Generally speaking, there are three types of bear markets: structural, cyclical, and event-driven. Every bear market has a unique set of drivers, of course, but throughout history most of them fall into one of these three categories:

- Structural – These are bear markets like the 2008-2009 downturn, which are driven by financial bubbles, too much leverage, credit market dislocations, and other structural imbalances.

- Cyclical – Cyclical bear markets happen more as a function of the business cycle, when growth leads to inflation, interest rates go up too fast, the yield curve flattens or inverts, loan activity declines, demand wanes, etc.

- Event-Driven – These bear markets are triggered by an exogenous event, like an energy crisis, political instability, war, or in the case of the current bear market, a global pandemic.

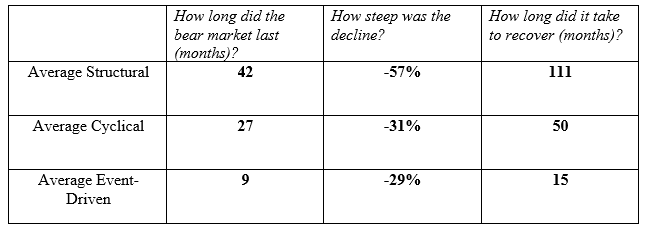

Looking back at data going back to the 1800’s, here’s what we know about the relative magnitude and duration of each category of bear market:

Source: Goldman Sachs1

It makes sense why structural bear markets tend to be the most severe – they result from systemic issues in the financial system and capital markets, which can take a lot of time and pain (in the form of bankruptcies, restructurings, etc.) to fix. Cyclical bear markets are next, and generally require the business cycle to run its course, for interest rates to fall, maybe some monetary and fiscal stimulus to stoke demand. Cyclical bear markets are bad, but have tended to resolve themselves with time and adequate policy responses.

Last on the list are ‘event-driven’ bear markets, which throughout history have tended to be shorter, less severe on the downside and take less time needed to recover than ‘structural’ or ‘cyclical’ bear markets. This makes sense: in many cases, the global/US economy is in decent or good shape before an exogenous event takes place, meaning that it does not take quite as long for the economy to recover once the impact of the ‘event’ fades.

In the current environment, for example, millions of jobs were lost very early in the crisis as businesses made fast and severe adjustments to cope with shutdowns and restrictions. But once these restrictions are removed, the lost jobs could return fairly quickly – and arguably more quickly than if this were a structural or cyclical recession, in my view.

To be fair, I think it’s important to acknowledge that there has not been an event-driven bear market in history that was triggered by a virus/disease outbreak. I think it’s important to hold out the possibility that this event-driven bear could morph into a structural bear if the crisis is not contained by, say, summer. In the meantime, however, I think the sheer size and speed of fiscal ($2 trillion legislation) and monetary (virtually infinite liquidity) stimulus should help keep this bear market in the event-driven category for a few months.

In China, new Covid-19 cases fell sharply by mid-March, with the first day of no new cases reported on March 19 – about two and a half months into the outbreak. As I write this, more than 98% of China’s major industrial companies have resumed operations, with 90% of workers back on the job. Shopping malls in Wuhan, where Covid-19 first appeared, opened for business this week after being shut completely for two months.2 If, in the West, we manage to contain the crisis and the ‘curves all flatten’ by summer, we could tiptoe back to normal economic activity perhaps by late summer. Time will tell.

Bottom Line for Investors

There is no way to know when this bear market will bottom. But what I can tell you, from a long reading of history, is that the bear market will likely come to end as the news remains bad and even gets worse. In other words, I think on day 1 of the new bull market, we will still be reading about job losses, lost profits, and bleak statistics about the pandemic. That’s what makes it impossible to predict.

Now that we’re in the throes of the bear market, the most important outcome for investors, in my view, is to ensure that you’re positioned from Day 1 to participate in the rebound when it occurs. If this is an event-driven bear market, which I believe it is, that rebound could arrive much sooner than many anticipate.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.