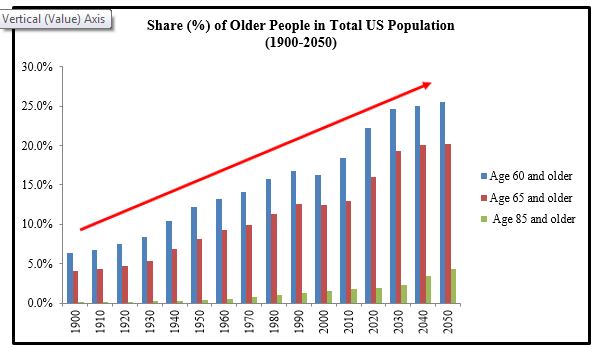

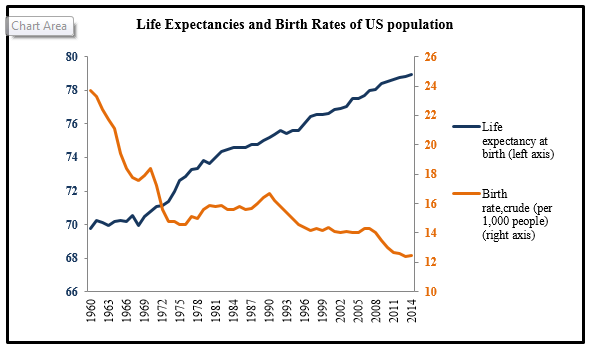

Is the American population aging too fast? With rising life expectancy and declining birth rates, the bell curve is certainly shifting—and fast. People age 60 and over are becoming an increasingly large percentage of the total population, a trend that’s expected to persist into the coming decades. By 2040, 60+ individuals could make up more than a quarter of the American population, as suggested by U.S. Census Bureau’s projections.

Source: Compilation by Administration on Aging (U.S Department of Health and Human Services) using Census data

Source: Compilation by Administration on Aging (U.S Department of Health and Human Services) using Census data

Source: World Bank

Source: World Bank

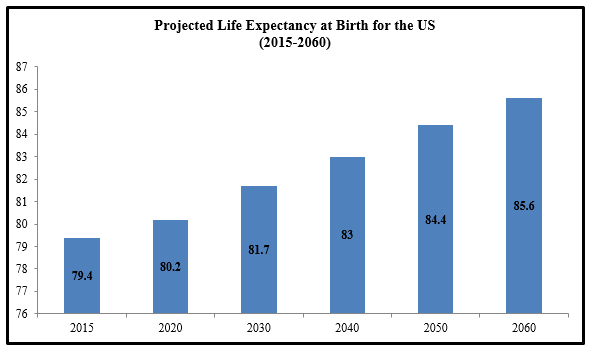

Source: US Census Bureau

Source: US Census Bureau

It’s clear from these graphics that this trend is not based strictly on gueswork – there are real forces at work. Based on 1980-2010 data, research estimates that a +10% increase in the fraction of 60+ population could contract GDP per capita growth by -5.5%, including a -1.7% decline in growth rate of workers per capita and a -3.7% reduction in GDP per worker (i.e. produdctivity) growth (according to the National Bureau of Economic Research).

Never Too Old to Go to Work

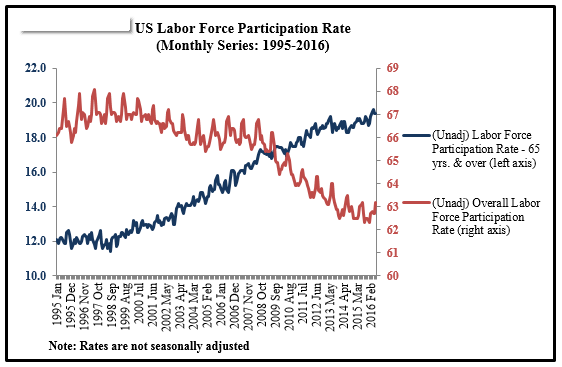

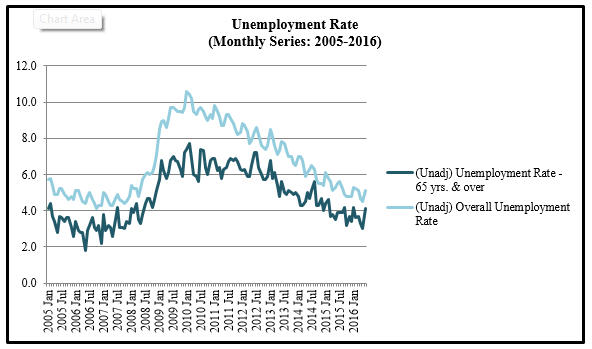

On the other hand, even as many baby boomers’ retirement lowers the overall labor force participation, an increasing number of older Americans have been willing to work past their so-called ‘prime years,’ bucking the general labor force participation trend.What’s more, the elderly’s participation is pulling down the unemployment rate for them as a category.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

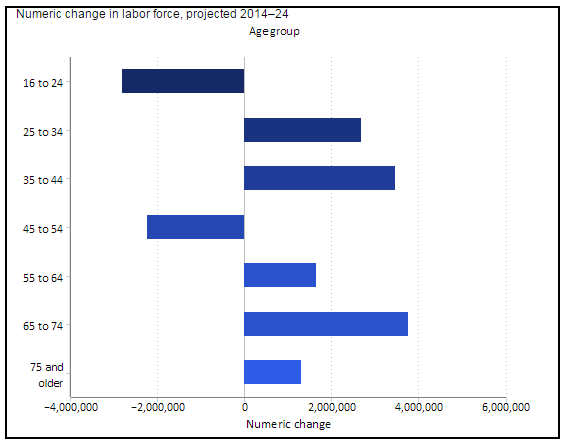

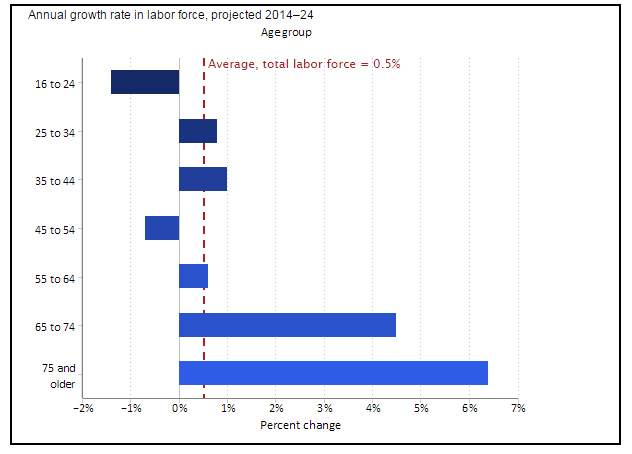

The Bureau of Labor Statistics projection (released December 2015) for the 2014-2024 period indicates that the addition to 65-74 year-olds in the labor supply pool would be the most among all age groups. 75+ year-olds would also have the fastest average annual growth rate in the labor force, at +6.4%.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Bottom Line for Investors

The link between an aging population and economic output is relevant, but given the possibility that the older generation is increasingly working longer may mute its impact on overall growth. Also, the recent proliferation of working options, including those requiring less physical exertion and more knowledge/cognitive skills, as well as flexibility in work location and hours should help older people find suitable jobs.

It’s also important to note that a boost in productivity does not solely hinge on a worker’s age. Technological advancement has been the driver of long-term economic growth for centuries. Therefore, as far as progress in productivity is concerned, innovation and education are probably more important ultimately than a population’s age composition.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.