With recent headlines focused squarely on the U.S. – China trade dispute and the possibility of an interest rate cut from the Federal Reserve, few have noticed that crude oil prices have been in steep decline since last fall. Prior to last October, crude oil prices had been locked into an uptrend since the beginning of 2016, as global demand remained firm and global economic growth expectations were fairly robust.

But that growth narrative has faded, with most economists now worried about flat or softening growth rates. Crude oil prices seem to be responding in kind to this sentiment shift.

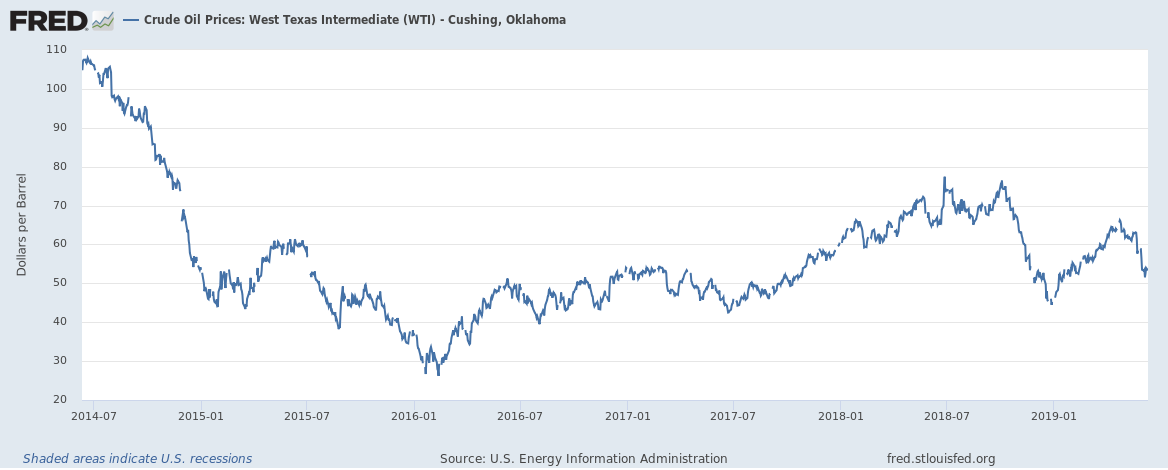

Crude Oil Prices in Decline Since October 2018

Source: Federal Reserve Bank of St. Louis; U.S. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma[1]

From a peak of $75.13 in October, crude oil prices now hover below $55 a barrel – even amidst supply concerns emerging from geopolitical tensions involving Iran. Prices saw a boost when the U.S. blamed Iran last week for the attacks on two tankers in the Gulf of Oman, as any type of military confrontation could have significant consequences for oil supply moving through the Persian Gulf.[2]

But the market appears more concerned with excess supply and inventory of crude oil, as global demand levels off and as the probability of recession rises. On the supply side, the market is contending with a spike in U.S. stockpiles which recently hit multiyear highs. The ongoing shale production boom in the U.S. continues to keep inventories near record highs, even as the summer season takes hold (which usually leads to higher demand and falling inventories). This is arguably why the market has appeared to shrug off any threat of a supply disruption in the Middle East.

On the demand side, investors are increasingly worried of a global slowdown tied to the late cycle headwinds and the ongoing trade dispute between the United States and China. The Energy Information Administration and the International Energy Agency both lowered their forecasts for 2019 global oil demand growth, as GDP growth forecasts soften across the developed world and as trade forecasts move lower in lockstep.

China in particular has downgraded growth forecasts as manufacturing and industrial production numbers show early signs of weakness. For the month of May, industrial production growth in China was the slowest it’s been in years, with fixed asset investment also slowing. Manufacturing PMIs around the developed world are also flashing yellow, with confirmed contractions (readings under 50.0) in South Korea, Japan, Taiwan, Malaysia, Russia, Poland, Turkey, Italy, Germany, and the U.K. China and Spain are stagnating but seem to be on the verge of contracting.[2]

The capital markets (with the exception of the stock market which appears to be pricing a rate cut) have shown signs of concern over slowing growth, with assets pouring into safe havens like U.S. Treasuries, German Bunds, and Japanese Bonds – driving yields to historic lows. Other commodities besides oil, like nickel and cotton, have been under pressure as well as the trade talks between the U.S. and China collapsed.

Bottom Line for Investors

Oil and commodities prices are inherently volatile – remember, we saw a 50% price drop in crude oil prices midway through the current economic expansion and bull market,[3] and the expansion was not thrown off course. What we see today, however, is an interesting set of circumstances where global inventories are near record levels and global demand is slowly starting to turn over. Absent a re-acceleration of global growth expectations – which I do not foresee anytime soon – the major event to watch is whether the situation escalates with Iran, which could significantly impact supply expectations and could send prices higher.

Disclosure

2 The Wall Street Journal, June 17, 2019. https://www.wsj.com/articles/oils-slide-highlights-global-growth-fears-11560733588?mod=djem10point

3 Federal Reserve Bank of St. Louis, June 12, 2019. https://fred.stlouisfed.org/series/DCOILWTICO#0

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.