Billy E. from Lakeland, FL asks: Hi Mitch, if you had to cite one positive feature of the U.S. economy today, what would it be? I just don’t see much improving right now. Thanks for taking the time.

Mitch’s Response:

Thanks for your email! The positive factor that I would choose is also the most important one to the U.S. economy: consumers.

The Federal Reserve conducted a survey last fall, and in it, Americans reported the highest level of financial well-being in 10 years. Americans’ finances were boosted during the pandemic by fiscal stimulus programs, in the form of direct payments and also from PPP business loans and expanded unemployment benefits. We know that many households used this money to pay down debt and buffer savings accounts.1

4 Steps to Prepare for Retirement Amid Market Downturn

The market is currently very volatile, and investors, especially those who are building a retirement nest are questioning what to do with their assets.

When the headlines focus on ‘worrisome stories’, it’s easy to get caught up in short-term decision marking. Instead of falling into this trap, here are some important factors that investors should consider before retirement:

- Determining your expenses

- Determining your income

- Matching your income source with your goals and time frame

Considering these factors can be a daunting task, but there are four simple steps that can help you plan for retirement! If you have $500,000 or more to invest, get the scoop on these simple steps with our guide. Click on the link below to get your copy today:

Download “4 Steps to Managing Your Retirement Assets!”2

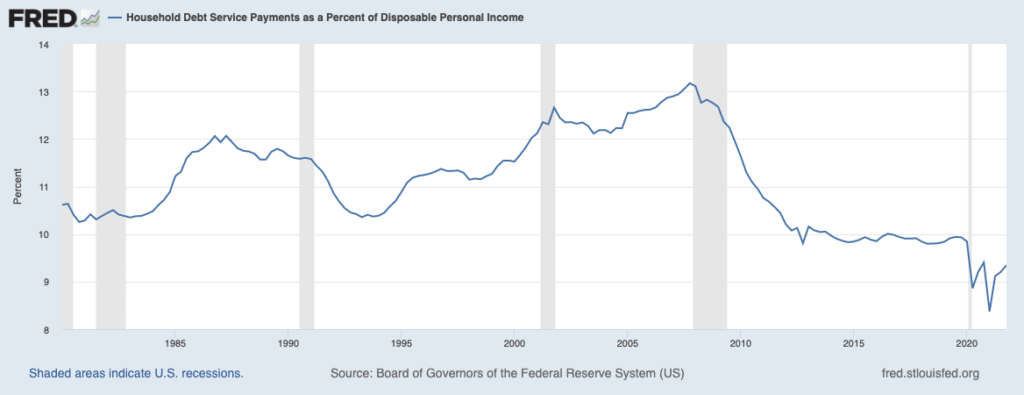

The end result is that American household debt payments as a percentage of disposable income are at a 40+ year low, which puts Americans in a strong position to weather an economic slowdown or even a recession:

The effect of fiscal stimulus has largely faded, but now Americans are being boosted by a strong jobs market with rising wages. Overall, many American households are in a stronger financial position now than they have been in decades.

Now, to be fair, the Fed’s survey was taken several months ago, before the Omicron variant dented growth and before higher inflation and particularly rising food and gas prices rattled consumers. Rising wages help to offset the effects of inflation, but at the moment prices are rising faster than wages, so consumers are feeling it. But the effect has not been so big that consumers are all of a sudden financially vulnerable. JP Morgan Chase reported last week that they expect credit losses to remain uncharacteristically low through 2023, and they are reporting strong cash balances among bank customers. It is also true that the labor market is one of the tightest we’ve seen, ever.

Lingering inflation can hurt consumer sentiment and could eventually cause consumers to retrench from purchases – this will be a factor to watch in the second half of the year. But for now, I think American household finances are a big positive today that may be underappreciated, and that could also carry this economic expansion forward despite the challenges.

During this time of rising inflation and increased volatility, I would recommend that investors (especially those nearing retirement) go through four steps that are outlined in our exclusive guide, “4 Steps to Managing Your Retirement Assets4.”

This guide can help give you some ideas for how to transition into retirement with confidence even when worries are high.

If you have $500,000 or more to invest, click on the link below to get your copy of “4 Steps to Managing Your Retirement Assets.”

Disclosure

2 ZIM may amend or rescind the “4 Steps to Managing Your Retirement Assets” guide for any reason and at ZIM’s discretion.

3 Fred Economic Data. April 4, 2022. https://fred.stlouisfed.org/series/TDSP

4 ZIM may amend or rescind the “4 Steps to Managing Your Retirement Assets” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.