During the S&P 500’s -34% plunge followed by its sharp “v-shaped” rally, it became apparent to me that almost every sector of the US economy had varying levels of exposure to this crisis. We have never seen an induced recession in the name of public health like we’re seeing now, with government-mandated shutdowns and social distancing restrictions. Not all industries are being impacted equally by this economic reality – some have been affected badly, others are weathering the storm, and some are actually thriving.

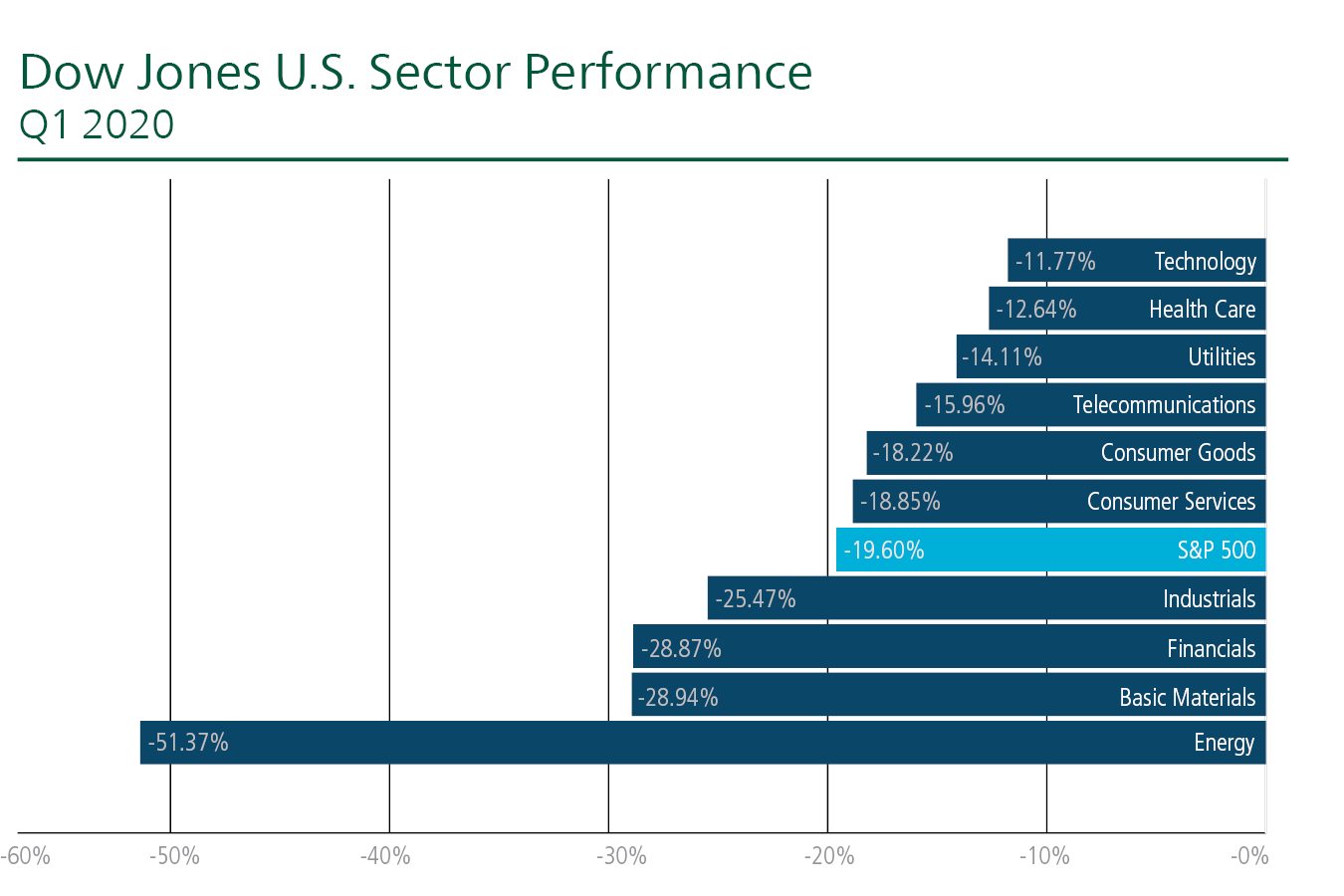

You can see the different levels of impact in the Q1 performance numbers. The S&P 500 finished down -19.6% for the quarter, but an investor’s participation in the downside had everything to do with exposure: Energy (-51.37%), Financials (-28.87%), and Industrials (-25.47%) got clobbered on the way down, while Technology (-11.77%), Health Care (-12.64%), and Utilities (-14.11%) outperformed on a relative basis.1 A handful of strong technology companies even finished the quarter in positive territory. If an investor had equally weighted all S&P 500 sectors in their investment portfolio from January 1 to March 31, they would have been down -30.08% versus the S&P 500’s actual -19.6% (cap-weighted) finish.2 Allocation decisions matter.

