The end of the year is the perfect time for investors to start thinking about possible investment themes. In today’s Steady Investor, we look at three themes to consider for 2024:

• Inflation edges lower

• The Federal Reserve’s 2024 interest rate projections

• Why Americans are still unhappy with the economy

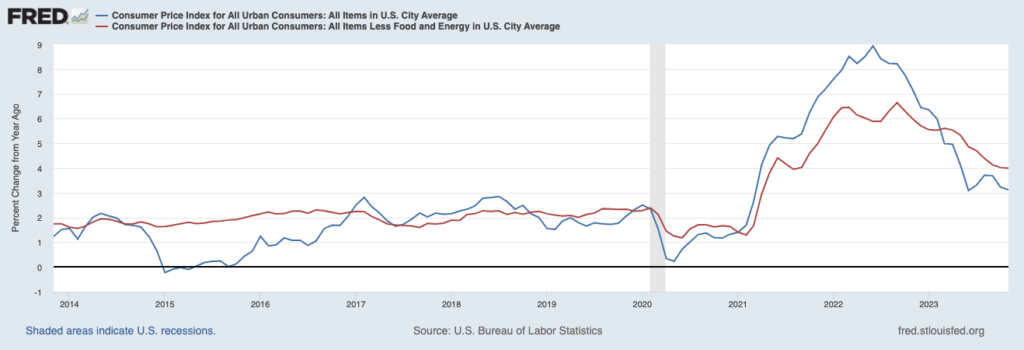

Inflation Continues to Moderate – A key inflation metric was released this week, and the data confirmed what the market was hoping: prices continue in a downtrend. The consumer price index measure of inflation rose 3.1% in November from a year ago, an improvement from October’s year-over-year pace. Prices rose 0.1% month-over-month, which was higher than what economists expected but was modest enough not to cause much concern. Falling gasoline and durable goods prices were offset by price increases for shelter (housing), auto insurance, and a few other services. Core prices, which exclude food and energy, were up 4% year-over-year. Overall, it’s a mixed bag for consumers in terms of what is still frustratingly expensive and what goods and services have become reasonably priced again. Anecdotally, one airline recently offered a $20 one-way flight, and TVs are cheaper today than they were before the pandemic. Holiday shopping deals are also expected to continue throughout December, as retailers compete for U.S consumer dollars.1

The Consumer Price Index Continues to Trend in the Right Direction

Thinking about Retiring Soon? Let’s Help You Make It Happen!

When retiring, you should feel as confident and assured as possible. Yet, for many investors, witnessing the day-to-day highs and lows of the market can cause anxiety and bring up concerns for the future, especially for those who are building a retirement portfolio. While apprehensions about the future are normal, making a detailed retirement plan can help alleviate this anxiety and help you retire with peace of mind.

To help you do this, we are offering readers our free guide that provides a step-by-step blueprint to potentially help you build a sound retirement portfolio. This guide offers you a checklist of the most important financial, tax, and investment considerations for new retirees, with detailed explanations to help you prepare for this new stage in your life.

If you have $500,000 or more to invest, get our free guide today!

Download Zacks Guide, Thinking of Retiring Soon? Here are 4 Things to Consider First3

The Federal Reserve’s 2024 Interest Rate Projections Tell the Real Story – On the heels of the CPI announcement, the Fed placated markets by making an announcement of their own: that the benchmark fed funds rate would remain where it was—and may even fall in 2024. The market was broadly expecting the Fed to refrain from raising rates at this policy meeting, but what came as a positive surprise was the decision to publish interest rate projections for the following year. In many public remarks leading up to this Fed meeting, Federal Reserve Chairman Jerome Powell had emphasized that while the Fed was happy with the progress made on inflation, there was still work to be done to bring it down to the 2% target. “Higher-for-longer” interest rates were the party line. In comments this week, however, the Fed Chairman appeared to pivot: “You’re getting now back to the point where both mandates [inflation and unemployment] are important,” adding that “We’ll be very much keeping that in mind as we make policy going forward.” What was once unilaterally an inflation fight has now become one where the Fed is more concerned with economic growth and employment, which marks a pivot. The ‘read between the lines’ implication is that the Fed now appears ready to step in to avoid a recession, an idea underscored by their interest rate projections of 4.5% to 4.75% by the end of 2024. That’s 0.75% lower than where the Fed funds rate is today.

Americans Continue to be Unhappy with the Economy – A new Bankrate survey found that nearly 60% of Americans felt like the U.S. economy was in a recession. This comes as the U.S. just posted a 5+% GDP growth rate in Q3, which followed two-quarters of 2+% growth in the first half of the year. Higher prices continue to weigh heavily on consumer sentiment, driving an overall feeling that the economy is in weak fundamental shape when the opposite – at least for now – is true. This is the type of disconnect that tends to move markets when sentiment and expectations are far outstripped by reality. It’s also an example of the “wall of worry” in the current environment, which markets have a long history of climbing.4

Planning Retirement Soon? 4 Steps to Consider First – If you’ve been planning to retire for a while, but are still hesitant about whether this is the right time, here are some steps to consider.

To guide you through this new phase, we’ve created our new guide to help you review your financial and investment situation so you can make any adjustments necessary to keep your plans and lifestyle on track.

If you have $500,000 or more to invest and want to understand your retirement options, get our guide, Thinking of Retiring Soon? Here are 4 Things to Consider First.5 Simply click on the link below to get your copy today!

Disclosure

2 Fred Economic Data.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

4 Wall Street Journal. December 12, 2023. https://www.foxbusiness.com/economy/majority-americans-us-economy-recession-survey

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.