Volatility has rattled the market with the S&P 500 down slightly more than 11% in just six trading days (though 8/26/15). Global markets have fared worse. But, my advice to you now is – don’t let it rattle you too.

To many investors, this correction may feel especially dramatic (and a bit scary) because of its steepness and rapid onset. But, it’s also important to remember that we have not experienced a correction (a quick, sharp drop in the 10% to 20% range) since 2012, when the S&P 500 fell 9.9% between April 2 and June 1.

Given that the market experiences, on average, an intra-year correction of -14.2%, it’s been rather surprising that we have gone three years with such relative calm. In that sense – and as I’ve said many times – I think this correction was long overdue. And, I don’t think it’s quite over yet.

Expect Short-Term downside Volatility

Investors should expect more volatility from here (both upside and downside), and I think the market could even correct a bit more over the next month or two. But, here’s the thing about corrections: no algorithm or ‘expert’ can tell you when they will start, end, how much the market will fall, or how quickly it will rebound. It’s impossible.

The issue that troubles many investors – and ultimately hurts them – is that they allow volatility to tempt them to “time the market,” allowing short-term uncertainties to drive their decision-making. This too often results in an investor getting whipsawed—capturing the downside but missing the upside, and it can significantly impact your long-term returns. It’s better to stay the course.

Amidst all the volatility and scary headlines, I encourage investors to keep their cool. I think this downside should be short-lived and the bull market should continue apace over the next year. Trying to perfectly time this correction, in my view, is a fruitless pursuit.

4 Reasons to “Stay Cool” in this Volatile Market

Corrections, by definition, are generally short, sharp declines in the market in the 10% – 20% range, accompanied by sensationalized stories (think European sovereign debt crisis, fiscal cliff, Greek exit from the euro, and now, China’s slowdown). These stories often turn out to be false fears and I think that is what we’re seeing here. Our economic outlook for the U.S. and global economy, before last Monday, was positive – and one week of market declines has not changed this thinking.

Corrections thrive when investors become fixated on headlines and ignore underlying fundamentals. Don’t let that happen to you. Here are four reasons I think this decline will be short-lived.

1. U.S. Fundamentals Remain Strong – Through Q1, the United States has seen 19 straight quarters of earnings growth, with S&P 500 operating earnings per share at record highs ($28.46 for Q2 2015). Strip away Energy earnings – which we’ve known for some time would be a significant drag – and corporate earnings and revenues are in fact quite sturdy and even robust by historical standards. Consumer spending is higher (lower gas prices help) and private businesses keep expanding: the non-manufacturing business activity index increased to 64.9%, which marks 72 consecutive months of growth at a quicker pace. Even with the impending interest rate hike, interest rates are near historic lows; unemployment has dropped below 6%; we expect the economy to grow in the 2% range on year…no issues here with U.S. fundamentals.

2. “The Bull Market is Solely Fed-Driven” is a Myth – I’ve seen some pundits argue that Federal Reserve stimulus and ‘QE’ have single-handedly forced investors to rotate into risk assets (stocks), and that’s been the driving force behind this bull market. Now that the Fed has ended QE, they argue, there is nothing left to save the market. I strongly disagree with this view. While I don’t refute that the Fed contributed to rising asset prices, I do not believe they were the sole cause of it. Such a theory ignores any fundamental forces that have supported higher equity prices, like earnings growth and GDP growth, which has been sturdy over the last six years. What’s more, if this Fed theory were true, then why have equity inflows trailed bond inflows throughout this bull market? Since March 2009, equity mutual funds have seen an outflow of $82.5 billion, compared to a $1 trillion inflow for bond mutual funds. It doesn’t make sense. As for QE, recall that the Fed effectively shut down QE in October 2014, yet the market has largely trended higher for 9 months since. How is that possible according to the “Fed-driven bull market” argument? Throughout this bull, the Fed has been initiating and unwinding programs – QE, QE2, Operation Twist, and they’re all gone. Yet the bull market continues.

3. China Woes Overblown – an early gauge of China’s factory activity fell to a six-and-a-half year low in August, despite China’s efforts to boost economic growth with monetary easing—and that has investors worried. But I see two issues with this narrative: 1) haven’t we already known for some time that China was expected to slow? What is the ‘new news’ here? 2) China still expects to grow 7% on year, perhaps a bit less now. Is that really powerful enough to send the expanding global economy into a full-on recession? I simply don’t believe that if China grows, say, 6.5% instead of the expected 7%, that it will somehow send the rest of the world into a downward spiral. I see this as a “false fear.”

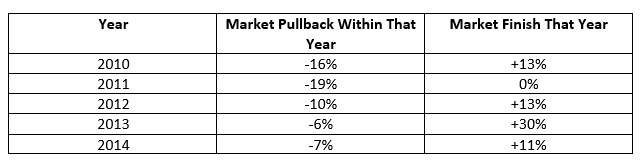

4. A Market Correction is Not Only Overdue, but Also Very Normal – Since 1980, despite average intra-year drops of 14.2%, the market finished positive in 27 of those 35 years – or 77% of the time. In this bull market alone, we’ve seen six fairly sizable pullbacks, only to have the market finish higher each time (with the exception of 2011):

The Bottom Line for Investors

My belief is that we shouldn’t fear the headlines if they are not fundamentally changing the global economic or corporate earning environment. If the world is expected to continue growing—and corporations are posting earnings growth each quarter (as they have throughout this bull market)—then stocks should continue to do relatively well in our view.

Overreacting to short-term news and market volatility often leads investors to mistakenly change their asset allocation and investment approach, which can potentially harm the ability to achieve the long-term returns needed to meet investment goals. Rather than fear volatile markets, investors should maintain their composure by staying focused on long-term economic and market expectations, which today remain positive in my view.

– Mitch

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.