Dollar Doom? Markets are Telling a Different Story

Headlines have been buzzing over the last several weeks as gold and other “hard” assets have sprinted higher. The rally has been accompanied by a familiar storyline: investors are supposedly fleeing dollar assets, termed the “debasement trade,” because of the U.S.’s unsustainable fiscal trajectory, deficit spending, upended global trade, etc.1

In the most extreme of cases, the narrative is that the dollar is doomed, which means investors need to look beyond dollar-denominated assets for secure investment opportunities.

Don’t “buy” it.

If the dollar were genuinely under siege and U.S. financial assets were being shunned, we would see telltale signs in various corners of the market. But we’re not.

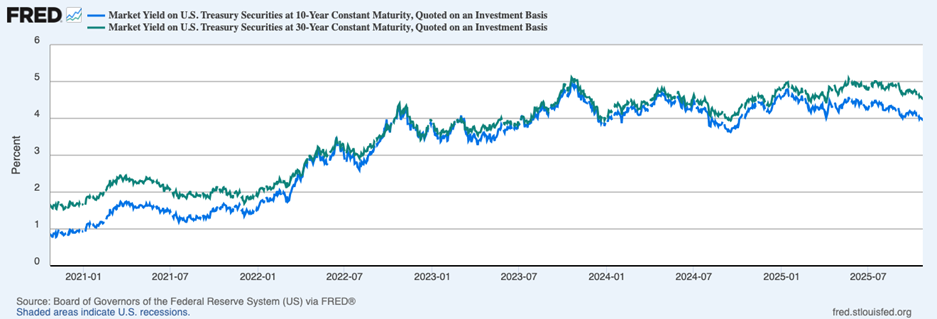

Start with bonds. When investors fear a long-run loss of purchasing power, they usually demand higher yields to compensate. Instead, the opposite has unfolded: the 10-year Treasury yield is notably lower than where it began the year, and even the 30-year, typically most sensitive to long-term inflation worries, has drifted down as seen in the chart below. That isn’t the behavior of a market dumping Treasurys. On the contrary, it points to steady demand.

10- and 30-Year U.S. Treasury Bond Yields

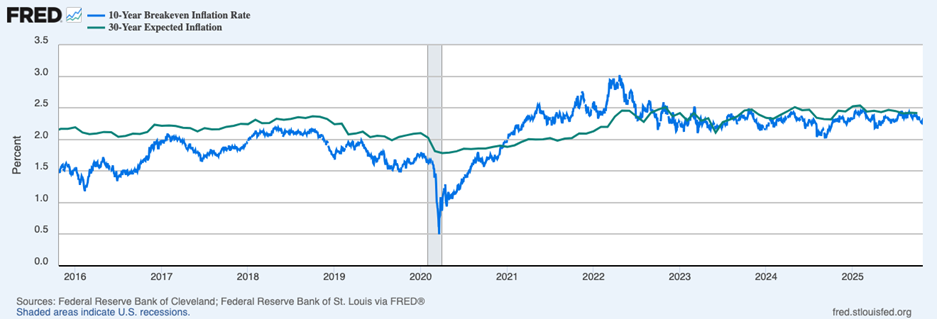

Another place to look is inflation expectations. The 10-year breakeven rate sits a bit above 2.2%, and 30-year expected inflation is near that level as well. In other words, expectations are pretty firmly anchored, with bond markets still expecting inflation to average close to the Fed’s target over the long haul. If investors truly believed a lasting bout of currency erosion was at hand, you would expect those measures to pop, dramatically. They haven’t.

10- and 30-Year Expected Inflation

The dollar tells a similar story. After a weak first quarter, the broad trade-weighted dollar index has been broadly stable for months and has even outperformed several major peers recently. If fears of dollar erosion were truly driving flows, you would likely see a cocktail of rising long-term nominal yields, widening corporate credit spreads, and a sliding greenback. We’re just not seeing that now.

To be sure, I’m not making an argument against gold or other inflation hedges here. A modest allocation can diversify portfolios and dampen volatility, particularly during bouts of geopolitical stress or when real yields fall. The keyword is “modest.” Going all-in on a single narrative leaves investors exposed to timing and headline risk. If markets have taught anything in the last few years, it’s that stories can travel faster than fundamentals, and then reverse just as quickly.

Long-time readers of my columns know what I see as the most effective inflation hedge over time: owning stocks. Buying shares of leading businesses offers a natural inflation valve, since companies can lift prices, improve efficiency, and compound earnings over time. Across most rolling 10-year periods, U.S. stocks have outpaced inflation—even through episodes of rising deficits, shifting policy regimes, and currency fluctuations. Over longer investment horizons, which most investors have, profits and dividends have been powerful antidotes to inflation and currency fluctuations. I don’t see that changing now.

Bottom Line for Investors

The so-called “debasement trade” may have a kernel of logic behind it, but not the kind of logic that justifies labeling the dollar as doomed. When you strip away the noise, what markets are signaling is stability, not debasement. Bonds are rallying, inflation expectations are anchored, and the dollar remains the world’s preferred reserve currency. I’m confident that will not change in our lifetime. For investors, that means this is not the time to overhaul portfolios in favor of hard assets or chase a narrative about dollar decline. The playbook hasn’t changed: own the world’s most productive companies, stay diversified across asset classes, and let corporate earnings compound over time. A small allocation to gold or other real assets can provide ballast, but the real protection against inflation or dollar weakness is the same as it’s always been, in my view: Own stocks.

Disclosure

2 Fred Economic Data. October 28, 2025. https://fred.stlouisfed.org/series/DGS10

3 Fred Economic Data. October 28, 2025. https://fred.stlouisfed.org/series/T10YIE

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.