The U.S. and global equity markets got shaken up a bit last week, with weak manufacturing numbers in the U.S. and globally indicating pronounced slowdowns in factory activity, employment, and trade. The manufacturing sector is very globally interconnected, with very few sophisticated products being assembled in a single country, so the synchronized slowdown comes as no surprise. There are cyclical forces at work here, in my view, but the adverse impact of the trade war is also starting to show up in the numbers.

With the impeachment inquiry also flooding the airwaves last week, it may feel to some readers as though we’re due for a reckoning. I would tend to agree that in the short term, all the noise is likely to contribute to higher levels of volatility, full stop. But does that mean it’s time to shift portfolios or turn fully defensive? I don’t think so.

If you ignore the noise and consider the broad range of fundamentals, the picture for markets and the U.S. economy does not look as bleak.

Manufacturing versus The U.S. Consumer, Labor Markets, and Services

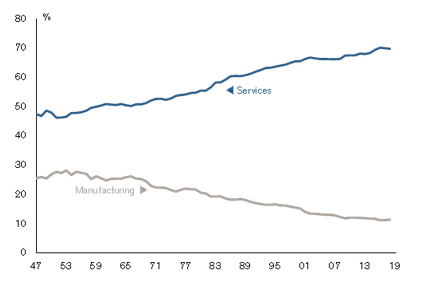

Manufacturing is an important component of the U.S. economy and has historically been a leading indicator. But news last week made it appear as though factory activity is a bellwether for the U.S. economy. It isn’t. The manufacturing sector only accounts for around 10% of the U.S. economy, and that number has been shrinking progressively over the years.1

I believe this shrinking trend does not signal any kind of economic downfall and should not be viewed in a negative light – it is simply part of a longer-term transition, where the U.S. has moved from being an industrial economy to now being a services and consumption-based economy. In the modern economy, skilled labor has more value and pays higher wages than unskilled labor, which has led to overall increases in wealth over time (though creating winners and losers in the process).

Services Account for a Growing Share of the U.S. Economy

Source: Credit Suisse2

To be fair, if the ISM services data last week had indicated contracting activity in the U.S. economy, my tone here might be a bit different. But the ISM Non-Manufacturing PMI, which measures services in the U.S. economy, remained comfortably in expansion territory and relatively healthy. Many news reports noted that services data was less expansionary than expected, and that it surprised to the downside, but at the end of the day growth is growth.3

Macroeconomic data in the labor market and retail sales (the all-important U.S. consumer) also offer evidence that it is not all doom-and-gloom in the U.S. economy. Job growth as measured by non-farm payrolls remains strong, with reports last week showing that the U.S. added 136,000 jobs in September, bringing the jobless rate (3.5%) to its lowest level in 50 years.4

Small businesses, which are often considered a key growth engine for the U.S. economy, have been increasingly reporting labor shortages, where 57% of owners have said they’re hiring or trying to hire new workers. A majority of these business owners have reported finding few, if any, qualified applicants for open positions, which might at once point to strength in economic activity but also a skilled labor shortage in the U.S. A key takeaway from the NFIB Small Business Jobs Report was that “hiring has slowed down, but it’s due to the inability to find qualified workers, not because of a lack of customers.”5

The U.S. consumer is another proxy for the health of the U.S. economy, and signs for now point to solid spending as we enter the holiday shopping season. Total retail sales for the June 2019 through August 2019 period were up 3.7% from the same period a year ago, with a particularly strong showing in July. In the latest ISM Non-Manufacturing report, the statement from the Retail Trade sector was that “business continues to pick up as we quickly approach Q4. Week by week, we inch closer to a much-anticipated holiday retail season, which requires not only last-minute buys, but a push to fill open positions.”6 Again, not all doom-and-gloom.

Bottom Line for Investors

Recession risks are clearly rising, and growth across the global economy is slowing. U.S. corporate earnings are also expected to post their third straight quarter of negative growth in Q3, which hasn’t happened since 2015 – 2016. Investors should expect any bit of bad news to invoke a volatile response in the stock market.

But it’s not all doom-and-gloom out there, and the base case is that the U.S. economy is still growing. The all-important services sector remains in expansionary territory, the U.S. consumer is still spending at a nice clip, the jobs market is quite healthy, and interest rates are falling. Recessions do not tend to happen when these factors are all working in the positive, and I do not think that changes now.

Disclosure

2 Federal Reserve Board, Haver Analytics®, Credit Suisse. October 2, 2019.

3 Institute for Supply Management, October 3, 2019. https://www.instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?SSO=1

4 The Wall Street Journal, October 4, 2019. https://www.wsj.com/articles/u-s-september-nonfarm-payrolls-grew-steadily-11570192288?mod=article_inline&mod=hp_lead_pos1

5 NFIB Small Business Jobs Report, September 2019. https://www.nfib.com/foundations/research-center/monthly-reports/jobs-report/

6 Institute for Supply Management, October 3, 2019. https://www.instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?SSO=1

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.