With Brexit analysis consuming the vast majority of investor news airtime (and because we just celebrated our 240th year of independence), I think it’s the perfect time to bring the U.S back into the spotlight. When you’re positioning your investment portfolios for the next six to twelve months, take my advice: don’t forget about America’s strength!

To be sure, we’re not talking mid-1990’s blustering growth here. The job market is good, but wages have been stubbornly moving sideways and GDP growth has been below long-term averages for the better part of this expansion cycle. Additionally, we’re 89 months into this bull market—making it the 2nd longest bull since 1926 (the longest being the 1990’s bull that lasted 115 months). In terms of magnitude, the current bull is the 3rd largest, behind the early 80’s bull that returned 229% and the 90’s bull that soared 417%.

With rising uncertainty in Europe and global growth seemingly running out of steam, something’s got to give, right?

Not So Fast

A bull market does not have to die of old age, and the market knows no calendar. I could list off several macro factors that support more U.S. growth from here, such as low interest rates, contained inflation, high and rising leading economic indicators (LEIs), and an upward sloping yield curve. But I won’t bore you with all of that. Instead, I’ll look at America’s relative strength through the lens of the Brexit effect, which I believe strengthens the case for stocks over the next 6–12 months. Here are 4 reasons why:

- Minimal Trade Impact – the U.S. only exported around $56 billion to the UK in 2015, and imported around $57 billion. That represents less than 5% of total trade. Also, remember that the Brexit does not mean our trade relationship with Britain or the EU is somehow put on hold or needs to be altered. If anything, we may be able to negotiate even more favorable trade terms with Britain once they’re autonomous. We have been working with the EU on a trade deal (TTIP) for years now to no avail. With Britain leaving, getting a deal done with the EU could be a bit more difficult, and I see that as a potential setback. But, that just means things remain as they are today, which is nothing to sweat about.

- Interest Rates: Lower for Longer – the Fed has steadily backed away from raising rates on growth and job concerns but, with the Brexit now a reality, it seems highly unlikely they will engage in a rate hike anytime soon. This could mean it’s 2017 before we see another quarter point bump. With this in mind, not only will financing remain cheap, but stocks will continue to look very attractive relative to fixed income. For the first time in a long time, many yield seekers will choose stocks over bonds, and that should support prices.

- Sentiment Supports Surprises – uncertainties created by the Brexit, China’s growth, and negative earnings have soured investor sentiment. Pessimism can often lead to more volatile markets, but it also means many investors will underappreciate positive fundamentals and focus on the negative. Underappreciated positives means a higher likelihood of an upside surprise, which is effectively how the “wall of worry” gets climbed time and time again.

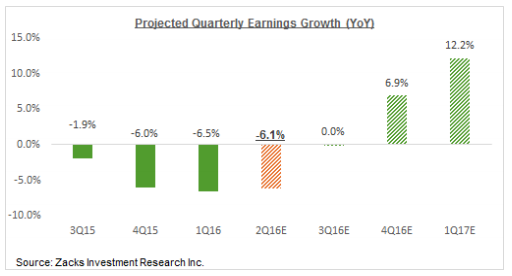

- Earnings Rebound – much has been made of the fact that S&P 500 companies have posted 5 consecutive quarters of negative earnings growth, but that line alone makes it seem as though everyone is suffering. That’s not the case at all, as Energy and resource-sensitive companies have disproportionately contributed to the declines. Regardless, higher crude prices and seasonality should boost earnings in the back half of the year. Below you can see Zacks Investment Research estimates:

Bottom Line for Investors

There’s one key point not mentioned above that could make the path forward for equities a rocky one, and that’s the election. While we focus on policy as it is written, and whether we think it will affect earnings and property rights, what we’re seeing in Europe and the U.S. is a growing, vocal discontent with the political establishment. Should trade be compromised due to policy and regime shifts, the market may respond adversely. We’re too far away from any real policy moment to comment on this now, and the market won’t likely start pricing-in those possibilities until much later. For now, I believe we still have a base case for equity price support with stocks as the most attractive asset class. Stay steady.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.