In today’s Steady Investor, we examine the important factors affecting the market and what might lie ahead, including:

• U.S. GDP growth surges

• Higher labor costs hit

• The Federal Reserve holds rates steady

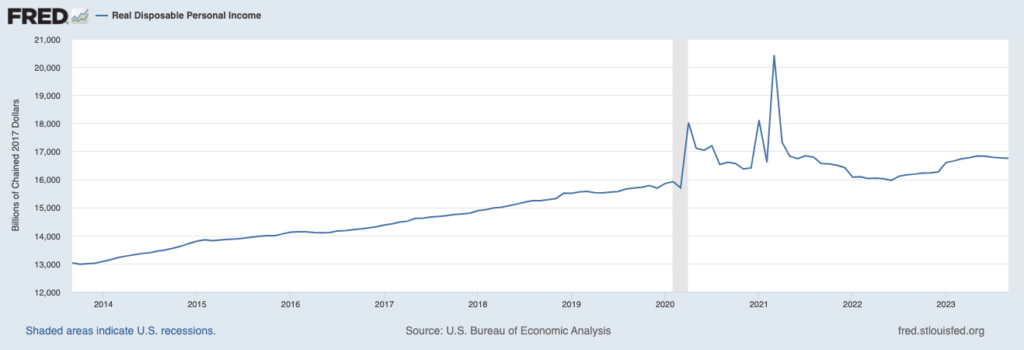

U.S. GDP Growth Surges in the Third Quarter – According to the Commerce Department data released late last week, the U.S. economy expanded at a 4.9% annual rate in Q3, which was more than twice as strong as growth posted in the previous quarter. So much for the near-unanimous consensus that the U.S. economy would enter a recession in the second half of 2023. The fact is, the economy went the other way and accelerated when nearly every expert expected a contraction. We have written before that we think the recent uptick in long-duration interest rates is tied to this better-than-expected growth. Yet even with this strong economic performance, many headlines referencing the GDP numbers struck a cautionary tone, with many pointing out that U.S. growth was driven largely by consumer spending that does not seem likely to last. Some point out that student loan payments are yet to take a bite out of disposable income, and others point to real disposable personal income (which is income adjusted for inflation) has fallen in recent months.1

Dealing with Market Volatility?

The challenge that investors face is not finding a way to eliminate volatility—it is

developing a disciplined and mental approach for facing it.

Our exclusive guide, “Helping You Manage Market Volatility,2” will help you better handle volatility and answer certain questions, such as:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you and $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”2

Real Personal Disposable Income

What’s missing from this narrative is that American workers continue to benefit from a strong labor market and pay raises, even if those higher wages are not as compelling as they were last year. Employers spent 1.1% more on wages and benefits in Q3 compared to Q2, which was slightly better than the previous quarter-over-quarter growth of 1%. Other reasons given for ‘unsustainable’ economic growth are rising interest rates and wars in the Middle East and Ukraine, but we would argue these headwinds are already priced into equity markets and neither seem likely to derail the global economy – at least for now.

Auto Workers and Detroit’s Big Three “Strike” a Deal – After inking deals with Ford Motor and Chrysler parent Stellantis, the United Auto Workers (UAW) reached a final deal with General Motors to end what had been a six-week strike. Labor prevailed in this case, and the automakers will also benefit from having all factories fully back up and running. The tentative agreements will include a 25% pay boost over four years, which could bring top hourly pay for production workers to $42/hr (including cost-of-living adjustments). All told, unionized workers should expect annual income to land in the mid-$80,000s with the new raises, which doesn’t include overtime pay. For the automakers, higher labor costs will of course pressure margins and require renewed efforts to increase productivity and contain other costs. But it’s also true that labor costs make up a relatively small percentage of the overall cost of producing a vehicle, so we shouldn’t expect to see a major impact on earnings forecasts based on this labor deal alone.4

As Expected, the Federal Reserve Holds Rates Steady – The Federal Reserve convened this week to determine their next monetary policy decision, which as expected was to hold the benchmark fed funds rate steady at a range between 5% and 5.25%. Fed officials have now ‘paused’ rate increases at two consecutive meetings, which marks the longest stretch without a rate increase since they started their tightening campaign in March 2022. The Fed was weighing several factors during this week’s meeting, which included an economy that accelerated in Q3, a sharp uptick in long-duration interest rates, and inflation that continues to cool – albeit at a slower pace than previously. The Fed likely considers the downtrend in inflation and higher long-term interest rates as two factors working in the right direction, since the former means their primary objective is being addressed and the latter implies tighter financial conditions looking ahead.5

Facing the Market’s Downturns – In a world of high inflation and volatility, the challenge for many investors is understanding how to react to it. It is important to remember that volatility is a normal part of the market flow.

Our volatility guide, “Helping You Manage Market Volatility,”6 will provide you with insights and answers to questions, such as:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you and $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

3 Fred Economic Data. October 27, 2023. https://fred.stlouisfed.org/series/DSPIC96#

4 Wall Street Journal. October 30, 2023. https://www.wsj.com/business/autos/detroit-is-paying-up-to-end-the-uaw-strike-now-carmakers-will-live-with-the-costs-df1d88d7?mod=djemRTE_h

5 Wall Street Journal. November 1, 2023. https://www.wsj.com/economy/central-banking/fed-extends-rate-pause-but-keeps-door-open-to-another-hike-0fa978f8?mod=hp_lead_pos7

6 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.