In today’s Steady Investor, we look at key factors that we believe are currently impacting the market and what could be next for the markets such as:

- Federal Reserve’s status of lifting interest rates

- Acceleration of inflation

- U.S. dollar’s ongoing strength

Higher-Than-Expected Inflation Reading Sends Markets Spiraling – For the month of August, consumer prices (CPI) rose 8.3% year-over-year, which was a slight decline from July’s 8.5% pace. The problem was that month-over-month, prices rose 0.1% from July even as prices eased for gas, airfares, and items like rental cars – which had driven significant inflation earlier in the year. That meant that core prices – which exclude food and energy and give a broader picture of prices for consumer goods and services – rose far more than expected, signaling that inflationary pressures could be more broad-based than anticipated. Indeed, core prices rose 0.6% from August to July, which all but confirms that the Federal Reserve will continue pursuing its hawkish path with interest rates. According to Moody’s Analytics, the average household is now spending about $460 more each month to buy the same basket of goods and services as compared to 2021 prices, marking a significant uptick. Incomes have risen over the same period, helping to offset some of the higher costs, but wages have not gone up as quickly as inflation. The market responded with a sharp selloff, with every sector in the S&P 500 falling and the index plunging by -4.3% in a single day of trading – the biggest selloff since the depths of the Covid-19 bear market in early 2020. It appears the market had been hoping that the inflation print would confirm a downtrend, which would have taken the pressure off the Fed to raise rates so aggressively. The readout did the opposite, however, all but assured at least a 75-basis point increase at the Fed’s September 20-21 meeting.1

___________________________________________________________________________

8 of the Biggest Financial Mistakes You Should Avoid

Many investors, especially those who are trying to plan for retirement, may be wondering how to prepare for what’s to come. When volatility comes to play, there is no definite answer. However, we believe that it’s better to prepare for any given financial situation.

While there are many unknowns at present, we believe there are eight common mistakes that many investors make when planning for retirement. In our guide, 8 Retirement Mistakes to Avoid, we outline these mistakes and how you can potentially avoid them.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Learn About the 8 Retirement Mistakes to Avoid!2

___________________________________________________________________________

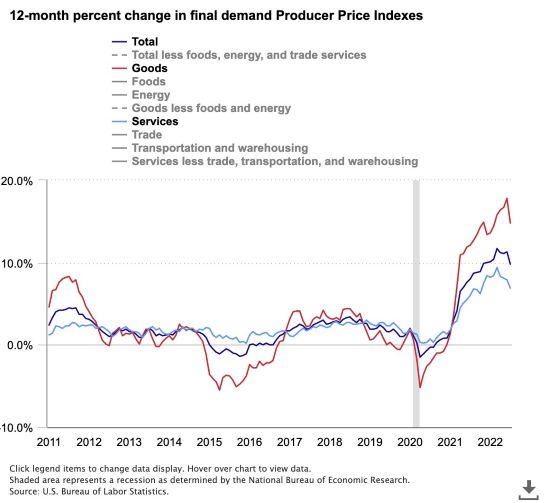

Some Slightly Better Inflation News – Consumer prices remained sticky in the month of August, but more hopeful news could be found in the producer-price index (PPI), which measures what suppliers charge businesses for the delivery of goods and services. Generally speaking, changes to the PPI will show up in the CPI numbers with a lag, as businesses can adjust pricing over time as input costs fall. PPI in August fell 0.1% from July, which followed a 0.4% decline from June to July (see chart below). The year-over-year decline in August was also notably significant compared to July, with the PPI rising 8.7% in August compared to the 9.8% increase posted in July. Both the CPI and PPI data are fickle from month to month, so focusing on one or even a few months’ worth of data can be misleading. Even still, it wasn’t all bad news on inflation for the month of August.3

The U.S. Dollar’s Ongoing Strength – The greenback continues to have a historic run. In 2022 alone, the dollar has appreciated by 13% against a basket of other developed currencies, and has risen by 17% against the pound. The dollar has also risen to parity against the euro, a first in over 20 years. The reasons for the dollar’s persistent strength are many, but the primary driver has been the U.S.’s economic strength relative to the world in the post-pandemic period. Europe continues to struggle with growth and China has been hampered by its zero-Covid policy, with rolling shutdowns and restrictions still the norm. The United States has also been engaged in monetary policy tightening, and higher rates arguably stand to attract more foreign capital. But an unsung reason for the dollar’s resilience has been long periods of innovation, growth, and improved profitability of U.S. corporations. Innovation spurs investment, which means foreign capital flows into this country and pushes up the value of the dollar. For those who believe the U.S. economy will remain competitive and resilient relative to the rest of the world for a long time to come – which we believe here at Zacks Investment Management – a stable and high U.S. dollar is likely to follow.5

Retirement Mistakes to Avoid During Times of Uncertainty – While we can’t predict or control the future of the market, it is possible to stay focused on actions that can help guide your future investments. There are common mistakes and habits that we believe can help some investors succeed while others fail. Don’t fall prey to common investing mistakes!

To help you understand some of these mistakes and how to avoid them, we have created the guide, 8 Retirement Mistakes to Avoid.6

In this guide, we provide our thoughts on what we believe are 8 of the biggest retirement mistakes investors should avoid. If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

3 Wall Street Journal. September 14, 2022. https://www.wsj.com/articles/u-s-supplier-inflation-remained-elevated-in-august-11663161329?mod=djemRTE_h

4 U.S. Bureau of Labor Statistics. August 16, 2022. https://www.bls.gov/opub/ted/2022/producer-prices-up-9-8-percent-from-july-2021-to-july-2022.htm

5 Wall Street Journal. September 11, 2022. https://www.wsj.com/articles/for-wall-street-a-strong-dollar-is-front-and-center-11662849218?mod=djemRTE_h

6 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.