Is There a Disconnect Forming Between the Equity Market and the Economy?

The U.S. stock market continues to hover around all-time highs, and with it, in my view, investor optimism has been on the rise. As I alluded to in last week’s column, it seems that many investors are comfortable assuming the worst of the trade war, tariff hikes, and policy uncertainty is behind us.

This may be true. But to arrive at this conclusion, it is also necessary to look past some recent weakness in economic data, where the picture suggests that growth is more middling than booming. For long-term investors, this does not necessarily signal trouble ahead. But it does argue for caution, particularly if enthusiasm is starting to shift toward complacency, as I wrote last week.1

Let’s look at what the data is telling us.

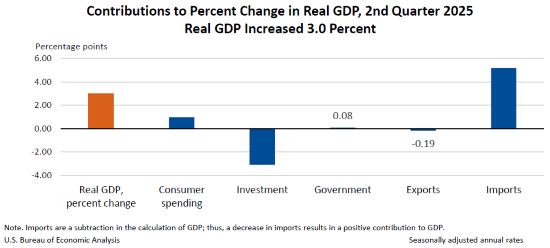

On the surface, the U.S.’s Q2 GDP print (3.0% annualized) looked very solid. But digging into the details reveals a more mixed picture. In Q1, GDP contracted by -0.5% because imports surged nearly 38% annualized as businesses and consumers rushed to ‘front run’ new tariffs. Since imports subtract from GDP, there’s a fair argument that the economy looked weaker in the first three months than it really was.

But in Q2, that dynamic flipped.

Imports plunged more than -30% annualized, creating a statistical boost to growth. Exports fell as well, down -1.8%, as the rest of the world worked through the goods they had stockpiled earlier in the year. In my view, this indication of declining total trade is what stood out, indicating weakening overall demand in the global economy. It’s one data point, but it will be key to watch these figures for the rest of the year.

When you strip away the trade swings and look at private domestic demand, which again is a more telling signal of economic strength, in my view, the story is less rosy. Consumer spending grew at a 1.4% annualized pace, which was better than Q1 but still pretty moderate. Business investment, which is more cyclical and a key swing factor, slowed sharply from 10.3% in Q1 to just 1.9% in Q2. Investment in structures fell by double-digits, and R&D posted its third straight decline. These are signs businesses are pressing pause on long-term projects until there is more clarity on tariffs and trade policy, and to me, it’s an overlooked negative that prompts me to think more cautiously.

The jobs picture is also looking more complicated than it did a few months ago. July’s payroll growth came in at just 73,000, and prior months’ gains were revised down by a combined 258,000. The Conference Board’s Employment Trends Index fell to 107.6 in July, its lowest reading since last fall. These figures suggest hiring momentum is cooling.

Finally, tariff-related pressures are increasingly evident in inflation data. The core Consumer Price Index rose 3.1% year-over-year in July, up from 2.8% in May. Producer prices surged 0.9% month-over-month, marking the biggest jump in three years. Producer prices have historically led consumer inflation data, so we could see some of this pressure in the CPI data this fall. To be fair, the inflation pass-through looks more gradual than disruptive, but it’s also early. Question marks over inflation can complicate the policy outlook, which can make markets vulnerable to a negative surprise. Remember, at this point, markets continue to price in multiple rate cuts later this year.

Bottom Line for Investors

I want to be clear that we still see the U.S. economy as resilient. That’s the bottom line. But we’re also taking a much closer look at the underlying data, which we think paints more of a ‘muddle-through’ environment than an all-clear expansion.

For investors, this isn’t a reason to turn bearish. But it is a reminder that when sentiment shifts toward complacency, caution is warranted. The market may paint a picture of a gangbuster’s economy, but the data suggests something more moderate. This gap is worth watching closely.

Disclosure

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.