Q2 earnings season came and went with very little fanfare. Of course, most financial and other news coverage seemed to be focused solely on the Covid-19 outbreak, unemployment data, politics-as-usual, and fiscal and monetary stimulus. From what I could gather, earnings were barely mentioned at all. But they should have been.

Long-time readers of my column know how much emphasis I place on earnings as a long-term driver of stock prices. If a company consistently grows earnings and frequently exceeds expectations in the process, the stock will almost certainly do well. If you made the argument that the three most important words in equity investing are “better-than-expected,” I’d probably agree with you.

That’s why it is meaningful that earnings were barely mentioned in the news. Even though earnings took a huge hit in Q2 – total earnings (or aggregate net income) for the 458 S&P 500 members that have reported are down -35.4% on -11.3% lower revenues – corporations largely performed better than most analysts and even CEOs expected.1

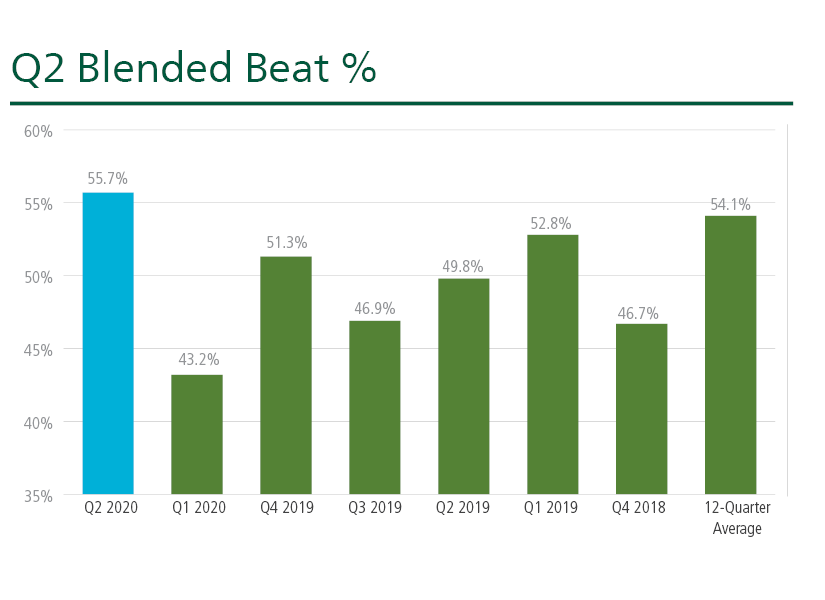

As I write, 79.7% of reporting companies beat consensus earnings-per-share estimates and 62.9% beat revenue estimates. On a blended basis, 55.7% of companies exceeded expectations, which represents a very strong showing relative to recent history:2

Source: Zacks.com3

To be fair, analysts were totally in the dark as they set their Q2 earnings-per-share and revenue estimates. As we all know, most companies withdrew previously issued guidance given how difficult it was project business trends during the period because of the pandemic. Everyone was venturing into the unknown.

In my view, however, the tendency to assume worst-case scenarios led to analyst and CEO projections that were far too dire. When the ‘worse than the Great Depression’ forecasts did not materialize, stocks rallied. This is often how markets work.

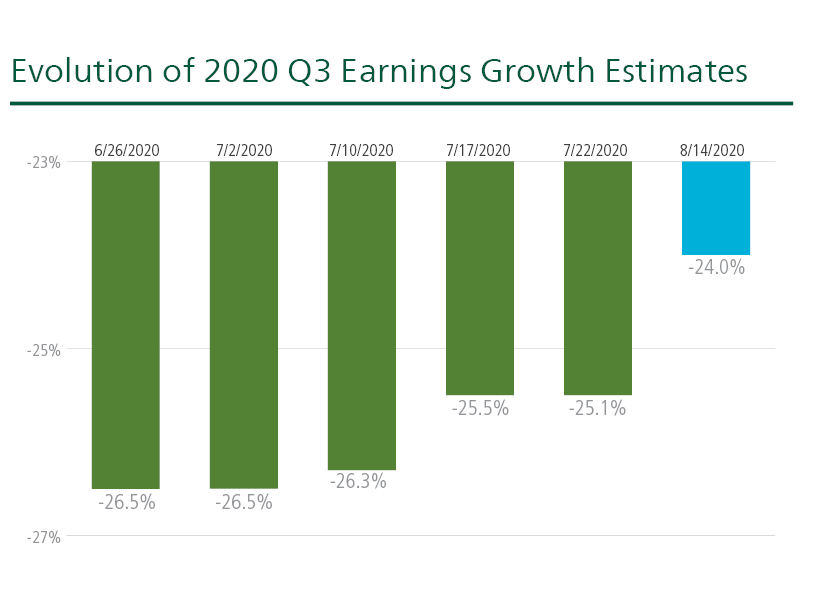

Importantly, the realization that the economy and corporate earnings outlook may not be as bleak as expected is extending to the current period (Q3 2020) and beyond. As you can see in the chart below, Q3 earnings growth estimates for the S&P 500 index have been gradually improving week to week, getting better in tandem with a slowly – but steadily – improving economic growth picture since the start of July. We have been seeing a similar trend take place for Q4 2020 and full-year 2020 estimates as well.

Source: Zacks.com4

Source: Zacks.com4

This is a notable improvement in the overall earnings picture since the start of the pandemic, and is in-line with high-frequency macroeconomic data showing a similar improvement in the economy’s growth drivers. Recent readings in retail sales, initial jobless claims, and factory activity have all shown steady momentum. Again, the point is not to say the economy is humming again – it isn’t. But are the economy and U.S. corporations holding up just slightly better than many anticipated? I think the data above suggests the answer is yes.

Bottom Line for Investors

Weak economic data is likely to persist for months or maybe even quarters to come, as the pandemic continues to deliver headwinds on growth. But in my view, equity investors should be less focused on this nearer term economic data and more focused on where corporate earnings and the economy are likely to be a year from now, or even by the end of 2021. No one can know the answer for sure. But if I was asked if the economy and earnings are likely to be stronger and better than many people expect as of today, I’d say the answer is yes. Sometimes “better-than-expected” is all that matters.

Disclosure

2 Zacks.com, August 14, 2020. https://www.zacks.com/commentary/1042209/can-the-earnings-picture-continue-to-improve?

3 Zacks.com, August 14, 2020. https://www.zacks.com/commentary/1042209/can-the-earnings-picture-continue-to-improve?

4 Zacks.com, August 14, 2020. https://www.zacks.com/commentary/1042209/can-the-earnings-picture-continue-to-improve?

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.