sector readings suggest some deceleration in the recovery, we believe the economy will power-through and support a sustained improvement to the earnings trend. In my view, if earnings are even just marginally better than what most expect, the stock market should feel the tailwind.

Perhaps the trillion-dollar Q4 question is whether Congress and the White House will ink a deal for more spending. I personally think we will see more fiscal stimulus in the next three to six months – which will be a boost for equity markets – but this outcome is far from assured. Most everyone on Capitol Hill (and at the Federal Reserve for that matter) agrees that more stimulus is needed, but coming to terms on how much and where to spend has been elusive thus far. Look for an unexpected breakthrough in Q4.

Bottom Line for Investors

“Uncertainty” seems to be the word du jour for describing the United States’ economic, political, and social situations. The economy has made strong gains off the bottom of the recession, but remains a long way off from pre-pandemic activity. Some of the gains from the summer were the low hanging fruits of economic recovery, and I think more stimulus is needed to bridge the country to the vaccine. From what I can see today, the economy is not poised to go in reverse in Q4, but the tailwinds are fading.

Even still, the markets almost always move on expectations vs. reality, and if the economy and corporate earnings – and the election, for that matter – all post results even just marginally better-than-expected, stocks should do just fine in the next six months.

With so much

uncertainty, you may be wondering how to position your investments for success.

To help you make the most of the current, turbulent environment, I recommend

sticking to the hard data and key fundamentals. To help you do this, I am offering all readers our Just-Released October 2020 Stock Market Outlook

Report.

This Special Report is packed with newly revised

predictions that can help you base your next investment move on hard data. For

example, you’ll discover Zacks’ view on:

- Should you be worried about the 2020 Presidential Election?

- What stocks could go up when vaccine distribution rolls out?

- Signs of recovery in certain sectors

- What of U.S. GDP Growth?

- An update on U.S. fiscal stimulus

- U.S. returns expectations for 2020

- What produces 2020 optimism?

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 The Wall Street Journal, August 27, 2020. https://www.wsj.com/articles/millennials-help-power-this-years-housing-market-rebound-11598520601

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

4 The Wall Street Journal, August 30, 2020. https://www.wsj.com/articles/a-flexible-fed-means-higher-inflation-11598796001

5 Zacks.com, October 2, 2020. https://www.zacks.com/commentary/1070308/previewing-the-q3-earnings-season

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPXSM) call and put options. On a global basis, it is one of the most recognized measures of volatility -- widely reported by financial media and closely followed by a variety of market participants as a daily market indicator. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.