Depending on who you ask, the globalization trends of the last 30+ years are either still pushing forward, grinding to a halt, or are in the early stages of outright reversing. But I think committing to just one of these narratives is problematic.

That’s because globalization is not an on-off switch – it’s a complex and layered set of relationships between countries regarding trade, investment, financial systems, immigration, technological networks, supply chains, and so on. At any given time, a country may be seeing more cooperation in some of these areas, and less cooperation in others.1

Much of the consensus that de-globalization is underway comes from the rippling effects of the pandemic and the Russia-Ukraine war. The proximity of these two shocks has led many corporations and some western governments to prioritize the resilience of supply chains – i.e., domestic production – over the benefits that globalization affords, like efficiency and low costs. For readers who have heard the term “reshoring,” that’s what this trend refers to.

__________________________________________________________________________

Investing in an Unpredictable Market – Download Our Just-Released Report!

De-globalization would be a major negative for the global economy if the worst fears come to fruition. To help you understand what could be next for the market, I am offering all readers our just-released December 2022 Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- What fundamentals are U.S. stock markets pricing in?

- Setting U.S. return expectations for 2023

- Zacks forecasts at a glance

- What’s ‘fair value’ on the S&P500?

- And more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released December 2022 Stock Market Outlook2

_________________________________________________________________________

But the other key factor driving de-globalization fears is the increasingly strained relationship between the U.S. and China. Some worry that the global economy will become fragmented into two blocks – countries that do business with the U.S., and countries that do business with China. With the U.S. and China currently levying tariffs and ‘playing defense’ when it comes to capital flows and access to technology, these concerns are certainly warranted.

It should be noted, too, that history is playing an important role in how economists and other experts are viewing current globalization trends. If we look back to the early 1900s, globalization was accelerating with tailwinds from the industrial revolution and the adherence of major economies to the gold standard, which the U.S. joined in 1900.

What brings nations together economically can sometimes drive them apart in political and social terms, however, as nationalism and other domestic priorities push back against the forces of globalization. In the early 1900s, World War I essentially thwarted all of globalization’s momentum, with global trade as a percent of GDP peaking in 1914. Trade wouldn’t return to those 1914 levels until the mid-1970s.

The 2008 global financial crisis, the Covid-19 pandemic, and the Russia-Ukraine war may be the new factors that will ultimately drive a secular slowdown in global trade. No one can know for sure. What I can say is that there is not much hard evidence that de-globalization – at least in terms of global trade – is firmly underway. In 2021, global trade growth accelerated so quickly that it shot back up to the pre-2008 trendline. It’s also true that in 2022, global trade volumes reached a new record, posting figures nearly 10% higher than they were pre-pandemic. If de-globalization is happening, it cannot be explained by trade.

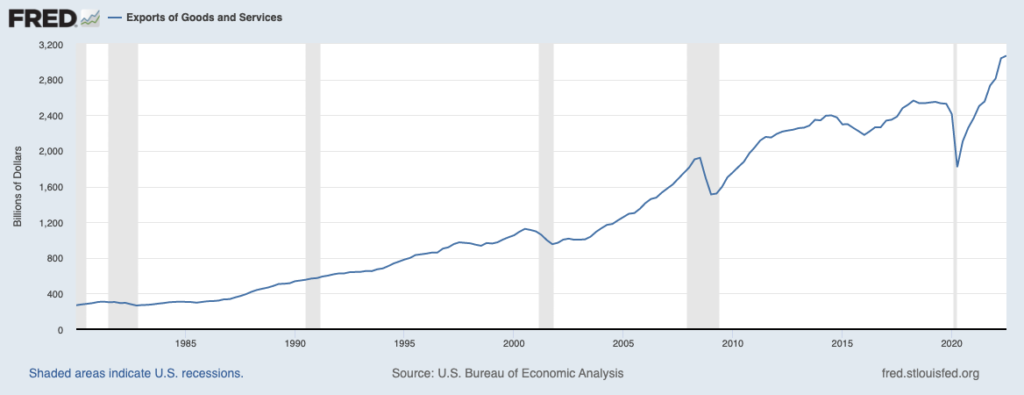

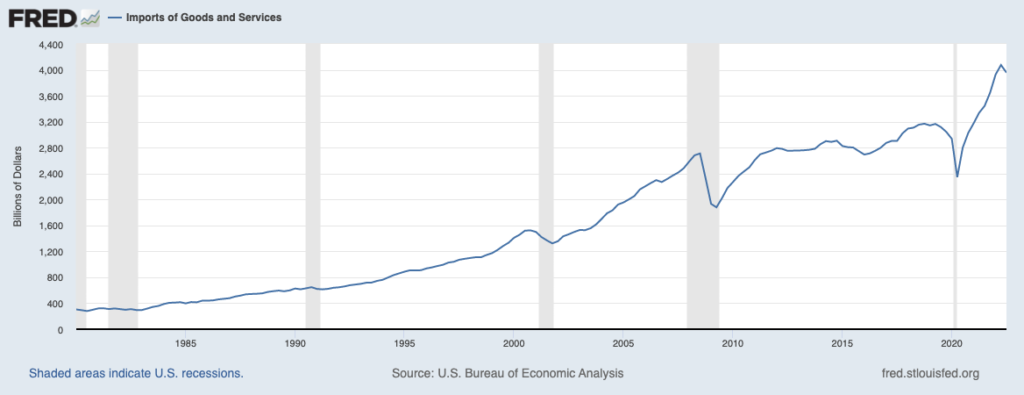

The U.S. economy fits into this global trade pattern as well. As readers can see in the two charts below, total U.S. exports and total U.S. imports have recovered from pandemic lows and are now well into record territory. I have written before that in my view, it’s total trade – not trade surpluses or deficits – that paint a clearer picture of how robust overall activity is.

U.S. Exports at Record Levels

Source: Federal Reserve Bank of St. Louis

U.S. Imports Close to Record Levels

Source: Federal Reserve Bank of St. Louis

Finally, I think it’s important to make the point that many tend to think of globalization as the free movement of goods and labor across borders, but it is also true that services can be imported and exported between economies. More so than ever, countries are cooperating and trading by opening access to technology, financial markets, and other services that exist in the non-goods economy. By these measures, one could argue that globalization is not reversing or corroding, and may even be accelerating.

Bottom Line for Investors

De-globalization would be a major negative for the global economy if the worst fears come to fruition, and it would also be longer-term inflationary. Turning inward economically generally means paying higher input costs, which would also imply having to charge more to consumers.

These trends are worth watching closely, but the worst-case scenario outcome is far from assured. Global trade data suggests it should not currently be an economic fear at all.

To help you navigate through this unpredictable market, I am offering all readers our Just-Released December 2022 Stock Market Outlook Report. This report will provide you with key forecasts along with additional factors to consider, such as:

- What fundamentals are U.S. stock markets pricing in?

- Setting U.S. return expectations for 2023

- Zacks forecasts at a glance

- What’s ‘fair value’ on the S&P500?

- And more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.