Many readers are likely concerned about recent escalations between the United States and Iran. Geopolitical tensions and even war are, unfortunately, inevitable over time. An investor’s job is to constantly assess and re-assess how each conflict may ultimately affect the global economy – or whether it will disrupt growth at all. In times when politics and geopolitics create ‘crisis-like’ narratives, I believe it is critical to tune out the noise redouble your focus on fundamentals.

A good place to start is by examining history in search of parallels and insights – knowing the past can often provide valuable information for how to view the present. Though the current situation appears to have de-escalated for now, ongoing tensions with Iran may feel dire and worrisome to many. But it’s important to remember that the United States has been through much worse, and the economy and capital markets have a long track record of overcoming adversity.

Let’s start with stocks. In the table below, I’ve laid out some provocations (and worse) throughout history that I think bear some resemblance to the current situation. I’ve also included stock returns in the year that the event occurred.

| Year | Event | S&P 500 Return: |

| 1950 | Korean War | +30.81% |

| 1953 | Russia Explodes H-Bomb | -1.21% |

| 1961 | Building of Berlin Wall | +26.64% |

| 1966 | Escalations of Vietnam War | -9.97% |

| 1990 | Iraq Invades Kuwait | -3.06% |

| 2001 | September 11 | -11.85% |

| 2003 | U.S. Invasion of Iraq | +28.36% |

Source: Annual Returns on Stock, T.Bonds and T.Bills 1928-Current1

As you can see, there are some very significant, consequential events listed here. Market returns are mixed. In some cases, the declines were relatively modest, and in other cases, the upside was big. I believe the takeaway here is that geopolitical pressures and even war do not automatically imply weak markets. If the geopolitical situation gets bad, the Federal Reserve is tightening monetary policy (raising interest rates) to fight rising inflation, and oil prices are shooting higher, then maybe you get an outcome like 1990. Today, inflation is low, interest rates are low, the Fed is taking a neutral-to-dovish stance while expanding their balance sheet, and GDP growth is expected to notch 2%.

Geopolitics matter, but economic fundamentals matter more, in my view.

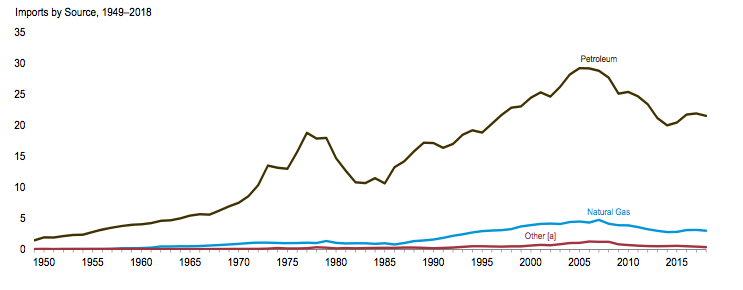

What about oil markets? When Iraq invaded Kuwait in 1990, oil was a key factor and rising crude prices put pressure on an already weak U.S. economy. But it is important to remember that in 1990, the U.S. was a major oil importer, and we were not a dominant energy producer on the global stage. Today, we are the world’s largest oil producer and our reliance on imports has been in decline for years:

Source: Energy Information Administration2

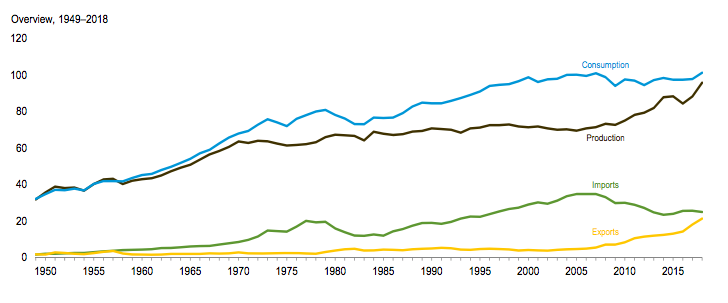

Another key feature of the current energy market in the U.S. is that technological advancement and new efficiencies have allowed our energy consumption to remain relatively flat over the past decade. Fewer imports, more production, and level consumption mean less reliance on foreign oil.

Source: Energy Information Administration3

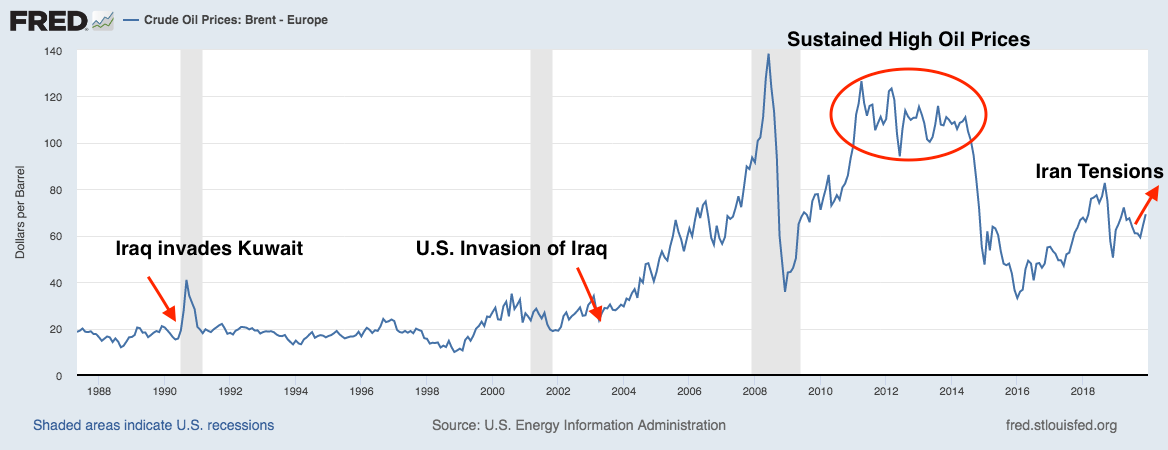

If Iran decides to disrupt oil markets perhaps by blocking shipping lanes in the Strait of Hormuz, for instance, I would argue the effects on the U.S. economy would be negligible. During the period of ‘sustained high oil prices’ in the chart below, the equity market did just fine and the economy continued to expand. Should oil prices go higher from here as tensions with Iran continue, I do not think we will see a material impact on growth fundamentals.

Source: Federal Reserve Bank of St. Louis4

Bottom Line for Investors

Other potential scenarios to consider are that further escalation – or war – could lead to more government spending, which may actually boost overall growth, in my view. Or perhaps increased risk aversion leads to more bond buying, putting downward pressure on yields. Again, outcomes are highly unpredictable.

In my opinion, the overarching point here is that while there are myriad potential outcomes, investors should consider the possibility – or even the probability – that geopolitics, economics, and markets often move in different lanes. While the geopolitical situation worsens, the economy can still grow and markets can still thrive. It’s an investor’s job to continually take the good with the bad, and to weigh the impact of a geopolitical dust-up versus the impact of macroeconomic forces. The latter, in my view, is almost always more important.

Disclosure

1 Federal Reserve database in St. Louis (FRED), January 5, 2019. http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

2 U. S. Energy Information Administration / Monthly Energy Review December 2019 https://www.eia.gov/totalenergy/data/monthly/pdf/sec1_2.pdf

3 U. S. Energy Information Administration / Monthly Energy Review December 2019 https://www.eia.gov/totalenergy/data/monthly/pdf/sec1_2.pdf

4 U.S. Energy Information Administration, Crude Oil Prices: Brent - Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DCOILBRENTEU, January 7, 2020.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.