Robert and Rose P. from Lawrence, KS ask: Hello Mitch, everyone seems to be saying that higher interest rates are bad for the economy and markets, but I wonder if it actually might be a good thing. Rates have been so low for so long, and for retired people like us, we can finally earn some interest on our cash to help keep up with inflation over time. What do you think?

Mitch’s Response:

Thanks for writing, Robert and Rose. I think you’re asking a question that has come up for many retirees and those living on passive income. Shouldn’t higher rates be a good thing, not a bad thing?1

From a pure yield standpoint, the answer is yes. For the better part of a decade, investors who wanted to earn risk-free returns did not have much to be enthusiastic about in the Treasury markets, money markets, or savings accounts. It didn’t matter what end of the duration curve you were on, either. Even if you committed to a 30-year U.S. Treasury, you could only expect to earn ~3%. For savings accounts, less than 1% interest was the norm.

Not Sure Where to Invest? Start with This Step!

If you are unsure where to invest in this current market, there are simple steps you can take to get started. Knowing your net worth is a great place to start as it is critical to your financial well-being and can help you prepare for what’s to come.

Our guide, Evaluating Your Net Worth, is available for free to readers who need help answering questions, like:

• How do I correctly calculate my net worth?

• How does my net worth compare to other households?

• What strategies can help me grow my net worth over time?

• What are the risks and factors that can help me grow my net worth?

If you have $500,000 or more to invest and want to understand how to evaluate your net worth, simply click on the link below to get your copy of Evaluating Your Net Worth2 today!

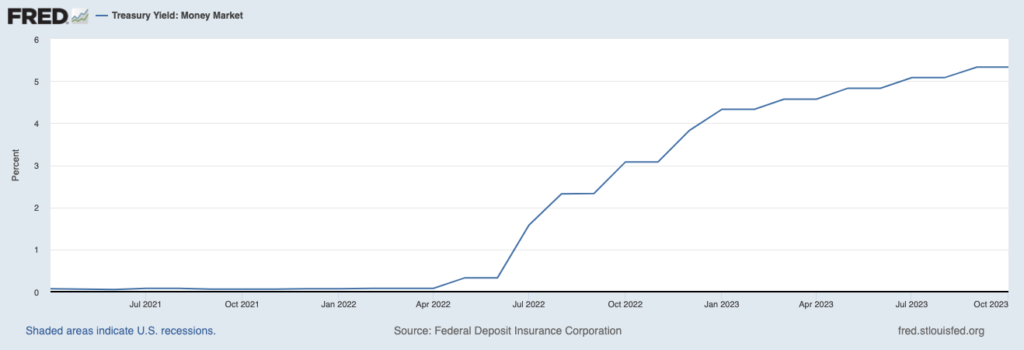

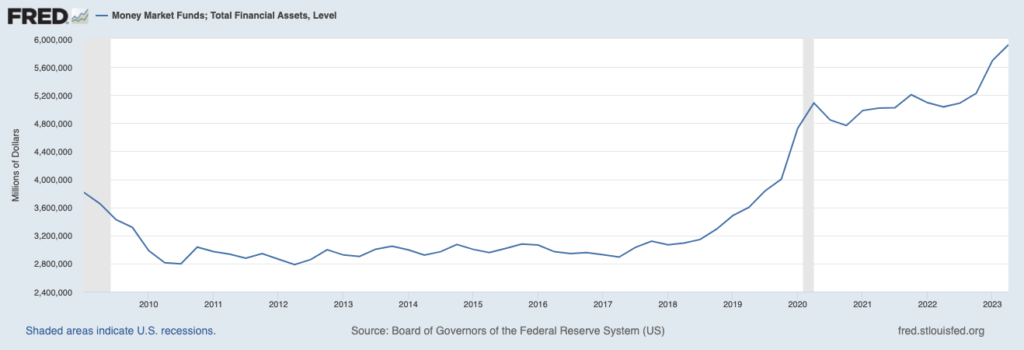

Everything changed last year, as the Federal Reserve engaged in aggressive monetary tightening – pushing up short-duration interest rates and ending their quantitative easing program, which removed pressure from long-duration interest rates. Rates rose (and are still rising) across the board, and now retirees and passive income investors have myriad options available to generate yield in portfolios. Money market yields, which are generally safe and liquid, have shot higher (chart below), as have money market funds (next chart).

Treasury yield: money market

Money market funds, total assets

In short, yield-seeking investors have options, and many short-duration Treasuries and savings accounts now pay yields a percent or two above the inflation rate, which means investors are earning a real return.

But I’d also like to suggest that higher rates could be good for the economy as well, which is a bit of a counter-narrative to what you said you’re seeing everywhere. For one, higher rates could effectively do some of the Fed’s work for them, in restraining the economy in such a way that inflationary pressures do not return in the near term. This means higher rates could effectively help to end the Fed’s rate hike cycle.

There’s a “goldilocks” possibility here, where the economy weathers higher rates and continues to grow, but at a more modest pace, with inflationary pressures kept at bay. The strength in the labor market and household finances (both of which drive consumer spending) make this outcome a distinct possibility, which means the Fed will have effectively reset the “neutral rate” to a higher level. As a quick refresh, the neutral rate is a sort of ‘sweet spot’ for the Fed’s benchmark interest rate, a level that supports the economy at acceptable employment levels while keeping inflation constant.

The Fed has been forecasting a neutral rate of 2.5% since mid-2019, but it seems possible that it can and should move higher. If it does, that could be good news for the economy in the long term. It means that the Fed would have a lot more wiggle room to cut rates in a future recession, without having to resort to extraordinary measures like “quantitative easing” or even to push rates to the zero bound. In my view, that could be the biggest benefit to higher-for-longer rates.

With so much uncertainty in the market, I recommend that investors become familiar with their net worth. This can be critical to your financial well-being and can help you prepare for what’s to come in this unexpected market.

I recommend reading our free guide, Evaluating Your Net Worth, which answers questions, like:

• How do I correctly calculate my net worth?

• How does my net worth compare to other households?

• What strategies can help me grow my net worth over time?

• What are the risks and factors that can help me grow my net worth?

You will have a better idea of where you stand in terms of your long-term investment goals. If you have $500,000 or more to invest and want to understand how to evaluate your net worth, simply click on the link below to get your copy today!

Disclosure