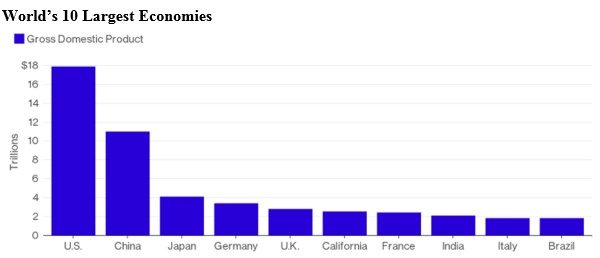

You might expect this article to be about a European country, like France or Italy. As it would seem probable that the world’s 6th largest economy is a country, right? Nope. In actuality, the world’s 6th largest economy is right here in America—the state of California!

Recently released GDP product data from the International Monetary Fund shows California surpassing France and India to become the 6th largest economy in the world, as of year-end 2015.

Source: California Department of Finance

Fuelled by strong economic growth and the U.S. dollar’s gains against foreign currencies, California, the most populous U.S. state with a GDP of $2.5 trillion, grew by +4.1% in 2015 compared to +2.4% for the U.S. and +1.1% for France (According to Blomberg).

California, which had slipped in the ranks since it last claimed the No. 6 spot in 2002, saw an economic resurgence over the last couple of years. This was largely due to state-wide economic growth on multiple fronts, particularly in professional and technical services, which included jobs spanning from IT consulting to construction-related engineering, architecture and manufacturing. Even the agricultural sector saw growth over the last two-plus years despite being hit by droughts.

With 4 out of the world’s 10 largest companies headquartered in California, including tech heavyweights like Alphabet Inc. and Facebook Inc., the spill-over effect from the innovation boom has played a big role in driving the state’s economic growth. Case in point: enhanced productivity owing to technological innovation enabled California to create an economic output of $2.46 trillion in 2015 compared to France’s $2.422 trillion, despite having 40% fewer people than France.

California’s vibrant and diverse industrial tapestry, together with strong job and wage growth and rising consumer spending, home values, and personal and corporate income has also massively helped the state bounce back strongly from 2009.

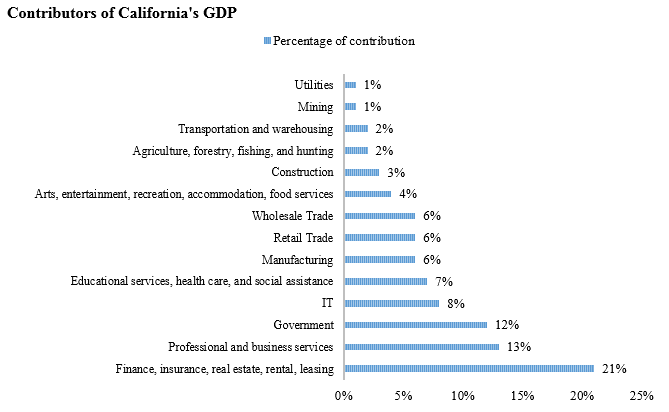

California’s resurgence also underscores it’s evolution as an economy. For many years, agriculture remained the core of the economy, but the gradual shift to industry as the core of the state’s economy has led to its vibrancy and diverse nature. Over time, many new industries were simply added to the existing base of established ones. This pattern of adding rather than displacing already established industries gave California its rich economic texture in which long-established industries, such as agriculture and mineral extraction thrive alongside emerging industries such as biotechnology, telecommunications, tourism, service and the internet. This ‘layered transition’ is evident in the fact that industries like financial activities and services, educational and healthcare services, professional and business services, leisure and hospitality and retail trade among others, are currently the major contributors to the California’s GDP.

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

The rise in nonfarm job growth is another indication of the transformation of the economy, which in turn helped the economy grow faster. According to the Bureau of Labor Statistics, out of the total 19.1 million jobs created in the state at the end of April 2016, nonfarm job constituted 16.38 million, whereas farm jobs constituted only 2.72 million.

Bottom Line for Investors

Considering the present economic scenario in California, economists believe that the state’s economic growth rate will continue to outpace the rest of the nation over the next five years. Challenges remain, however, as doing business in the state is quite expensive—it has one of the highest national corporate tax rates, and housing affordability is among the worst in the nation. No matter what, people will probably always be willing to pay the “sunshine tax.”

While this story sheds a positive light on the state of California, how does this speak to the overall economic state for the U.S. as a whole and with that, what does this mean for your portfolio? At Zacks Investment Management, we’re hyper-focused on the fundamentals and always look closely at macroeconomic trends to help guide investing decisions. And the success of our investing approach speaks for itself as five of our investment strategies are ranked in the top 10% of their respective asset classes by Morningstar (as of 6/30/16)—we call this our “Dean’s List.” Get an inside look into these strategies and see how they could benefit your portfolio by downloading our “Dean’s List” of investment strategies, click below

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.