With all the recent news and headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

- Corporate America’s investment boom

- Growth of transportation stocks

- Rise of U.S. gas prices

- A shift of Russian trade to Canada

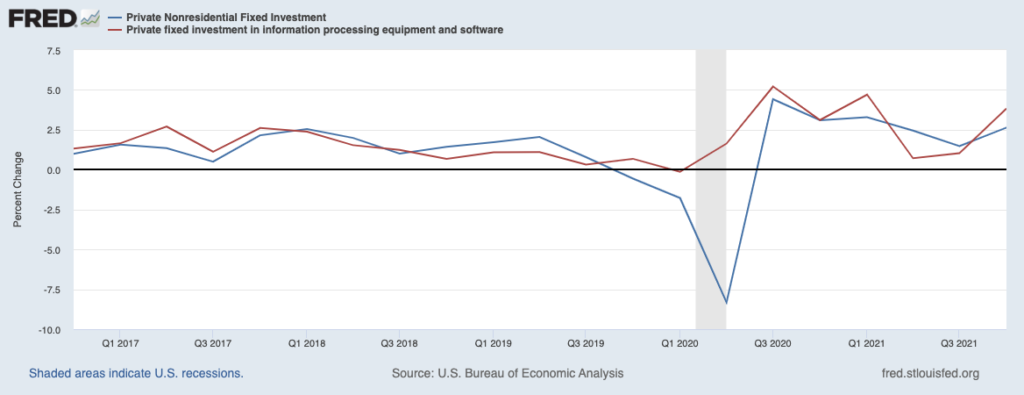

Corporate America’s Investment Boom – The ongoing war and rising oil and gas prices have been the focus of much financial reporting lately, perhaps understandably. But the near-constant coverage means that other, often well-performing areas of the economy receive little or even no coverage. This dynamic – where widely known negative stories receive all the attention while positive economic fundamentals are overlooked – is often quite beneficial for the stock market. It’s essentially the definition of when stocks “climb the wall of worry” (which they love to do). One economic area where this is happening now: business investments. American corporations have been ramping up capital spending as the pandemic risk fades, yet few are reporting on this positive trend. Private nonresidential business investment jumped 7.4% in 2021 even when adjusting for inflation, which was the fastest rate of increase since 2012. In particular, and perhaps not surprisingly, businesses spent the most on software and information-processing, as the need to ‘digitize’ business operations was catalyzed during the pandemic and is bound to grow as remote work becomes the norm. Spending in this area of IT rose 14% in 2021. This trend of ramping up business investment looks poised to continue: manufacturing firms surveyed by the Institute for Supply Management said they plan to increase investment by 7.7% in 2022, and services firms – which comprise a majority of the U.S. economy – expect a 10.3% increase.1

Are Your Investments Protected Against a Market Correction?

The recent market correction was a huge wake-up call for investors, and as inflation worries rise, we want to make sure that you are prepared if another correction occurs.

Market corrections are normal, but being unsure of how to protect your investments during that time can potentially cause you to make knee-jerk decisions that run counter to your long-term goals.

To help you navigate turbulent times, we have put together a free guide to help you avoid the worst impacts of a sudden market drop.

If you have $500,000 or more to invest, get our helpful guide, The 4 Keys to Navigating a Stock Market Correction2. It offers the most important steps you can take to help ensure that a temporary market downturn won’t cause irreversible long-term damage to your portfolio.

Business Investment on the Rise, Particularly in Software and IT

Transportation Stocks May Be Signaling More Growth Ahead – In a potential sign that there is more optimism brewing about the U.S. economic outlook, transportation stocks have been outperforming year-to-date in 2022 and also rallied more strongly than the broad stock market in March. As of this writing, the Dow Jones Transportation Average has risen +8% in March, nearly double the +4.6% gain posted by the S&P 500 over the same period. Transportation stocks are generally comprised of companies that operate trains, boats, planes, and trucks – moving people and goods across the country for services, consumption, and business. Transportation stocks tend to feel tailwinds when economic demand is expected to pick up, which makes them reasonably good proxies for what the U.S. economy might look like later in the year. This recent rally – while certainly too short to consider confirmation of robust economic activity ahead – is a promising signal that investors are feeling optimistic even in the face of inflation and rising rates.4

U.S. Natural Gas Prices Move Higher – As the U.S. enters the spring season, demand for gas tends to wane from the winter months when less is used to heat homes. Historically, that has led to a decline in gas prices heading into warmer months, and gas producers generally use the opportunity to build up inventories in storage facilities, until the seasons change and the cycle repeats. The dynamic is looking a bit different today – because of the ongoing war in Ukraine, U.S. gas producers are shipping more overseas than ever, which is keeping domestic inventories lean and putting upward pressure on price even as demand subsides here in the U.S. This has meant higher LNG prices this spring compared to last, with U.S. natural gas futures for May delivery above $5 per million British thermal units – or more than twice the price from 2021.5

Shifting Trade from Russia to…Canada? – Russia’s invasion of Ukraine has led to a unified global response to economic sanctions, which are also leading many countries to consider alternatives for some of Russia’s key exports – oil, gas, nickel, uranium, and wheat, among others. A somewhat surprising winner in this trade reshuffling is Canada, which has a similar climate and geographical features as Russia. Canada also produces many of the same commodities, among them the exports just listed above. European countries are increasingly turning to Canada for many of these commodities, in addition to courting Qatar for increased shipments of natural gas. A prolonged economic downturn for Russia seems increasingly likely as the war grinds on.6

How to Navigate a Market Correction – Inflation and volatility have shifted the market in many ways this year, and for those who are unsure of how to navigate volatility or a potential market correction, we want you to be prepared.

With that being said, now is the perfect time to base your investing decisions on research and fundamentals. To help you do this, we have created a guide, 4 Keys to Navigating a Stock Market Correction. This guide answers question like – Are there any silver linings that come with it? What are some ways to navigate through it?

If you have $500,000 or more to invest and want to learn more, click on the link below to download our latest guide: 4 Keys to Navigating a Stock Market Correction7.

Disclosure

2 ZIM may amend or rescind the free guide “4 Keys to Navigating a Stock Market Correction” for any reason and at ZIM’s discretion.

3 Fred Economic Data. March 30, 2022. https://fred.stlouisfed.org/series/PNFI#0

4 Wall Street Journal. March 28, 2022. https://www.wsj.com/articles/transport-stocks-are-flashing-bullish-signals-for-broader-market-11648393780?mod=djem10point

5 Wall Street Journal. March 30, 2022. https://www.wsj.com/articles/the-lng-export-boom-is-draining-u-s-natural-gas-supplies-and-lifting-prices-11648592494?mod=djemRTE_h

6 Wall Street Journal. March 29, 2022. https://www.wsj.com/articles/as-trade-with-russia-halts-countries-turn-to-canada-11648558980?mod=djemRTE_h

7 ZIM may amend or rescind the free guide “4 Keys to Navigating a Stock Market Correction” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Dow Jones Transportation Average is a 20-stock, price-weighted index that represents the stock performance of large, well-known U.S. companies within the transportation industry. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.