Several trends emerged in 2021 that will be worth watching in the new year. Here are four to keep an eye on:

- Rising housing prices

- Next steps for the energy sector

- Federal Reserve in 2022

- Current inflation worries

- Will Housing Prices Continue to Rise?

The U.S. housing market is on pace for its strongest sales year since 2005, and prices continue to push higher. In October, existing-home sales increased 0.8% from September and also notched a 13.1% increase in prices from a year earlier – the median existing-home now sells for around $353,900, a record. The frenzied pace of home-buying in 2021 came as many workers were given the option of working remote full-time or from home for certain days of the week. This shift to remote work and/or ‘hybrid work’, combined with persistently low mortgage rates and higher savings, nudged many first-time homebuyers to relocate out of cities and to suburbs for more space and remote work set-ups. Surging demand was met with limited inventories and a realization that homebuilders have been underinvesting over the last several years. The question of whether home prices will continue to rise in 2022 depends on how the supply/demand dynamic shakes out – homebuilders are currently ramping up projects, and the manufactured housing industry has indicated it is on pace to deliver more than 100,000 new homes for the first time since 2006. Demand may ease a bit as much of the pandemic-induced reshuffling has taken place, and as potential homebuyers are turned off by higher prices and potentially higher interest rates in the new year.1

_________________________________________________________________________

What Should You Do in a Volatile Market?

The future of the market could be affected by many current events, but in such volatile times, the key is not to panic. We recommend finding a way to navigate through market volatility!

If you have $500,000 or more to invest, get our free guide, “Using

Market Volatility to Your Advantage,” and learn our insights, based on

decades of experience, about how a volatile market may be able to help

investors refine their strategies and potentially generate solid returns over

time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”2

_________________________________________________________________________

- What’s Next for the Energy Sector?

