In today’s Steady Investor, we look at key factors that we believe are currently impacting the market and what could be next for the markets such as:

- Manufacturing rebounds across the globe

- Saving rate increased during the pandemic

- What does global demand for commodities say about current and future economic activity

Manufacturing and Services Rebound Around the World – A survey of manufacturing and services PMIs across the globe shows a similar pattern: a very steep decline in March and April activity, followed by a “v-shaped” bounce in May. This resurgence of activity took place across the U.S., Europe, and Asia, as the global economy slowly but surely pushes forward following pandemic-induced lockdowns. The U.S. composite index (produced by IHS Markit) rebounded to its highest level in four months, though to be fair still remains in contractionary territory (readings lower than 50). The United Kingdom and France saw rebounds in manufacturing, though demand remains weak. Japan’s services sector is showing bright spots, while its manufacturing rebound is lagging.1 Taken together, the manufacturing and services picture is mixed, but signs of life are returning, and it’s safe to say the worst of the economic crisis is now in the rear-view mirror – at least for now.

_________________________________________________________________________

Dividend-paying Stocks May Offer a Solution During this Pandemic

The challenge many retirement investors are facing through this crisis is knowing where to invest. Cash won’t do. But a portfolio invested in stocks with a strong track record of dividends and dividend growth may give investors the potential for a stable and predictable source of income in retirement.

To learn more about how to use dividend-paying stocks in your strategy to potentially generate cash flow for retirement, check out our guide “A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income.”

If you have $500,000 or more to invest, click on the link below to get our free guide today!

A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income2

_________________________________________________________________________

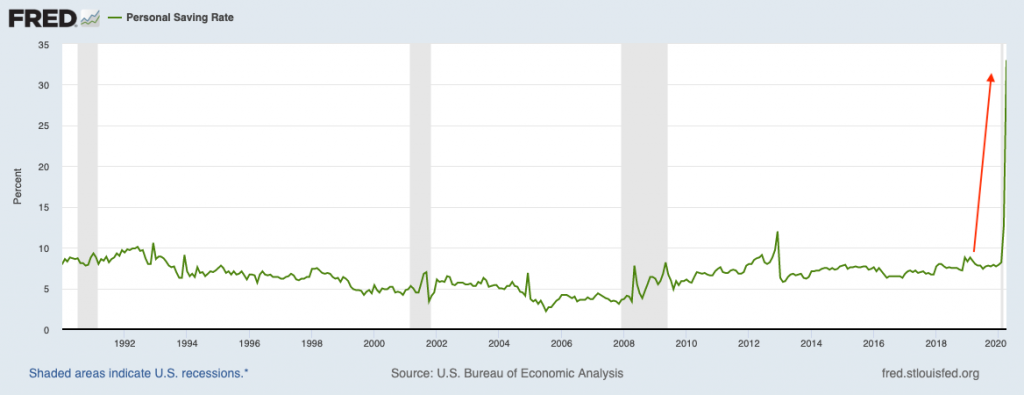

Savings Rates Shot Higher – Americans shifted spending to essential goods and e-commerce during the height of the pandemic, but they also saved more. In a surprising data quirk released this week, the savings rate in America shot higher last month, as households stayed home (and therefore reduced spending) and as government stimulus actually resulted in pay increases for many. As the economy reopens, many consumers will be out shopping again, and it should also be noted that the $600 unemployment boost ends on July 31.3 As such, the pop in the savings rate is likely to be short-lived, but hopefully, the experience encourages more households and save and invest for the long-term.

Commodities Prices Firm Up, Indicating Demand Returning – Looking at global demand for commodities is a quick way to gauge current and future economic activity, particularly in the realm of global manufacturing. A good sign that demand is returning can be seen in the prices for raw materials, like oil, copper, and tin – all of which have seen strong rebounds over the last couple of weeks.5 To be fair, producers have also cut supply in response to the full-stop to global economic growth, but rising prices now appear to be spurred by increasing factory activity and the resumption of global trade.

While we have seen parts of the economy start to recover, we are not out of the woods yet. You may be wondering what can you do in the meantime to protect your retirement. You have to invest somewhere, as cash won’t do. In times like this, I would suggest considering stocks that are growing earnings and dividends and have a track record of doing so.

To learn more about how to use dividend-paying stocks in your strategy to potentially generate cash flow for retirement, check out our guide “A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income.”6

If you have $500,000 or more to invest, click on the link below to get our free guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income offer at any time and for any reason at its discretion.

3 The Wall Street Journal, June 23, 2020. https://www.wsj.com/articles/the-coronavirus-savings-glut-11592905053

4 U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT, June 25, 2020.

5 The Wall Street Journal, June 22, 2020. https://www.wsj.com/articles/rally-in-raw-materials-signals-economic-rebound-11592818201

6 Zacks Investment Management reserves the right to amend the terms or rescind the free A Look Beyond Bonds: There May Be a Better Option for Your Retirement Income offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.