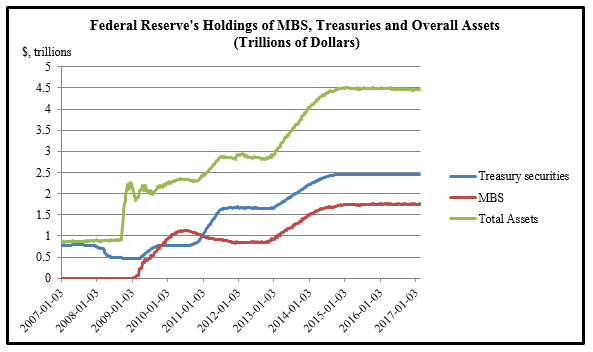

There is currently a record-high of $4.5 trillion worth of assets on the Federal Reserve’s balance sheet. A large part of the inflated balance sheet came as a result of its “rescue mission” in the midst and aftermath of the 2008-09 financial crisis. After short-term interest rate reductions failed to provide a substantial lift to the U.S. economy, the Fed took to massive buying (QE) of long-term Treasury securities and government-backed mortgage debt to pull down longer-term credit costs.

Source: Federal Reserve Economic Data/St. Louis Fed.

The plan worked…sort of. Long-term interest rates came down to record lows over the past couple of years – which made stocks look very attractive on a relative basis and helped support higher prices – but economic growth failed to do anything record-setting. GDP growth and employment gains in this cycle have been modest if not uninspiring, and it’s easy to argue that the monetary policy experiment of the last several years has been a mild failure.

Which brings us to the current scenario, where there are mutterings that the Fed is gearing up to reduce the size of its balance sheet (which ultimately means they will gradually stop re-investing the proceeds of maturing bonds). This has many market participants worried, especially those who believe that the Fed’s bond-buying programs and QE stimulus single-handedly fueled the bull market. Take away the punch bowl, they argue, and the stock market party is over.

But it’s not that simple, for three very easy-to-understand reasons:

- QE was arguably not the only factor driving stock prices higher – QE did have the effect of driving down longer term interest rates, which nudged yield seekers into the best alternative (stocks). While that likely helped stock prices over the years, it seems short-sighted to say that QE was the only reason stocks went up. Saying that would mean ignoring the economic growth and gains in corporate earnings that we’ve seen over the last few years, which are substantial.

- Janet Yellen is in no hurry – statements suggest that Janet Yellen is in no hurry to trim the Fed’s balance sheet. Although some regional Fed presidents suggested in recent weeks that its time the central bank reduced its asset purchases, the Fed chair indicated that the central bank would wait until it is more confident in the U.S. economy’s health.

- Reductions to the balance sheet are likely to occur very gradually – The Fed currently holds $1.7 trillion in mortgage-backed securities (MBS) making it the biggest holder of government-backed MBS. But Yellen’s latest statements indicate that a balance sheet trimming is unlikely to begin until the interbank interest rates rise sufficiently to make room for monetary loosening in case negative shocks emerge in future. When it does, the moves are almost certain to be “passive” – that is, the central bank would stop reinvesting the maturing principal/interest receipts in mortgage debt versus aggressively selling the holdings. That should make the process orderly and less abrupt, lowering chances of fire-sales in the securities market.

Bottom Line for Investors

The Fed’s reduction of securities’ holdings would mark a return to “normalcy” in monetary policy, which would mean a break from the policies that were only mildly effective for the amount of risk they assumed. The markets would likely welcome a normalization of interest rate policy, not shun it. For those who fear that reducing the balance sheet will mean skyrocketing long-term rates, keep in mind that a great deal of high quality sovereign bonds (Europe and Japan) pay lower yields than U.S. Treasuries. Should yields here tick-up, there is likely to be ample demand to keep rates in check.

As of now, the Fed’s focused on following through with the overnight rate hike cycle and closely assessing the U.S. economy’s progress. We’re hopeful that inflation will reach the Fed’s target by 2018, although some uncertainties regarding Trump’s policy implementation and global weakness still remain.

To understand how all of this could impact your nest egg over time, you need to stay up-to-date on every crucial turn in policies and their effects on markets. At Zacks Investment Management, we leverage the latest data and insights to help our clients with portfolio allocations, while addressing investors’ individual goals and risk tolerance. To learn more, call us at 1-800-918-3114.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.