The U.S. budget deficit – which is the difference between what the government spends and earns (tax receipts) in a given year – soared to $3 trillion in the twelve months ending June 30, 2020. Spending rose dramatically in recent months in response to the pandemic, while tax revenue plummeted. In the month of June alone, the federal government spent $864 billion more than it earned, which almost equals the entire deficit posted in fiscal year 2019.1

There’s more – Congress returned from summer recess on Monday, and a top priority on the agenda is to weigh the question of even more stimulus. As it stands today, additional spending appears to have bi-partisan support, though details may take some time to iron-out. The bottom line, in my view, is that more spending is coming, which should put the U.S. on pace to post its largest deficit as a percent of GDP since World War II.

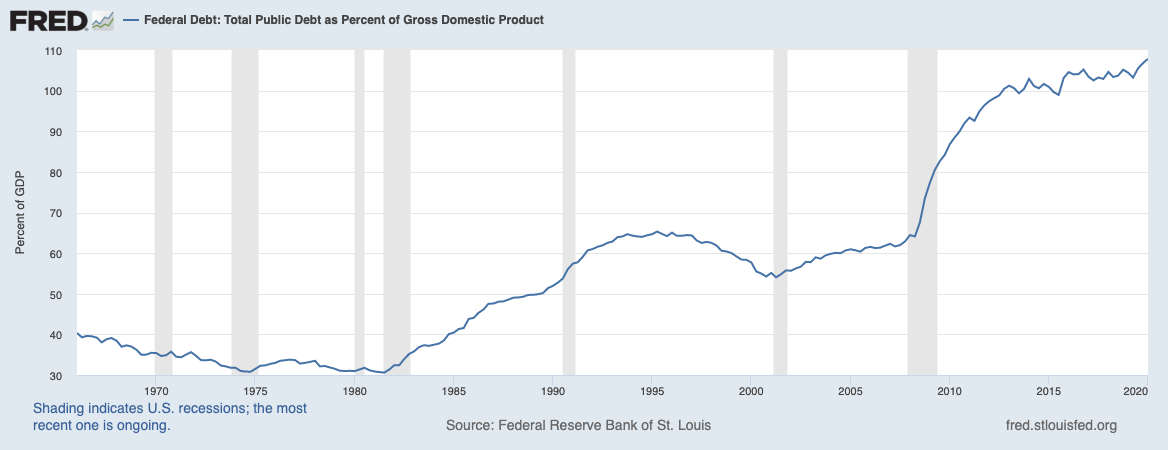

Rising deficits each year means the amount of total debt on the U.S.’s books keeps going up, too. The image below shows total U.S. federal debt as a percent of GDP over the years, which as readers can see, keeps pushing higher. I know many readers feel uneasy about endlessly rising debt (currently over $25 trillion), and worry about how and when the ‘chickens will come home to roost.’

On the Rise: Federal Debt as a % of GDP

Source: Federal Reserve Bank of St. Louis2

I empathize with concerns over rising debt and out-of-control spending rising, but I do not necessarily share those concerns. There’s a different way to think about debt and deficits, which for many people goes against the grain of everything they know and understand about debt.

When folks think about debt, they almost always default to thinking of it in personal terms. The car loan you have to pay off. The credit card debt collecting interest. The mortgage, student debt, and health care bills potentially piling up. Apart from mortgage debt, which can help a household build equity, the other categories of debt are viewed negatively. Debt is bad – it detracts from your net worth, and interest you pay on debt is the equivalent of losing money (unless, for instance, you borrowed money to start a business that is generating revenue).

When thinking about the United States, however, it is critical not to think about debt or deficits in personal terms. For one, the United States economy does not have an end date. Humans may only live to be 80 or 90, which means we have a limited number of years to get debt off our books. But the United States economy could technically exist in perpetuity – growing over time, borrowing over time, paying off debt via tax revenues over time, growing more, borrowing more, paying off more debt, and on and on.

Borrowing money for the U.S. has basically never been cheaper. As of July 15th, the yield on the 30-year U.S. Treasury bond stands at 1.33%. Ask yourself: if you could buy a house with a 30-year mortgage rate of 1.33%, would you borrow the money and buy it? The United States can currently go out into the debt markets and borrow money at next to nothing, using tax receipts from our $20 trillion economy to make the interest payments. According to the U.S. Treasury, net interest costs – which represent the cost of borrowing money – fell 11% in the first nine months of the fiscal year. 3 The U.S. has never missed an interest payment, and probably never will in your lifetime.

Bottom Line for Investors

The key takeaway is not to think about the U.S.’s absolute level of debt, but to consider our ability to continue making interest payments on our debt over time.

In a debt crisis, investors would worry about a country’s ability to make interest payments and repay debt, which would push interest rates higher – not lower. You may remember Greece in the years following the 2008 financial crisis, when bond yields soared and the country could not sell bonds in the debt markets. The European Central Bank had to step-in to buy Greek debt and backstop outstanding debt, and eventually Greece was able to re-enter the debt markets.

The United States does not have this problem today. As the most diverse and wealthiest economy in the world, I think it’s clear that global investors not only want our debt, but covet it. In spite of all of the world’s and the U.S.’s current problems, U.S. Treasury bonds are still considered among the safest investments in the world. This notion may puzzle many investors given the political/economic climate, but you don’t need to take my word for it. Just look at interest rates.

Disclosure

2 Federal Reserve Bank of St. Louis and U.S. Office of Management and Budget, Federal Debt: Total Public Debt as Percent of Gross Domestic Product [GFDEGDQ188S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEGDQ188S, July 20, 2020.

3 U.S. Department of the treasury, July 20, 2020. https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/textview.aspx?data=yield

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.