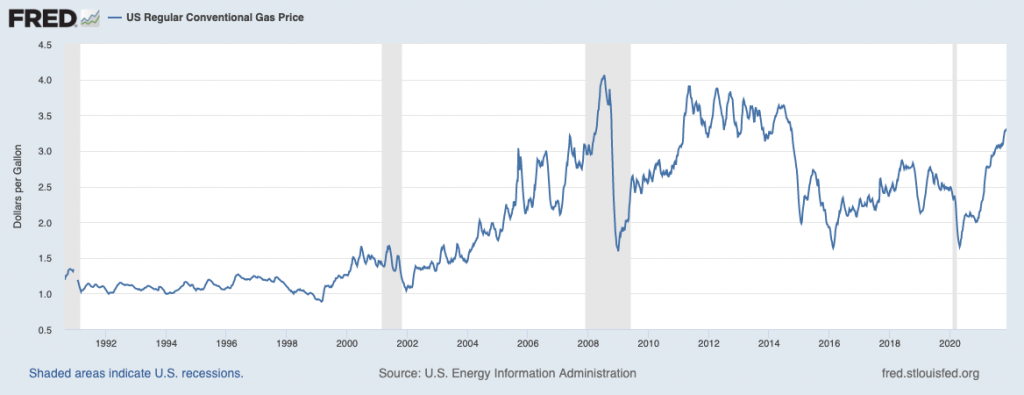

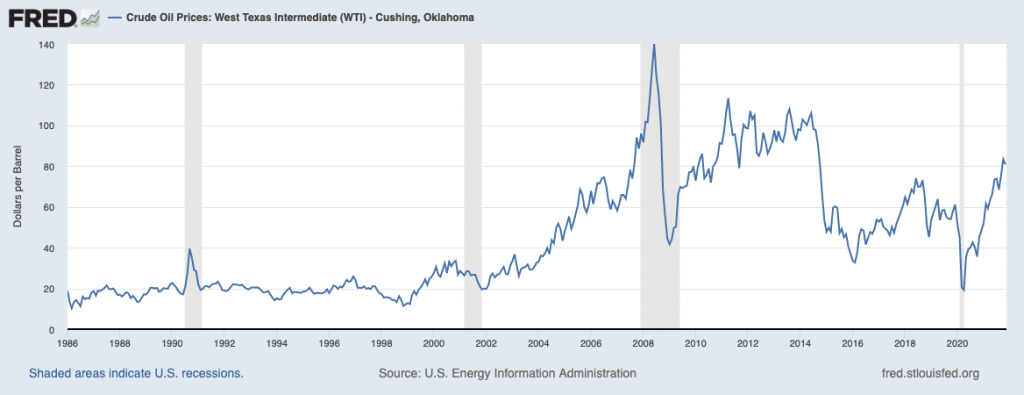

Most readers are probably very aware: energy prices are on the rise, from the cost of natural gas to heat a home to the price at the pump. As was the case in the U.S. housing market, the forces of supply and demand are largely to blame for higher energy prices. As the U.S. emerged from the worst of the pandemic, demand surged and inventories were low – driving up the price in the process. Generally speaking, higher prices should self-correct over time, i.e., oil and gas producers generally respond to higher prices by adding more supply, putting downward pressure on price. We’re starting to see oil production rise globally, but companies are a bit reluctant to turn on the spigots full steam. Oil and gas companies are feeling some pressure from shareholders to gradually increase supply to not reverse the price trend, and OPEC is in no hurry to flood the global market with supply. Even still, we’ve noted that supply is trending in the right direction, while demand is likely to remain firm in the short-to-medium term. The equity markets should not be too troubled by higher prices in the interim. As you can see from the chart of gas prices (top) and crude oil prices (bottom), the U.S. economy has absorbed higher prices before.3

- How Aggressive Will the Federal Reserve Be in 2022?

Federal Reserve Chairman Jerome Powell will likely be confirmed for a second term. His first term was characterized by very gradual tightening late in President Trump’s term, followed by a fully dovish turn when the pandemic struck. Looking ahead to 2022, the Fed Chairman may be confronted by the need to tighten again – the question is, how quickly? Inflation readings have been consistently high over the last few months, and employment remains about 4 million jobs below its pre-pandemic peak. The Fed’s narrative of inflation being ‘transitory’ has run into snags with a clogged supply chain being further strained by firm U.S. consumer demand. The Fed has already telegraphed plans to reduce bond and mortgage security purchases (QE) in the months ahead, and the big question for 2022 will be how quickly and aggressively the Fed will need to raise interest rates to counter inflationary pressures. In our view (see next point on inflation), the Fed may not need to move faster-than-expected in raising rates and tightening policy, as supply chain issues should eventually resolve and as the U.S. labor market continues to improve. If employment and inflation trend in the right direction, there will be less pressure on the Fed to act.6

- Is Inflation Here to Stay?

Inflation is generally defined as too much money chasing too few goods, which near-perfectly sums up the current situation in the U.S. Whether inflation is here to stay depends on two factors, then: will U.S. consumer demand remain this strong and perhaps get stronger, and will the U.S. and global producers and service providers be able to ramp up supply to meet demand? In our view, demand is likely to remain strong and supply should see improvements, too. “Too few goods” is fixable, in other words, and we should see more improvement on the supply side of the equation in 2022. In fact, global supply chain issues are already showing signs of getting better, as Covid-driven factory closures and energy shortages in Asia have abated recently. Ocean freight rates have also fallen from highs. Major retailers in the U.S. have also reported having more than enough for the holiday shopping season, in a sign that many were able to circumvent the worst of the supply chain crisis, congested ports, and a shortage of U.S. truck drivers. The widespread concern and worry remain higher, however, which tends to make us bullish. The reason is simple: when everyone is fixated on an issue and it becomes widely discussed, its pricing power concurrently falls, in our view. This is how “walls of worry” get built.7

This is one reason why investors should never let negative news

headlines or fears of the unknown impact their investing decisions. Instead, I

am offering all readers our guide “Using Market Volatility to Your Advantage”8.

This guide can help you learn about our insights, based on decades of

experience, about how a volatile market may be able to help investors refine

their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

3 CNN. November 10, 2021. https://www.cnn.com/2021/11/10/energy/oil-gas-prices-joe-biden/index.html

4 Fred Economic Data. November 22, 2021. https://fred.stlouisfed.org/series/GASREGCOVW

5 Fred Economic Data. November 17, 2021. https://fred.stlouisfed.org/series/DCOILWTICO

6 Wall Street Journal. November 22, 2021. https://www.wsj.com/articles/jerome-powell-will-face-an-utterly-different-economy-in-a-second-term-11637590207

7 Wall Street Journal. November 21, 2021. https://www.wsj.com/articles/supply-chain-problems-show-signs-of-easing-11637496002?mod=djemRTE_h

8 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.