Source: BlackRock3

A passive manager who owns the entire stock market, or specific sectors via ETFs, probably has exposure across the board – owning the good, the bad, and the ugly. An active manager can work to limit exposure to the latter two.

Long-time readers know that when it comes to growth and wealth building over time, I’m a die-hard advocate for owning a diversified portfolio of equities for long stretches (20+ years) of time. But that does not mean just blindly owning the entire market equally, or simply allocating an equity portfolio perfectly in-line with the S&P 500’s cap-weighted allocations. I believe that an active manager can help to determine how much relative exposure to allocate to each sector based on that sector’s outlook. Additionally, in my view, an active manager can go a step further and attempt to examine every single stock available to determine earnings potential, credit risk (very important in the current environment), earnings estimate revisions vs. actual results, valuation, historical dividend payments, and so on. An active manager can work to separate the bad and the ugly from the strong and the good.

At present, the “April Zacks Industry Ranks” produced a “stay-at-home” macro assessment of different sectors across the economy, and finds that Utilities, Communication Services, Information Technology and Health Care are the leaders. On the negative side, we see Materials, Industrials, and Energy on a continued lag. Computer-Office equipment and software/cloud sales are strong, as remote offices get set up. Continued weakness in global manufacturing PMIs and WTI oil price declines will likely persist as a drag for Energy, Industrials, and Materials. It is still way too early to call, but current Zacks earnings estimates for full-year 2020 shows spots of positivity from Information Technology (+6.0% y/y), Health Care (+4.7% y/y), Consumer Staples (+2.7% y/y), and Communications Services (+2.0% y/y).4

I believe size is another arena where active management can help you navigate the recession. Because of the ‘full-stop’ on economic activity that characterizes the current recession, large-cap companies – which tend to have stronger balance sheets, better technology, established relationships with banks, and more diversified sales channels – are ‘weathering the storm’ better than smaller and mid-size counterparts that do not have similar financial positions. Large-cap has been outperforming small-cap and mid-cap across the globe, across the growth and value (style) spectrum.5 This setup is another area where active managers can smartly position accordingly.

Finally, from a stock-specific standpoint, I believe active managers should be looking at credit risk on every company’s balance sheet in the portfolio. Reports this week showed the $350 billion Paycheck Protection Program was already out of money, and though Congress is poised to add more funds, not every business will benefit from bridge loans needed to keep the doors open. Energy companies in particular face acute credit risk as oil prices have plunged. Companies with strong balance sheets and cash positions will still hurt from falling demand, but their chances of surviving are much higher – and life after the crisis might mean less competition.

Bottom Line for Investors

Stock market volatility continues apace and is likely to remain elevated for the next few months as the world fights to contain the Covid-19 outbreak. The economic hit will also continue as shutdowns and restrictions on movement persist, with some sectors and industries feeling acute pain while others weather the downturn or even thrive. A passive investment approach in the current environment means owning some or many of the companies that are not likely to do well or potentially will not survive, in my view. An active approach to investing – like what we do here at Zacks Investment Management – means taking a more analytical approach to owning stocks that can survive the crisis and perhaps even emerge stronger during the recovery. That’s why I think it’s a good time to be an active manager.

Disclosure

2 Google Finance, April 21, 2020 https://www.google.com/search?client=safari&rls=en&q=INDEXNYSEGIS:+SPXEW&ie=UTF-8&oe=UTF-8

3 BlackRock, Benchmark returns comparison, March 2020.

4 Zacks Investment Management Stock Market Outlook Report. April/May 2010.

5 The Wall Street Journal, April 202, 2020. https://www.wsj.com/articles/the-winner-takes-all-stock-market-rally-11587374851?mod=djem10point

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.