Investors are getting increasingly edgy and bearish as stock market volatility continues apace, which is actually having the opposite effect on me – it’s making me more bullish. In this week’s column I’ll explain why I feel that way, but first I’ll unpack some of the sentiment indicators ‘flashing pessimism.’

You can find evidence of investor bearishness/skepticism in many places. Watching the news for one! However, there are also a few sentiment indicators available to give us a good idea of sentiment in the marketplace.

One such gauge comes from The American Association of Individual Investors (AAII). Late last week, they said that bearish sentiment – which is measured as the expectation that stock prices will fall over the next six months – soared 18.4% to 48.9% in just a week’s time. The AAII noted that 48.9% is the highest bearish reading since April 2013, and it also marks the 10th straight week that bearish sentiment has been above the historical average.

Similarly, the AAII said that bullish sentiment – which is measured as the expectation that prices will rise over the next six months – fell 17% to 20.9%, its lowest level since May 2016.[1]

Over the last few weeks, investors appear to be responding to the negative sentiment by shifting away from equities and ‘running for the exits,’ so to speak. According to Lipper, weekly outflows of US-based stock funds hit a record in the week of December 10, and it follows that bonds have outperformed stocks by 8.24% in the 20 trading days leading up to December 18. On a relative basis, this is close to the weakest performance for stocks relative to bonds over the past two years.[2] And as if you didn’t need any more evidence of bearish sentiment, I’ve got one more – investors have been buying puts and selling calls at some of the highest levels seen in two years.

Why This Investor Behavior Makes Me More Bullish

It is fairly obvious that today, pessimism is unusually high and optimism is unusually low. There aren’t a whole lot of investors asking what they should buy today, as the conversation is more geared towards whether it’s time to sell or go defensive in portfolios.

However, remember the adage that investors should be “fearful when others are greedy and greedy when others are fearful”?[3] I believe that it still applies today! In my view, the current investment environment has all of the classic marks of a correction – a short-term, emotionally-driven pullback with a characteristic disconnect: fear and worry running high with economic fundamentals remaining reasonably strong. That disconnect is precisely what I think we’re seeing today.

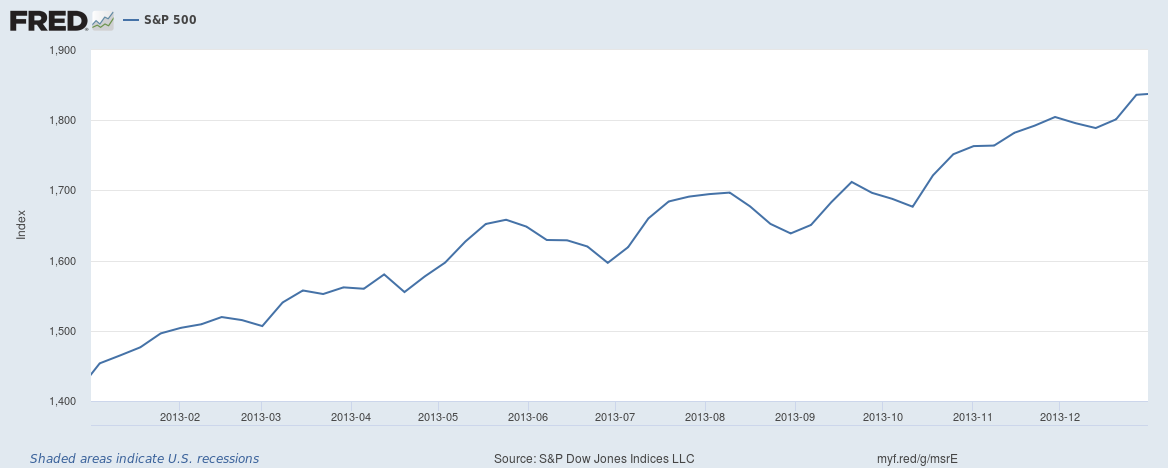

Historical data suggests that bearish investor sentiment is not a good indicator for bearish future returns. Earlier I noted that the last time investors were this bearish was back in April 2013, but take a look at what the S&P 500 did in that year:

As Investors Got More Fearful, Stocks Continued Climbing

Source: Federal Reserve Bank of St. Louis

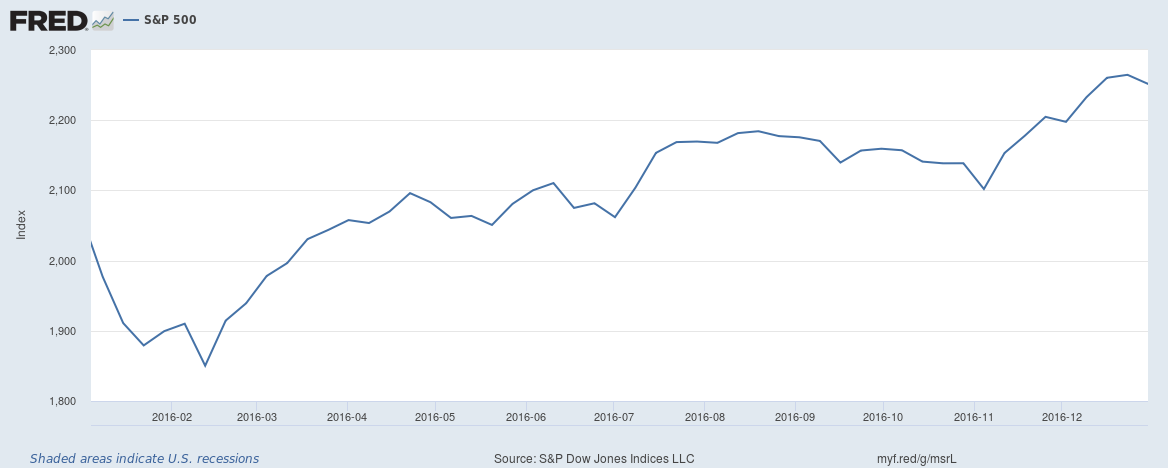

We saw a similar outcome in 2016. When bullish sentiment in that year dipped to levels as low as we’re seeing today, stocks still managed to track higher:

Source: Federal Reserve Bank of St. Louis

Bottom Line for Investors

It’s been a difficult few weeks for stock investors, and I empathize with the difficulty of remaining patient as the ups and downs – but mostly the downs – grip the market.

But I believe this volatility has the classic markings of a short-term, emotionally-driven correction, and in such situations historically it has been beneficial to remain calm and focused on the long-term. As the AAII also notes, instances of extreme investor pessimism have been followed by higher-than-median 6- and 12-month returns for the S&P 500. Going forward, I think patience will be rewarded once again.

Disclosure

2 CNN Business, December 18, 2018. https://money.cnn.com/data/fear-and-greed/

3 CNBC, June 30, 2017. https://www.cnbc.com/2017/06/30/buffetts-big-bank-score-proves-be-greedy-when-others-are-fearful.html

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.