The S&P 500 is back in positive territory for the year, driven in large part by technology companies posting solid Q3 earnings (so far). Tech stocks have rallied hard since late August, largely leading the way for S&P 500 sectors. Tech as a category is now up over 5% on the year, compared to the S&P 500 which is closer to flat. We maintain that Tech is an attractive sector that might merit an overweight in the equity investor’s portfolio. How well are you allocated to Tech?

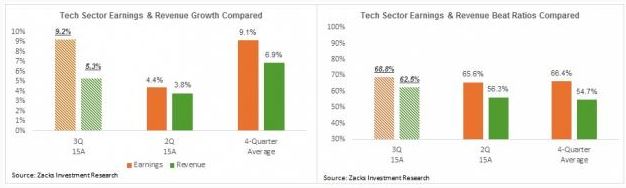

Earnings momentum in the Tech sector is the reason. As of this writing, we have Q3 reports from 32 of the 64 Tech companies in the S&P 500 including Apple’s report. These companies account for 65.6% of the sector’s total market cap in the index. Total earnings for these 32 Tech companies are up +9.2% from the same period last year on +5.3% higher revenues, with 68.8% beating earnings per share estimates and 62.5% beating revenue estimates. This not only represents sturdy performance from Silicon Valley, it’s also better than the numbers we’ve seen from this group of 32 in the recent past:

The Giants Wow the Street

Microsoft (MSFT), Alphabet (parent company of Google, ticker GOOGL) and Amazon (AMZN) all posted better than expected earnings releases which sent shares soaring.

Microsoft jumped 10% (its largest gain since October 2000) when it announced that cloud sales jumped 8% last quarter, and that it expects $20 billion in annualized commercial cloud revenue run rate by 2018. The company already values its cloud business at $8.2B and has enjoyed 70% year over growth.

In further evidence that cloud services are significant, Amazon surprised analysts after reporting a profit on a 23% sales gain (with revenues driven by strong sales in North America and explosive growth in its cloud computing business). Shares popped 6.2% in response.

Google, which announced in the quarter it’s formation of parent company Alphabet, continues its quest for world domination. The company posted stronger-than-expected earnings and revenues in the third quarter, which boosted its share price by 7.7%. The results were driven by big gains in searches on mobile phones and tight expense controls. The company also surprised investors with a share repurchase program under which the company has been authorized to buy back $5.1 billion worth of Class C shares. The market likes when companies cut expenses, expand revenue streams, and return equity to investors, making Alphabet a tech darling.

Still More Left to Report

Other earnings to look out for are other new-school tech bellwethers like Facebook (FB) and LinkedIn Corp (LNKD). Facebook has a $287.9 billion market cap with key growth factors from mobile advertising and strategic acquisitions. The share price has risen over the last quarter as investors think Facebook may be finally turning a corner.

LinkedIn Corp has been gaining traction on the mobile and tablet platforms, which are expected to boost top line revenues. Last quarter, it posted a 42.31% positive surprise that investors welcomed.

Other solid but less obvious tech companies to watch are T-Mobile US, Inc (TMUS) and CyberArk Software, Ltd (CYBR). Both companies have a unique approach to growing their customer bases and are expected to report better than expected earnings.

On a higher level, Zacks thinks Information Technology, on a broad basis, is an attractive sector looking forward. In particular, Telecom Services, Electronics, and Computer Software look the best to us.

Bottom Line for Investors

Tailwinds are building in certain pockets of the economy, but pessimism remains: the overall picture for Q3, combing the actual results of the 227 S&P 500 members that have reported results to estimates for the still-to-come 273 index members, has us expecting total earnings to decline -2.9% from the same period last year on -4.1% lower revenues. This would follow earnings decline of -2.1% on -5.7% lower revenues in Q2.

Of course, what is not apparent in the numbers is the disproportionate role played by Energy in pulling down aggregate earnings, which we think would be positive ex-Energy. But the media narrative is likely to focus on the earnings headline, without looking under the hood. That should create persistent pessimism and allow the ‘wall of worry’ to thrive, making a bullish case for equities in growth categories.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.